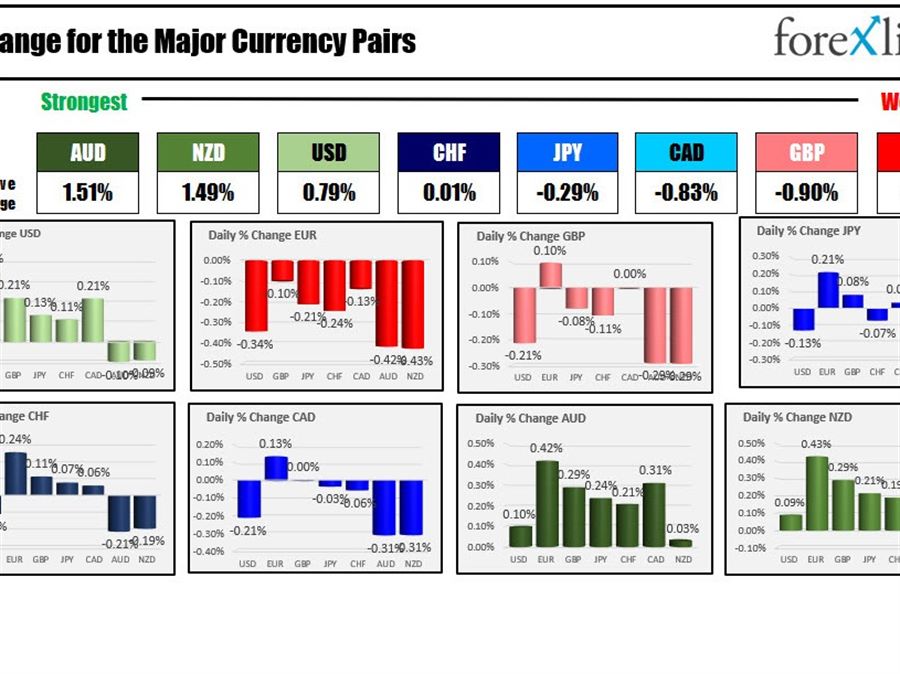

The strongest to the weakest of the major currencies

The AUD Read this Term currencies Read this Term

The tide has gone out again after a one day reprieve that saw stocks move higher, gold tumble, oil tumble. Today, stocks are lower, gold is higher and oil is also higher. The vision from the rose colored glasses have become more murky again.

Russia and Ukraine met for two hours and made no progress. The bombing continues. The sanctions continue with the UK adding sanctions to the owner of the Chelsea Football club, Roman Abramovich. Abramovich had put the club up for sale. That idea is now put on ice (although provisions have been granted a “special license”, that will allow the Premier League club to fulfil its fixtures and for “staff to be paid and existing ticket holders to attend matches”.

That bullish feeling in bitcoin yesterday has turned to a bearish feeling today.

The ECB is expected to keep rates unchanged with focus on when quantitative buying will be stopped and if there is any expectations for a hike in 2022. Lagarde press conference starts at 8:30 AM ET

A snapshot of the markets currently shows:

Spot gold is trading up $16.13 or 0.82% at 2007.71

Spot silver is trading up $0.12 or 0.48% at $25.90

WTI crude oil is trading at $113.62 up $4.85 from the settlement price yesteray

Bitcoin is back below $40,000 at $39186 after trading as high as $42053 and as low as $38796.

In the premarket for US stocks, the futures are implying a lower open after strong gains yesterday

Dow is down –317 points after yesterday’s 653.61 point rise

S&P is down -39 points after yesterday’s 107.18 point rise

Nasdaq is down -192 points after yesterday’s 459.99 point rise

In the European equity markets, the major indices are also lower after the sharp gains seen yesterday

German Dax -2.8%

France’s CAC, -2.4%

UK FTSE 100, -1.2%

Spain’s IBex, -1.2%

Italy’s FTSE MIB -3.05%

In the US debt market the yields are modestly higher. The 30 year is up a bit more. Today the US treasury will auction 30 year bonds at 1 PM ET. The 3 and 10 year issues have been met with more tepid demand.

US rates are modestly higher

In the European debt market, the yields the benchmark yields are little changed.

Euro 10 year yields ahead of ECB

ADVERTISEMENT – CONTINUE READING BELOW