All 11 sectors of the S&P are lower.

The majors stock indices are all closing lower with the Dow industrial average the worst performer.

- The S&P and Dow have been down for five the last six trading days

- The NASDAQ index has fallen five straight days

- All 11 sectors of the S&P index are lower today

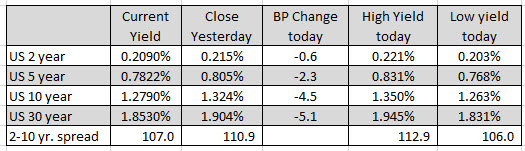

- US yields are sharply lower leading to the decline in the financials. The tenure yield is down -4.5 basis points. The 30 year yield is down -5.1 basis point.

- The Russell 2000 was the worst performer with a decline of over -1.4%

the final numbers are showing:

- Dow industrial average fell -291.07 points or -0.83% at 34578.56

- S&P index fell -25.5 points or -0.57% at 4443.23

- NASDAQ index fell -67.82 points or -0.45% at 15037.76

- Russell 2000 felt -30.83 points or -1.38% at 2209.95

Looking at the sectors of the S&P index (all declined), the worst performers included:

- Energy -1.54%

- Financials, -1.41%

- Industrials -1.23%

- Materials -1.16%

The best performers in a losing effort were:

- Healthcare -0.11%.

- Technology, -0.14%.

- Discretionary, -0.33%.

- Real estate, -0.34%.

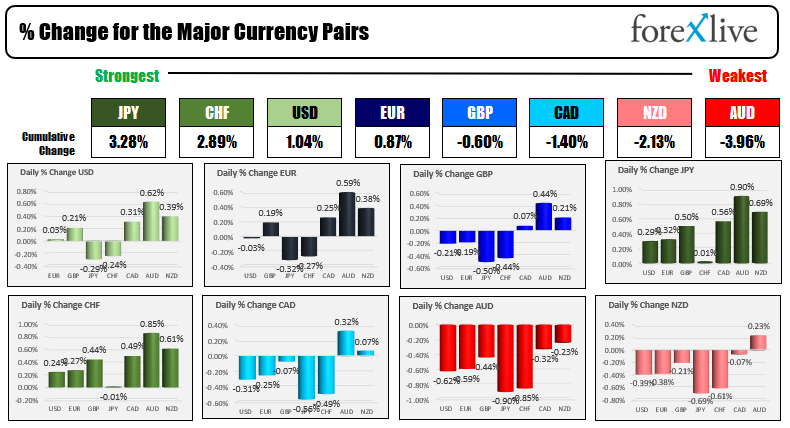

The fall in stocks led to a flow of funds out of the “risk off currencies” like the AUD, NZD and CAD. The JPY and CHF were the beneficiaries of “flight to safety flows”. The USD was also mostly higher with declines only vs the CHF and JPY (it was near unchanged verse the EUR).

The USD was lower after the tamer than expected CPI data, but that decline turned around after US stocks gave up early session gains and started to move lower.