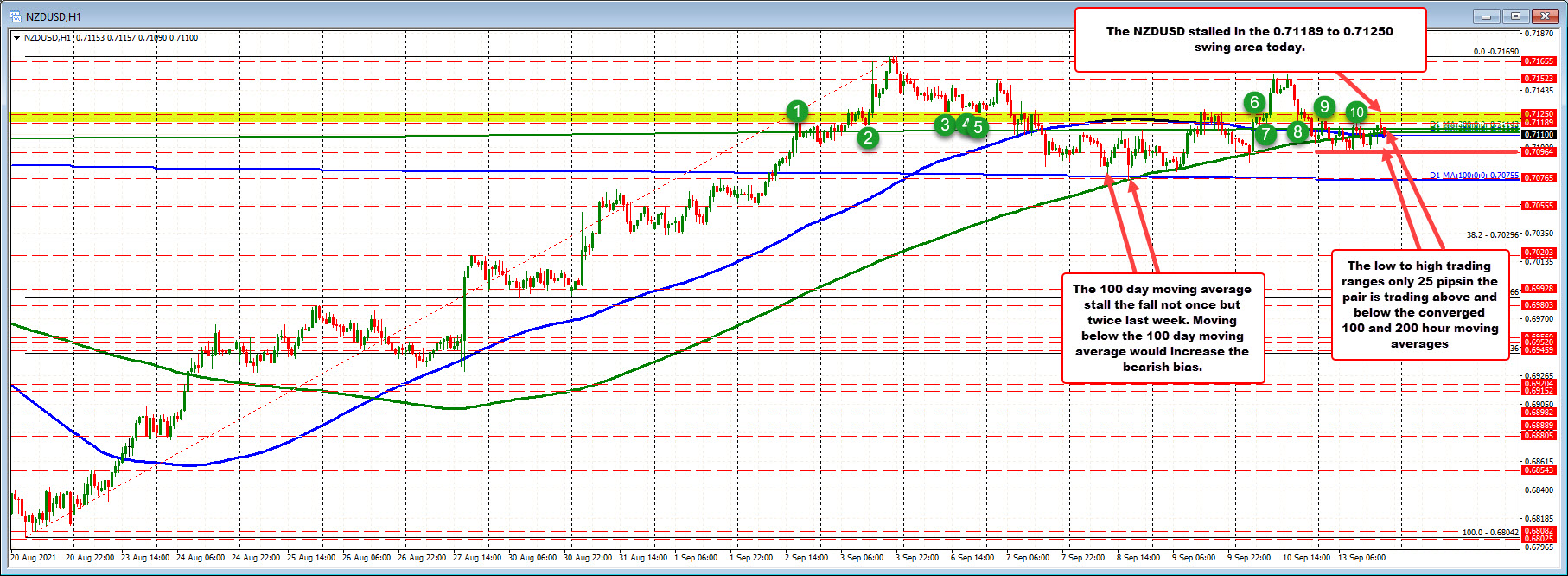

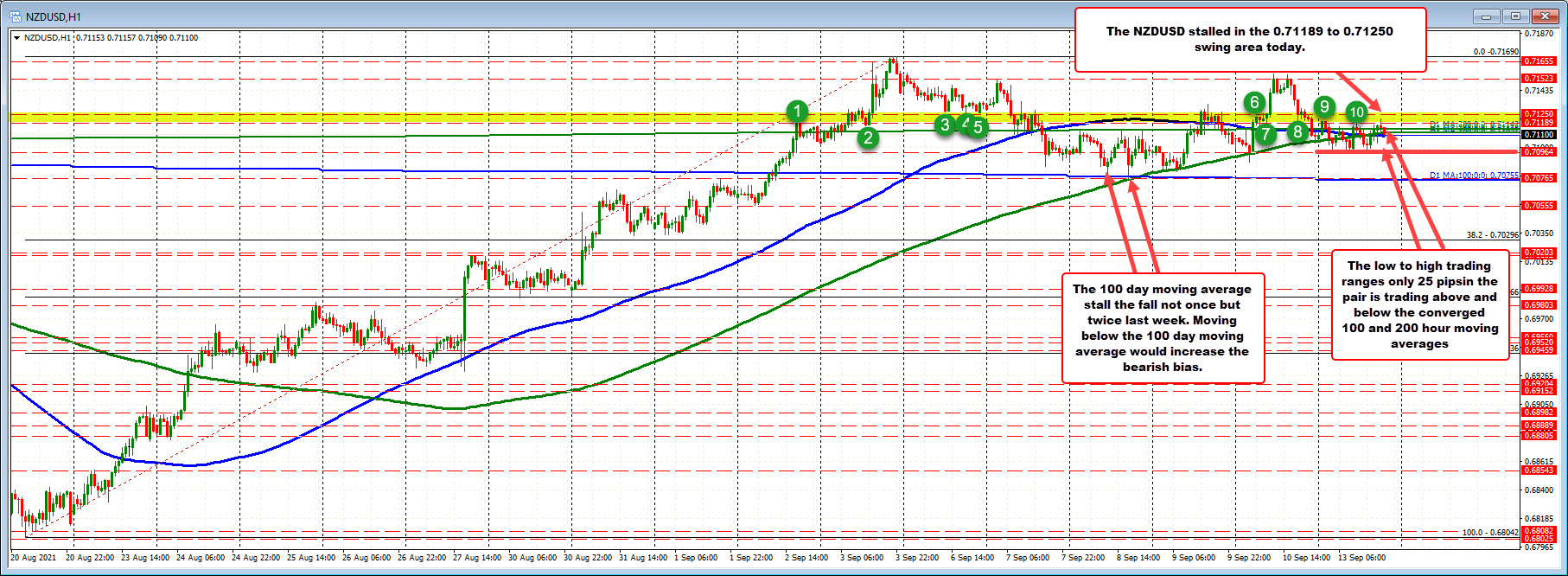

25 pip trading range for the NZDUSD

The NZDUSD barely has a heartbeat in trading today. The low to high trading ranges only 25 pips that compares to a 22 day average of 61 pips (around a month of trading). The lows reached 0.7096. The high price extended to 0.7122. That took out the Asian session high of 0.7120, but only by two pips.

In between those levels sits the near converged 100 and 200 hour moving averages at 0.7110. The current price is trading at 0.71099.

The “patient” is still alive but with a very faint heartbeat.

The good news is that in trading, the “patient” doesn’t die. In fact, the non-trends nature of the current market tends to lead to a more vibrant trending market as traders decide which way is the next shove.

As a result, simply be aware of the next “shove”, and look for momentum on the break.

On the upside, a bullish clue would be on a break above the 0.7125 (and stay above), followed by a rotation toward the 0.71523 level (and above that level).

On the downside, getting below 0.70964 would be a step one in the bearish direction, followed by a break of the 100 day moving average at 0.70755.

Recall from last week, that 100 day moving average did stall the fall on Wednesday not once, but twice. On Thursday, the 200 hour moving average held support ahead of the 100 day moving average. Getting below the 100 day moving average and staying below would be a bearish shove.