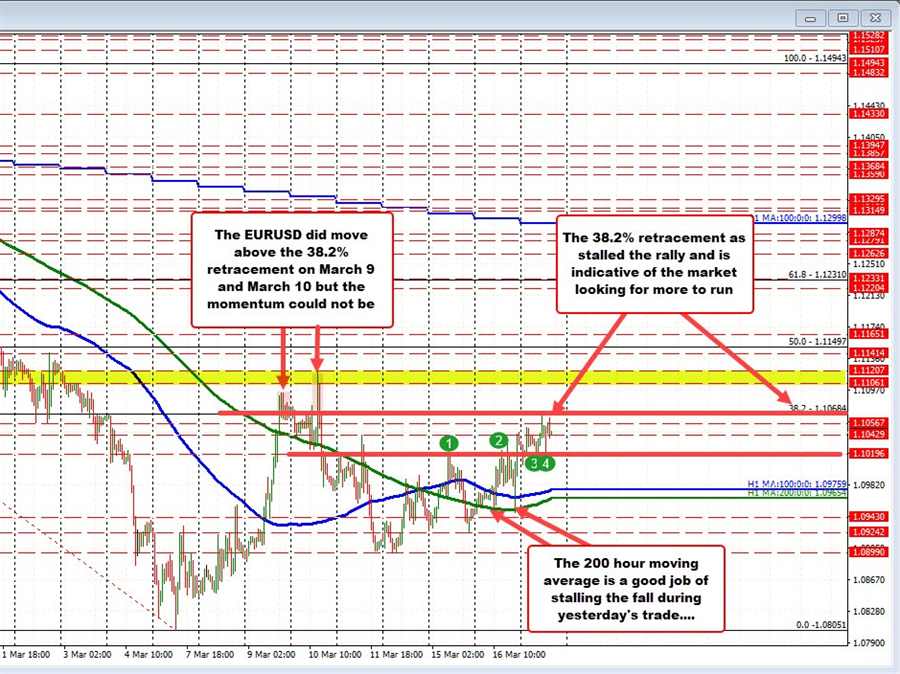

The EURUSD has seen up and down choppy price action with recent support at 1.10196 (was the high from Tuesday) and resistance against the 38.2% retracement of the move down from the February 10 high. That level comes in at 1.10684. The high price for the day reached 1.10666. The current price is trading at 1.1044 between those two intraday levels.

On corrective moves, getting and staying above the 38.2% retracement is a natural target. The price did move above that level both on March 9 and March 10 with the high price stalling at 1.11207. So the price has moved above that target. However, momentum could not be sustained and the price rotated back down toward the 1.0900 level on US employment Friday of last week and again on Monday (the low price reached 1.0899 a nice round number and natural support level). The price is been chopping higher since that low.

Of interest technically from yesterday’s trade was that the 200 hour moving average DID do with good job of holding support on tests. That helped to give the buyers the go-ahead to push higher.

However, the up and down price action today suggests the market is bit unsure of the next move. Yes….the price above the 100 and 200 hour moving averages, but holding the 38.2% retracement is a bit of a “I like the EURUSD, but I don’t love the EURUSD just yet”.

Traders who like the upside will want to see a move above that level and stay above that level. Traders two don’t like the EUR, could lean against level and look for a break of 1.101962 potentially for a retest of those lower moving averages again. .