Both the NASDAQ index and S&P index declined by -0.91% in trading today

The major indices are closing lower for the day and also lower for the week. Both the NASDAQ index and S&P index fell by equal -0.91%. The Dow industrial average fell by -0.48%.

The final numbers are showing:

- Dow industrial average -166.44 points or -0.48% at 34584.87

- S&P index -40.78 points or -0.91% at 4432.98

- NASDAQ is down 137.95 points or -0.91% at 15043.98

For the week,

- Dow, -0.07%

- S&P index -0.56%

- NASDAQ index -0.47%.

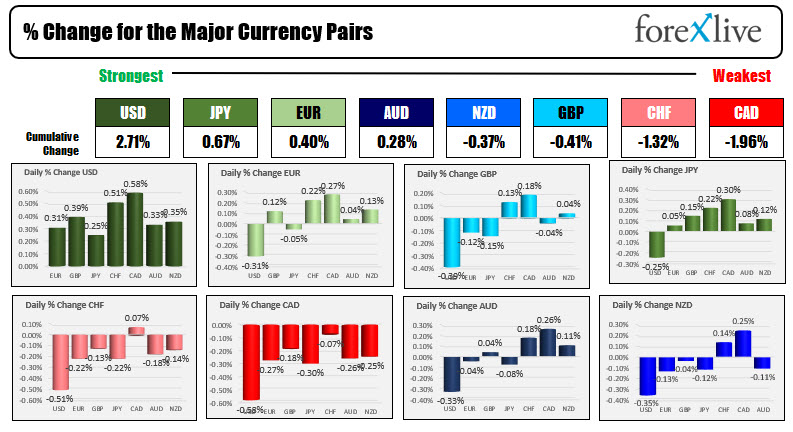

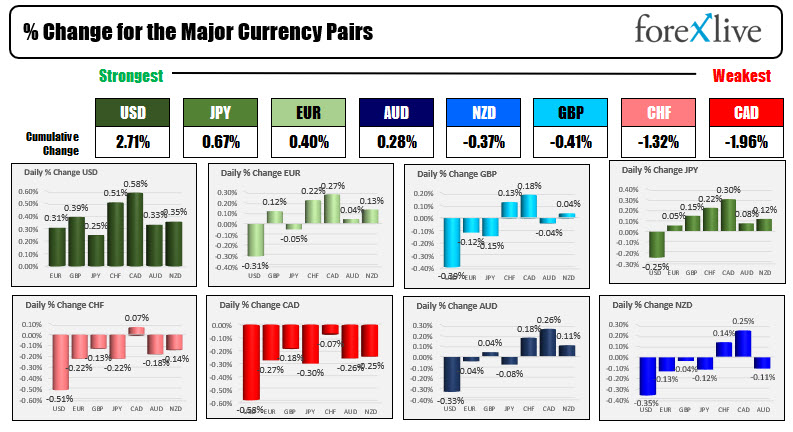

The strongest currency today was the US dollar. The weakest was the Canadian dollar. The US session saw the dollar moved to the highs help by rising interest rates.