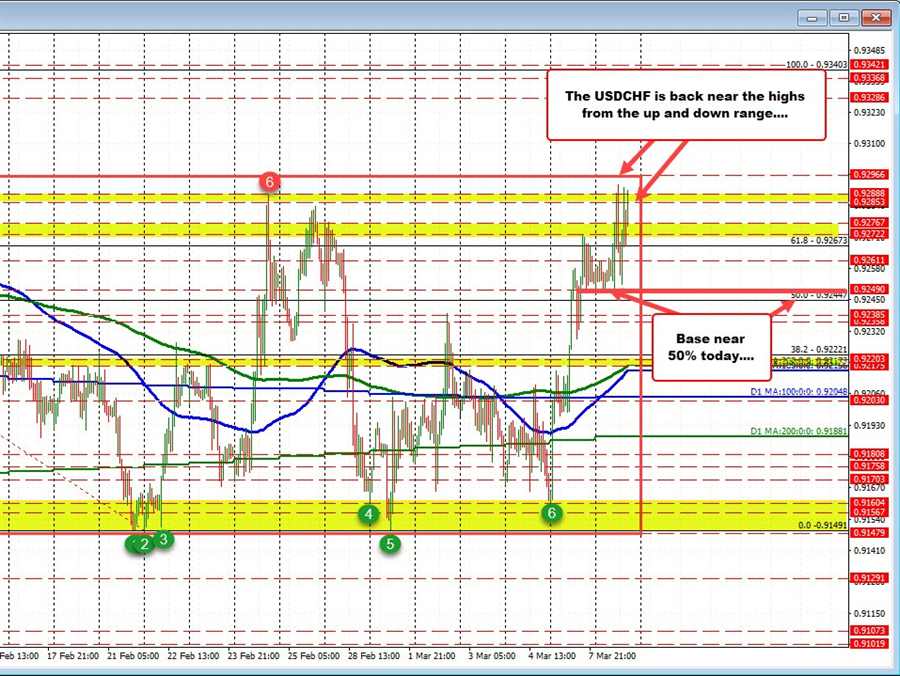

The USDCHF has been trading in an up and down trading range since the end of January. That range is from 0.9149 on the downside, to 0.92966 on the topside . The low extreme was last sniffed on Friday and Tuesday of last week. The upper extreme is being tested today.

The high price today has reached 0.92927 – just short of the high of the swing area at 0.92966. The current price is at 0.9287.

Helping the upside today was the holding of the 50% midpoint of the move down from the January 31 high. Holding above that today, gave the buyers the go-ahead to push higher.

Seller should look to lean against the topside resistance with stops on a break above. A move above would take the pair into the upper extreme area between 0.92966 and the Jan 31 high at 0.93425.

While the USDCHF has been in an up and down range, the EURCHF has been more in a trend move lower as flow of funds has seen sellers of the EUR and buyers of the relative safety of the CHF on the back of the Russian invasion and other geopolitical tensions.

The price of the EURCHF moved below the parity level yesterday on it’s way to a low of 0.9971. That took the price to the lowest level since January 2015. However, some trader concerns about Swiss National Bank intervention, sent the price back to the upside.

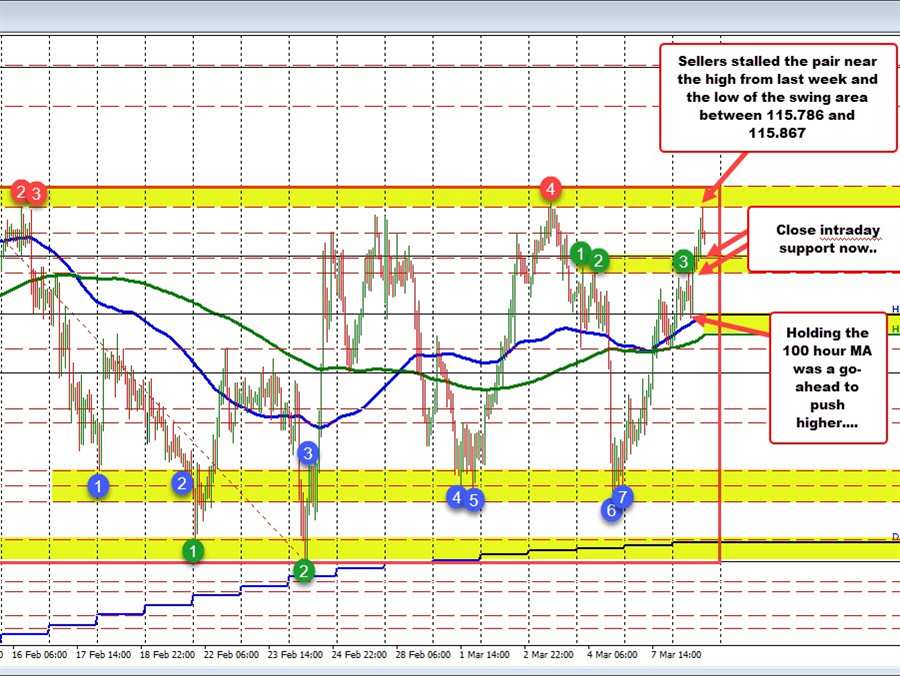

The price rise today was able to get above the 100 hour MA at 1.01119. The price has been trading above and below that MA over the last 4 or so hours as traders debate “is it time” to probe higher.

The low off the recent high is trying to hold support near the swing high from yesterday at 1.0099. If the price in the short term can hold, there is more upside corrective probing room with the 200 hour MA up at 1.0209 as a possible target (green line).

.