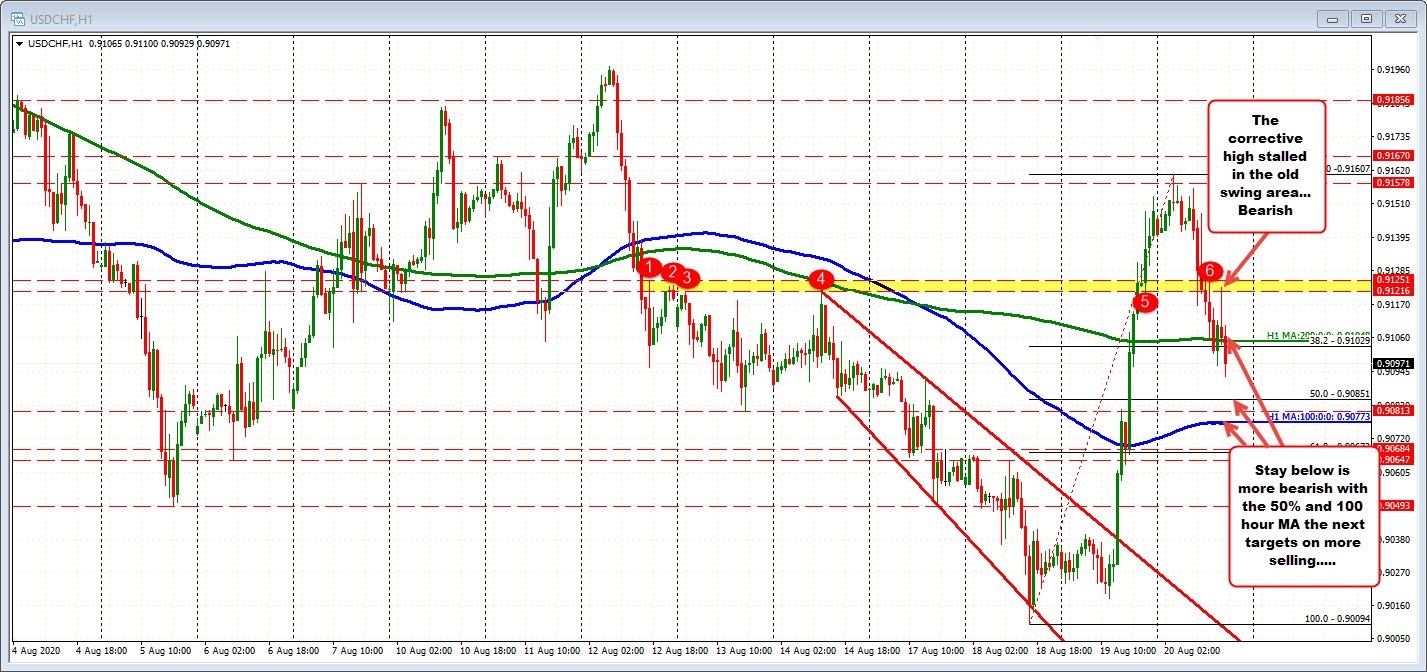

Run to the upside yesterday seeing corrective price action today

The USDCHF is trading to new session lows and continues its correction lower after the run higher yesterday.

The price is now trading back below its 200 hour moving average at 0.91049 and the 38.2% retracement of the move up from Tuesday low at 0.91029. Admittedly the price earlier today move below both those levels only to bounce back toward the swing highs going back to August 12 (see red numbered circles and yellow area). However sellers leaned against that old ceiling area and the price has resumed its moved to the downside.

Going forward staying below the 200 hour moving average will be eyed now as close risk. Stay below keeps the sellers more in control. The next target would be the 50% midpoint of the move up from Tuesday’s low at 0.90851 and the 100 hour moving average at 0.90773.

Right now, the sellers are more in control but the price does need to stay below the 200 hour moving average to keep that control.