USD/JPY trades back up to a session high of 110.14

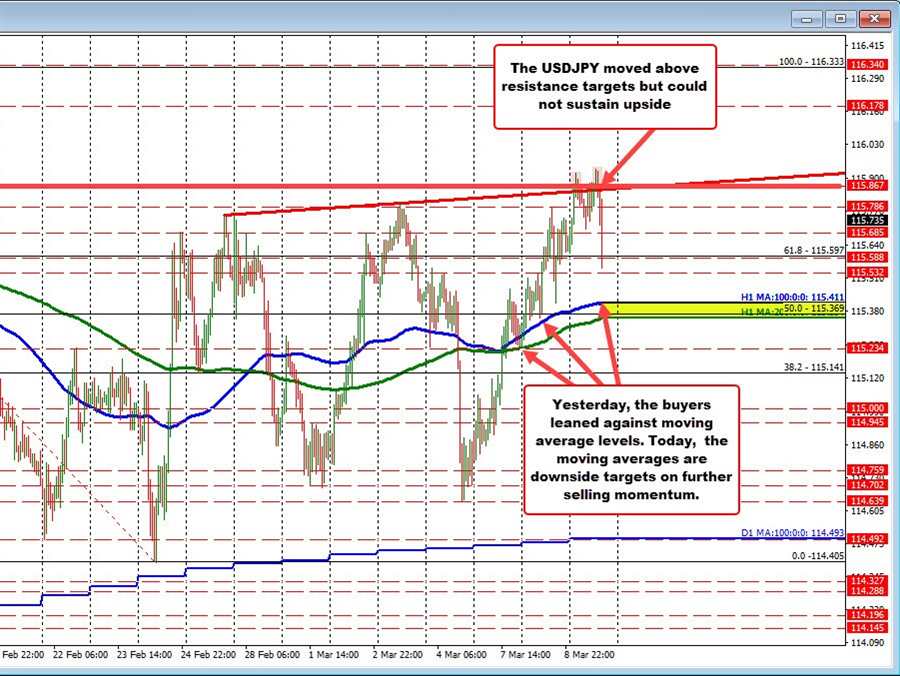

The pair was keeping a little lower earlier in the session with the dollar mildly softer across the board but buyers managed to put up a defense of the 100-hour moving average (red line) at the lows near 109.89.

The past few days basically just signals that the pair is still caught in a push and pull, though buyers are hoping to try and make some headway above the 110.00 level.

In the bigger picture though:

There is firmer resistance around 110.50 and then at the daily resistance around 110.70-80, which are still key levels capping any major upside momentum in the pair.

Looking past Jackson Hole, a lot will ride on sentiment in the bond market and unless yields threaten to build off the double-bottom pattern from the July and August lows and push above 1.40%, any major push in USD/JPY towards 111.00 may be undermined.