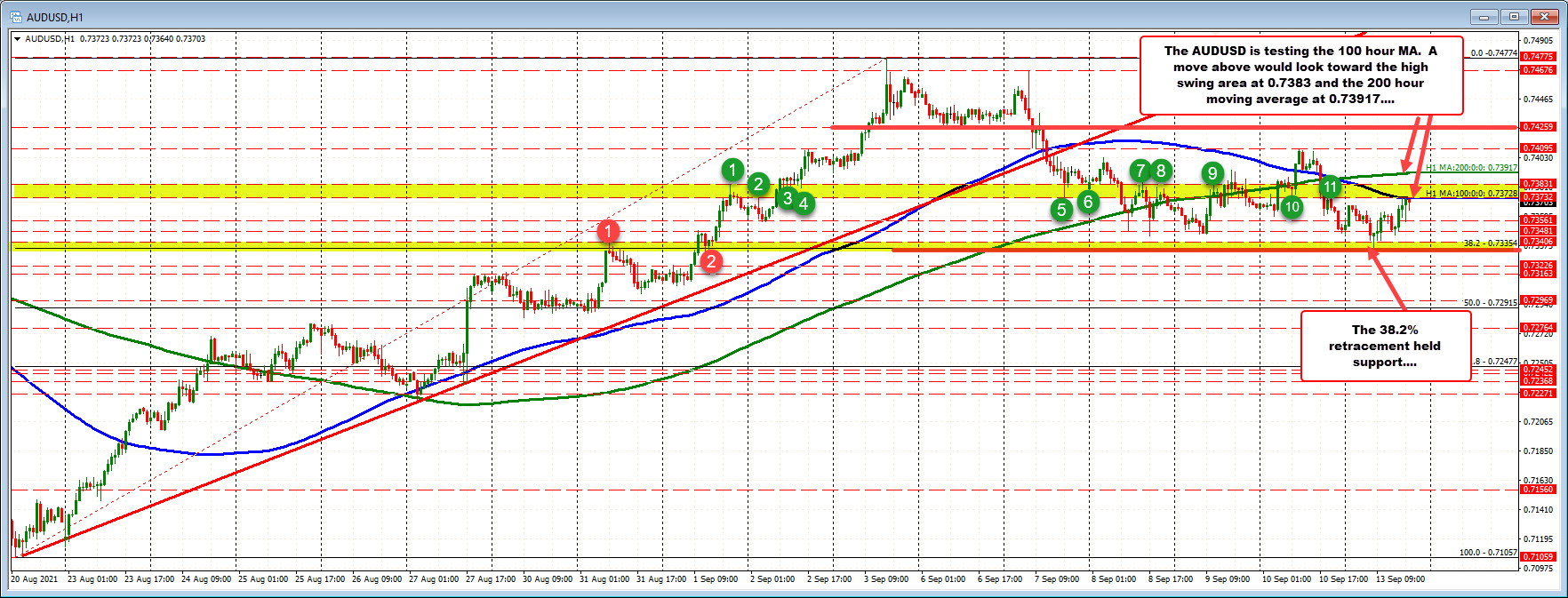

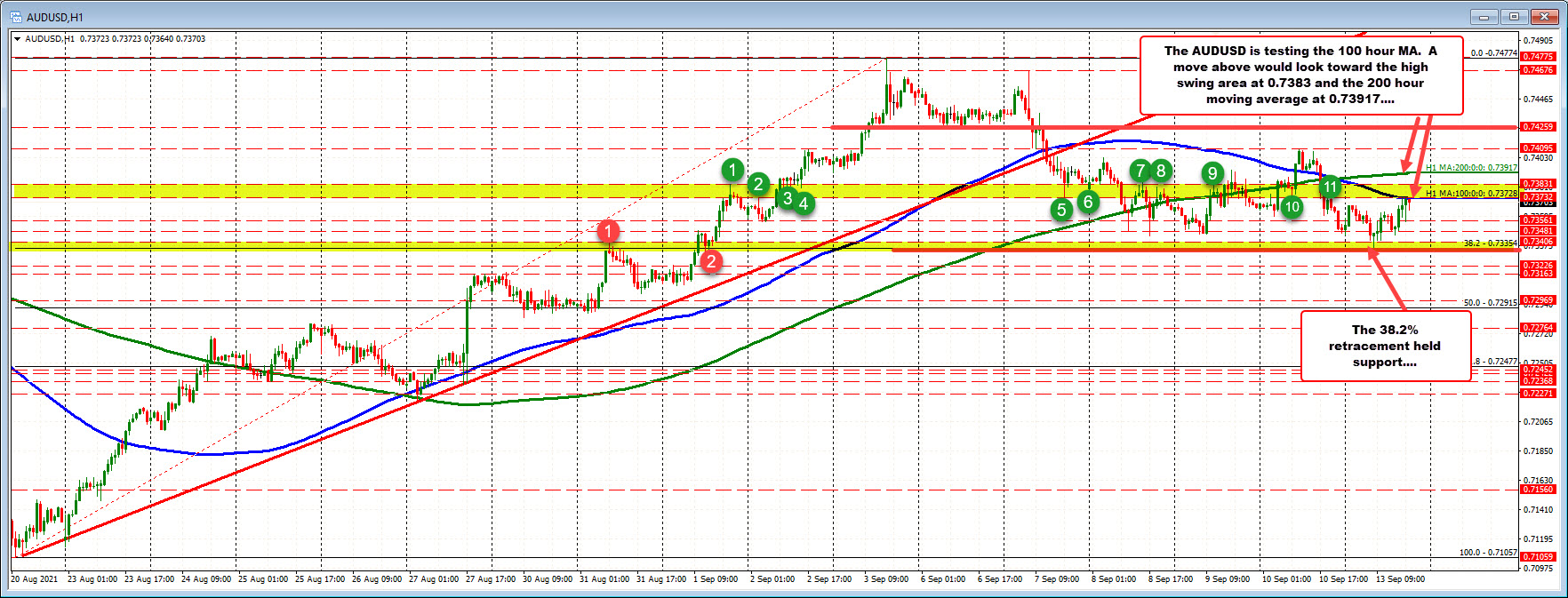

100 hour moving average at 0.73728

The AUDUSD is up testing its 100 hour moving average at 0.73728. The price high just reached 0.73735. A move above would have traders looking toward a high swing area at 0.73831 followed by the 200 hour moving average at 0.73917.

The trading range for the pair is only 38 pips so far today. The average of the last 22 trading days (around a month of trading) is 63 pips. As a result, there is room to roam. The upside is being extended on the current move higher.

The move to the upside has been helped by support buyers near the low today. Looking at the hourly chart, the low price stalled right at the 38.2% retracement of the range since the August 20 low. That level comes in at 0.73354. The low today was 0.73356. Buyers leaned against that level and have pushed the price higher in choppy trading.

Not being able to trade below the 38.2% retracement makes the corrective move off the high on September 3 a plain-vanilla variety. If sellers are to take more control after a trend move higher, getting below the 38.2% retracement is a hurdle that needs to be overcome. The sellers today cannot make that happen (or lastly for that matter). As a result, the buyers still remain in play despite the rotation down over the last five or six trading days. Getting back above the moving averages would give the buyers even more control.