The EURUSD is moving lower after a down and up day yesterday which saw the pair move to the lowest level since the end of May 2020.

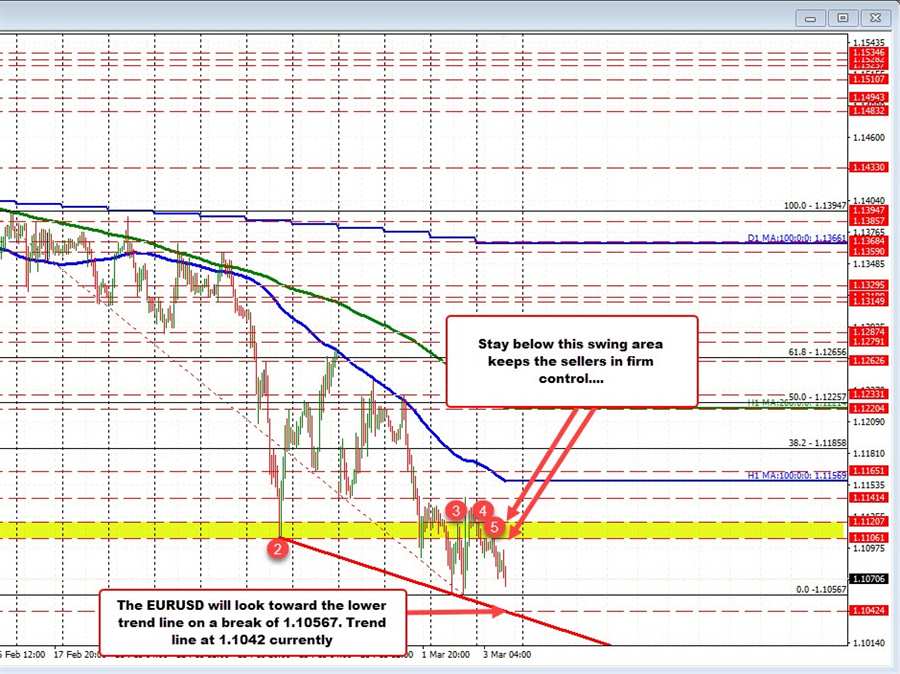

In the down and up process from yesterday, the price fell below the January 2021 low at 1.11207, and the February 2021 low at 1.1106. The subsequent rebound off a double bottom yesterday near 1.10567 ultimately saw a move back above that January/February swing low area. However, in the Asian session today, the price moved back below it and then stay below the level (see red numbered circles).

I would still use the 1.1106 to 1.11207 as a resistance/bias defining short term target now. Stay below and the sellers are more in control (the sellers can probe the downside).

The range so far is only about 57 pips (extending to new lows as I type). That is still short of the 22-day average of 90 pips.

As mentioned, the pair did form a double bottom yesterday on the hourly chart at 1.1157 area and that level is being approached (the low just reached 1.1167).

A move below the double bottom should open the door for more selling. A lower/downward sloping trend line cuts across at 1.1042 (and moving lower). That would be the next target. Move below it, and it opens the door even further as lowest levels since 2020 keep the bears happy.