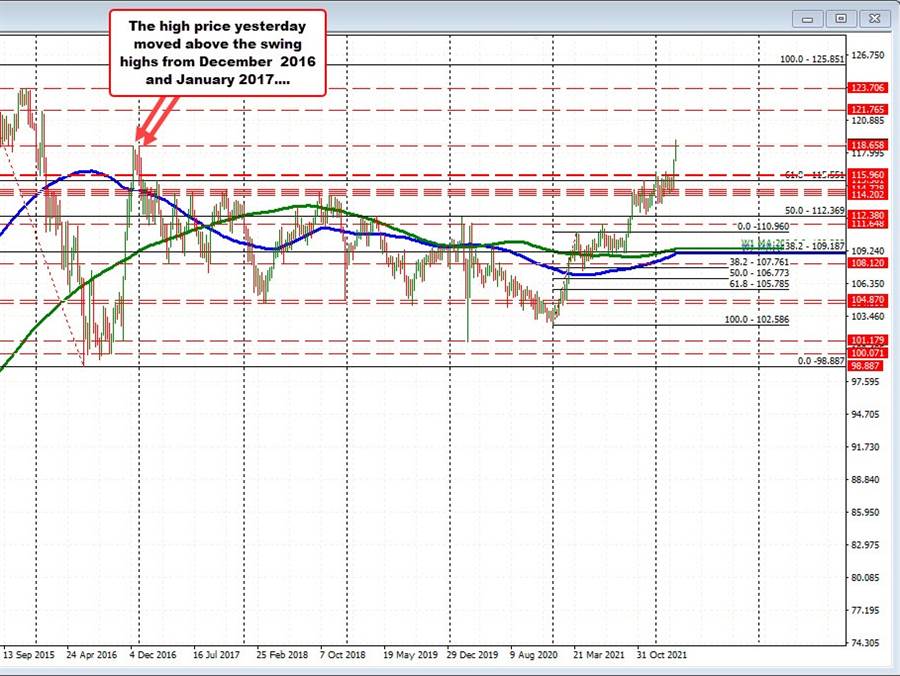

The USDJPY moved higher yesterday after the FOMC rate decision and was the only major currency pair that stay positive (higher USD) on the day. The move to the upside did extend above swing highs from the end of December 2016 and early January 2017 between 118.60 and 118.658.

That break took the price the highest level in over seven years (going back to end of January 2015 – see weekly chart above).

Drilling to the hourly chart below, the price correction off of the high yesterday at 119.116 saw the USDJPY move back toward the swing highs from 2016/2017 near 118.60 and 118.658. Finding support near that level did lead to a move up in the early Asian session, but stalled ahead of the high price from yesterday (the high price reached 119.019).

The subsequent fall today ultimately saw the pair below the aforementioned swing area, but could not get below the swing high from Tuesday’s trade nor the swing high from early yesterday near 118.44.

Recall from Tuesday, the price trend move to the upside ran out of steam at 118.44, and had a swift correction lower, only to quickly reversed back to the upside (see post here). The inability to break below that level, helped to keep the buyers still in play and the price has since moved higher.

Overall, my focus is still on the 118.60 to 118.658 area. Stay above is best case scenario for the buyers/bulls in the short term. Move below and we could see a rotation back down toward the 118.44 area. Will below that and traders would start to target the rising 100 hour moving average at 118.115.