Dow and S&P on pace for third straight down day

The major indices open lower but are seeing some modest rebound in early trading:

- Dow industrial average is trading down -113 points or -0.33% at 34845

- S&P index is down -13.4 points or -0.30% at 4386.27

- NASDAQ index is down 54 points or -0.38% at 14467

the Dow industrial average was down over 350 points in early premarket New York trading. The NASDAQ index was down over -100 points and the S&P was down over -40 points.

In other markets:

- Spot gold is trading near unchanged at $1786.68 (down $0.80).

- Spot silver is down $0.13 or -0.58% at $23.36

- WTI crude oil futures are down $0.98 or -1.52% at $63.60

- Bitcoin is down $35 and $44,686

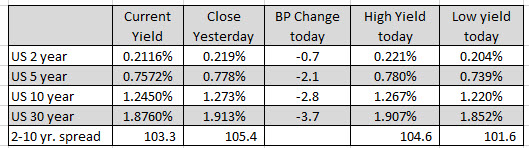

US yields are off their lowest levels. The 10 year yield reached 1.22%, but has rebounded to 1.245% currently. That still down -2.8 basis points but off the lows for the day.

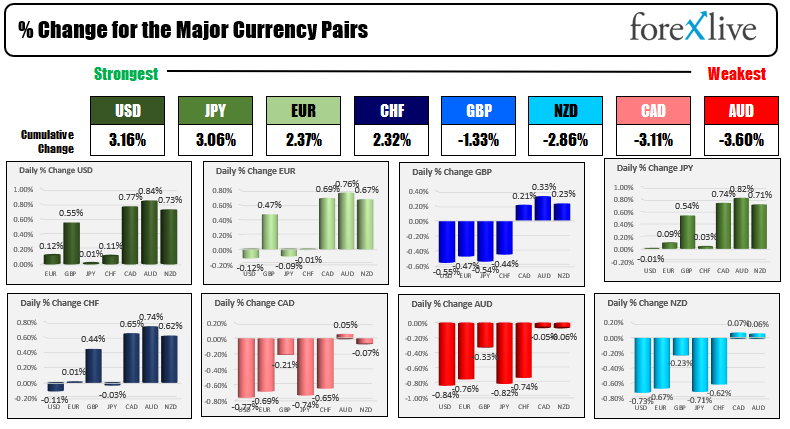

A snapshot of the forex market, shows the US dollar is now the strongest of the majors, the AUD remains the weakest. The USDs gains are mostly against the commodity currencies (CAD, NZD and AUD). The changes against the EUR, JPY and CHF are modest now.