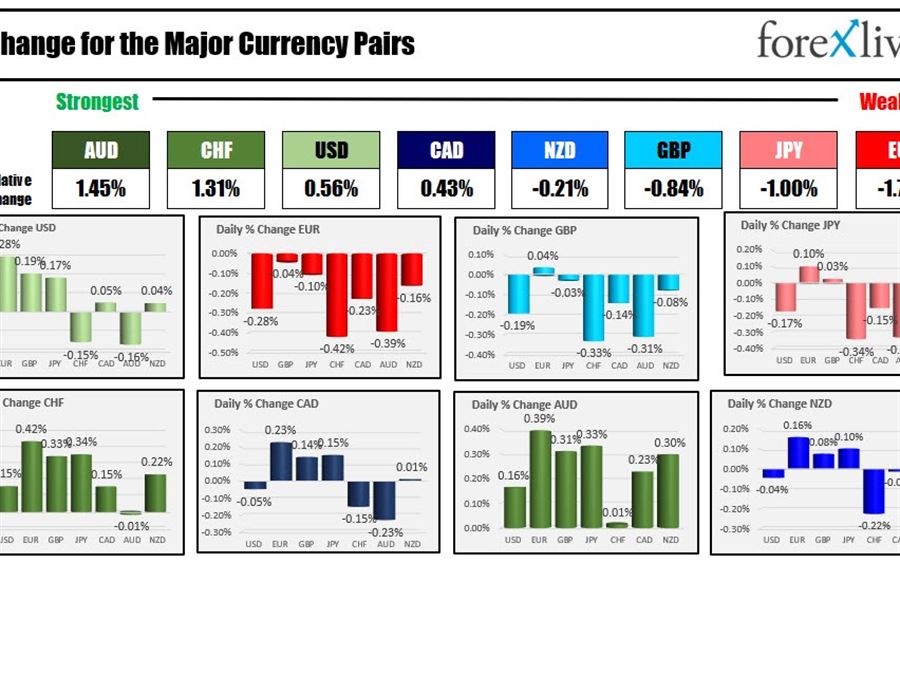

The AUD is the strongest and the EUR is the weakest as the NA session begins. The USD is mixed to modestly higher to start the session.

The EU PPI rose more than expected and the markets don’t like it, especially as the ECB (Lagarde) may put off tightening further because of the situation in Ukraine. The EU PPI came in at 5.2% MoM (vs 3.8% est) and 30.8% (vs 27.0% est) YoY.

Crude oil prices and other commodities are likely to not slow that train from going higher in subsequent months as well. The crude oil train passed the highs from 2013 and then the highs from 2011 as well and traded at the highest level since August/September 2008. The high price reached up to 116.57. Since the 2008 high spiked up to $147.27 (before starting the plunge from the 2008 Great Recession), there is a lot of track left to reach that level, but given the momentum (up 87% from the December low now) and the supply issues from Russia exasperating the trend, it is hard to rule out any scenario.

In the other commodity category, wheat futures in after-hours trading did dip after trading limit up for the second consecutive day yesterday. Corn futures also would marginally lower. Nevertheless , wheat futures are up 53.24% since February 3. Corn futures have risen 23.23% from the low to the high over that same time period.

Meanwhile in Ukraine, Russia deepened its offensive in the southern portion of Ukraine (Russian forces appear to have captured Kherson in the south). The 40 mile long convoy has been installed however. Nevertheless, cease-fire talks are scheduled to take place today. Economic pressures continue with EU commission Pres.von der Leyen saying that the EU’s ability to consider tighter sanctions. Companies continue to exert their own pressure with VW stopping operations in Russia. Mercedes, Toyota, and GM already said they would stop exporting to Russia. The seizing the property of the oligarchs is also increasing and tightening the screws against Putin.

Yesterday, feds Powell testified in Washington and said that he favors 25 basis point increases as the rate rise process begins at the March meeting, but would not be opposed to 50 basis points if inflation/growth continues unabated to the upside. Powell will testify in the Senate today starting at 10 AM. The stock market took the chair’s comments positively despite all the other geopolitical news. The US stocks managed to rise 1.6% to 1.8% in trading yesterday.

Today the major indices are marginally lower. US yields are also marginally lower after the sharp rise yesterday (two and five year yields were up close to 18/19 basis points, but also plunged lower on Tuesday).

In the economic calendar today,

- US initial jobless claims are expected to fall to 223K from 232K last week.

- The revised US nonfarm productivity and unit labor costs for the fourth quarter will also be released at 8:30 AM ET.

- The final Markit services PMI is expected to come in at 56.7 at 9:45 AM ET.

- The ISM services PMI and factory orders will be released at 10 AM with services PMI expected to rise to 61.2 from 59.9. Factory orders are expected to rise by 0.8% after a -0.4% decline last month

A look at the market levels as North American traders enter shows:

- Spot gold is up $3.93 or 0.20% of $1932.24

- Spot silver is up five cents or 0.20% and $25.33

- WTI crude oil futures are trading at $113.39 at sub $2.79

- Bitcoin is fairly steady above and below 44,000. The current prices trading at $43,502

In the premarket for US stocks, the major indices are marginally lower/unchanged

- Dow industrial average is trading above or below unchanged after yesterday’s 596.4 point gain

- S&P index is down -3.25 points after yesterday’s 80.26 point gain

- NASDAQ index is down 32 points after yesterday’s 219.56 point gain

In the European equity markets, the major indices are mostly lower (exception being France’s CAC)

- German DAX, -0.5%

- UK’s FTSE 100 -0.6%

- France’s CAC, +0.1%

- Spain’s Ibex, -1.9%

- Italy’s FTSE MIB -0.6%

In the US debt market, yields are mixed/little changed after yesterday’s sharp declines on flight to safety flows:

In the European debt market, yields are higher. The German 10 year yield is trading at 0.06% after dipping back into negative territory recently.