Sellers lean on first test

The USDCHF as seen and up, down and back up day today as the market reacts to the swings and stocks and risk sentiment. The three major indices are now trading in positive territory after opening lower. That has helped to push the USDCHF back higher (less flight to safety flows into the CHF).

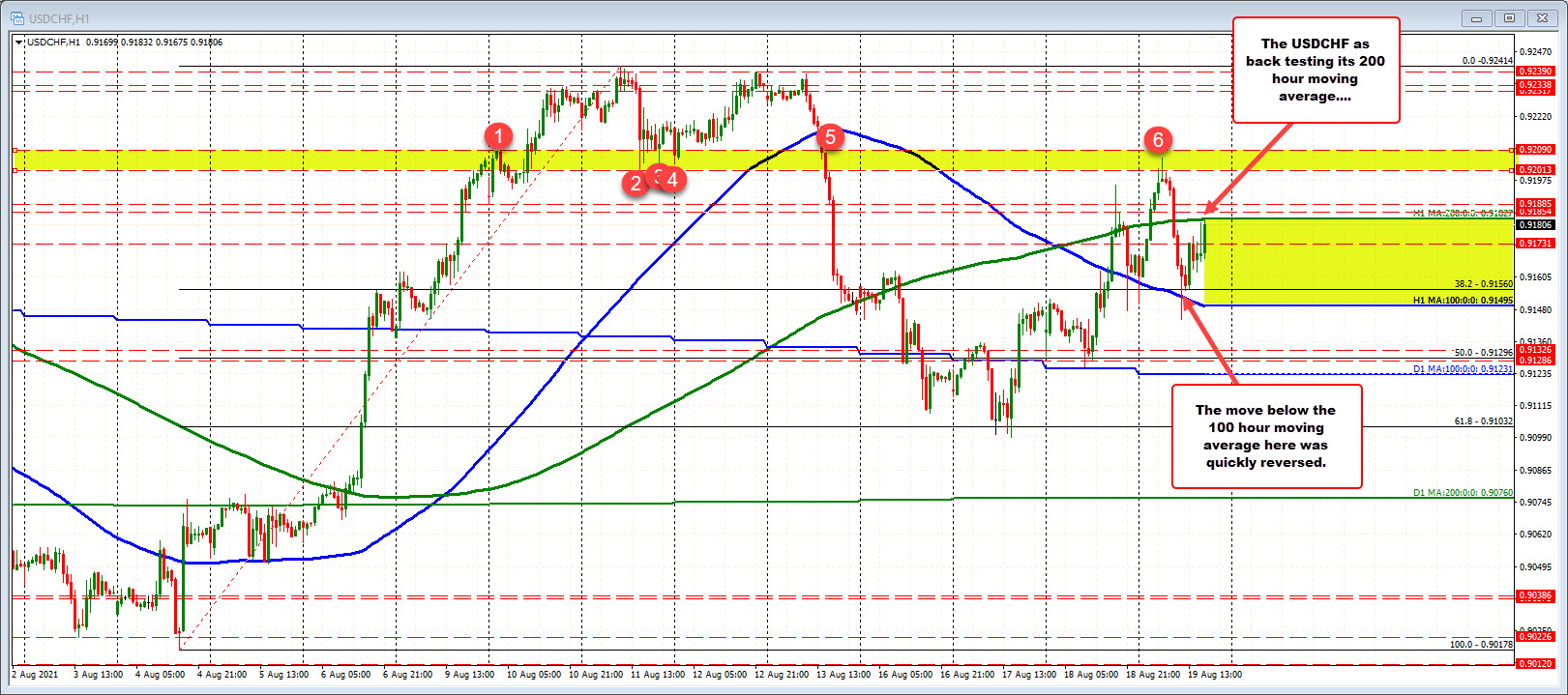

Looking at the hourly chart, the price low for the day did break below its 100 hour moving average (blue line currently at 0.91495), but the break could not be sustained and the price started to rotate back to the upside.

The North American session high just moved up to retest its 200 hour moving average at 0.91827. Sellers leaned against the moving average on the first test and the price has dipped off the level. However, the price remains near that MA level. A break above with momentum would have traders looking toward the 0.9201 to 0.9209 area. That is home to some swing highs and lows going back to August 10 through August 13 (see red numbered circles). The earlier session high price stalled within that area earlier today.

Looking at US yields, they remain lower on the day but are still negative. The tenure yield reach 1.22% earlier. A currently is trading around 1.255%.