USDJPY trades to the highest level since August 13 as markets react to Fedspeak ahead of Chair Powell

The market certainly turned more dollar bullish as Fed’s Mester started speaking on CNBC. Her comments were more in line with the other Fed officials (Bostic, Harker, Bullard, Kaplan, etc), but unlike the others today, the market suddenly found a dollar bid.

US stocks have come off high levels but are still higher on the day. The Dow futures are implying a 63 point gain. The NASDAQ is up around 35 points and the S&P is up around nine points (vs 79, 42 and 12 point respectively).

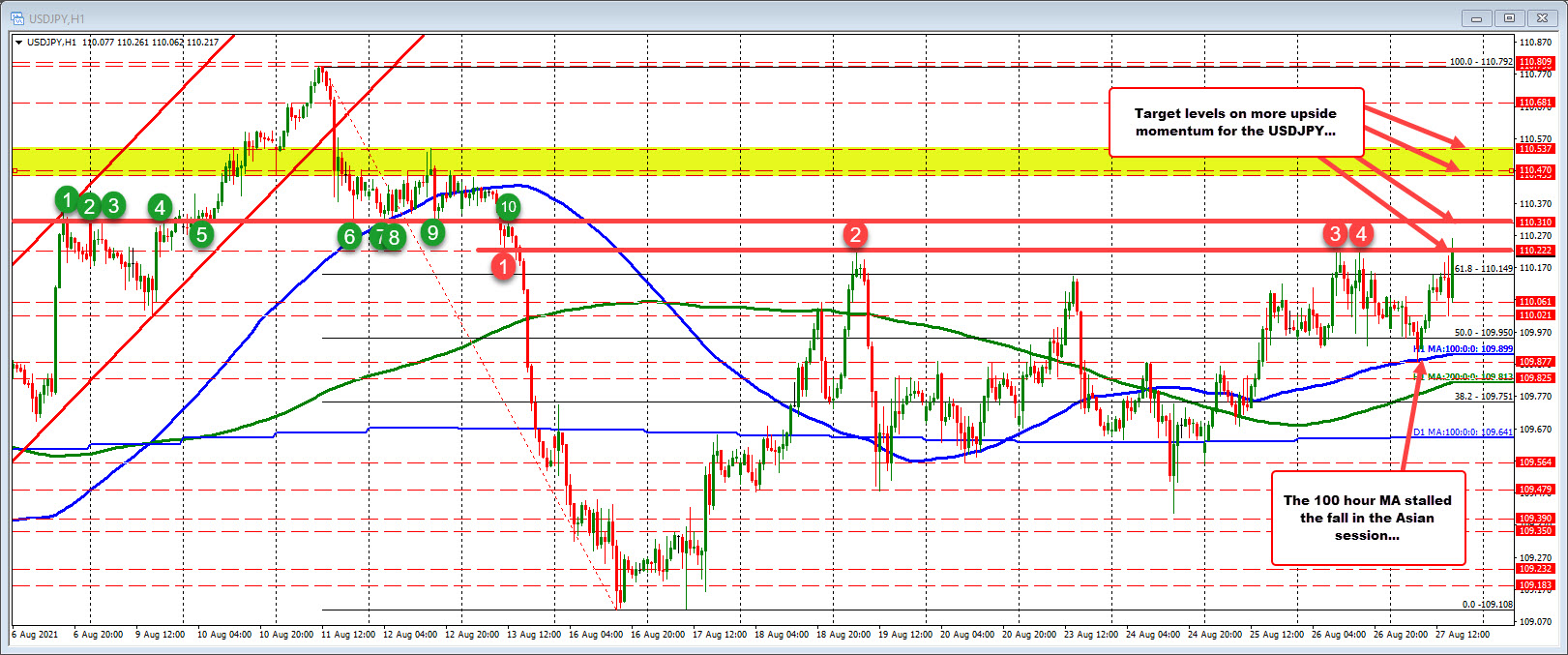

Looking at the USDJPY, the pair moved above the high price from yesterday at 110.222 and trade at the highest level since August 13. In the process, the price moved above the 61.8% retracement at 110.149. That is nothing new has the last two bars have also traded above that level. The question now is can the price stay above that level (PS the level was also the high price from Monday’s trade). Watch that low for close clues intraday. Stay above is more bullish and the best case scenario for the buyers looking for more upside. Move below and could see a rotation back down toward the 110.00 area ahead of Powell.

Note that earlier today, the price decline in the Asian session fell to test the rising 100 hour moving average (blue line). Staying above that level kept the buyers in the game (and in control) in helped lead to the general move to the upside today.