The major indices are trading mixed with the Dow industrial average up 0.34%. The S&P index of 0.16% while the NASDAQ index is down -0.56% currently.

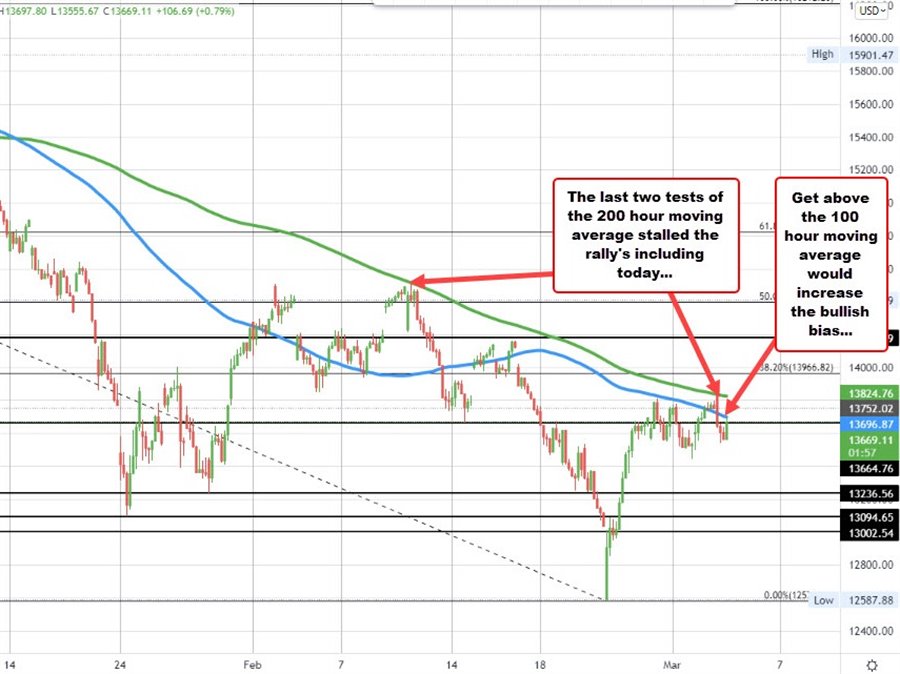

If you were to look at the hourly chart of the NASDAQ index above, the high for the day at 13837.59 stalled right near its 200 hour moving average (green line in the chart above). Sellers leaned against the level and pushed the price to the downside.

On the way back down, the price fell back below its 100 hour moving average (blue line in the chart above) currently at 13696.86.

The price is currently moving back toward that level. Move above it should have traders retargeting the aforementioned 200 hour moving average currently at 13824.74.

PS. Back on February 10, the price also tested the 200 hour moving average and found willing sellers. As a result, the moving average becomes more important for traders going forward. Move above should increase the bullish bias and have traders looking toward the 13966 level (38.2% retracement). Move above that and traders will look toward the 14,000 level.

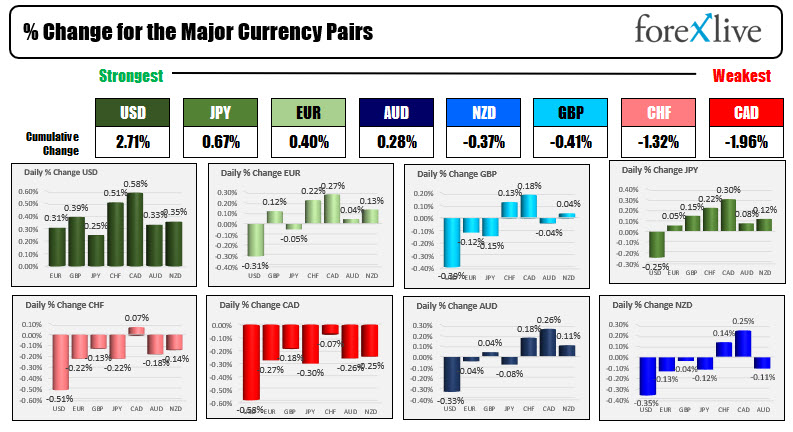

Looking at the hourly chart of the S&P index below, the high price today that 4416.78 also stalled right at the 200 hour moving average (green line). Like the NASDAQ index, sellers leaned against the risk of finding level, and push the price back below its 100 hour moving average.

Unlike the NASDAQ, the price has been able to extend back above its 100 hour moving average (blue line currently at 4372.01). The 200 hour moving average of 4415.72 currently (and moving lower) is the next hurdle to get to and through. Move above and traders would target the 50% midpoint of the move down from the January high to the January low. That level comes in at 4466.64. Get and stay above that level would add to the short-term bullish bias.

Conversely of the 200 hour moving average cannot be broken, the sellers remain in control and we could see rotation back below the 100 hour moving average before the close and potentially back down toward the 4278.94 swing low from earlier this week.

So the 200 hour moving average was “wild” today from a technical perspective. The moving average on the NASDAQ and S&P charts stalled the rally’s and sent the price back to the downside. The prices are trying to rebound. If the price can continue to rebound, and get through the 200 hour moving average on each chart, the technical bias would shift more in the favor of the buyers.