The pattern this week has been to sell the opening

The major US stock indices are open and trading negative/near unchanged levels. The indices did open higher, but as has been the pattern this week, sellers have entered and pushed lower. Monday and Tuesday had volatile up and down trading. The Dow and S&P both rose on Monday, but yesterday they declined. The NASDAQ index meanwhile has been down for five consecutive trading days. The NASDAQ index is currently trading marginally lower.

a snapshot of the market six minutes into the opening is showing:

- Dow industrial average -26 points or -0.08% at 34555.20

- S&P index is unchanged at 4443.15

- NASDAQ index is trading -4.43 points or -0.03% at 15032.38

In other markets, the snapshot currently shows:

- Spot gold is trading down $5.90 or -0.33% at $1798.10

- Spot silver is trading unchanged at $23.83

- WTI crude oil futures are up $1.72 or 2.44% at $72.20. That is up about $0.72 since the New York opening

- Bitcoin is currently up about $500 and $47,600

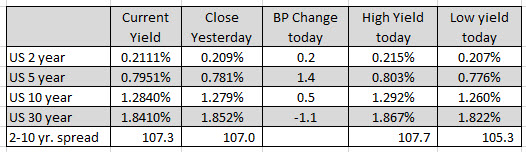

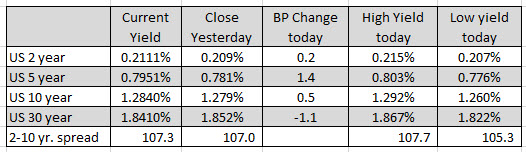

In the US debt market, the yields are mixed: