The GBPUSD

GBP/USD

The GBP/USD is the currency pair encompassing the United Kingdom’s currency, the British pound sterling (symbol £, code GBP), and the dollar of the United States of America (symbol $, code USD). The pair’s rate indicates how many US dollars are needed in order to purchase one British pound. For example, when the GBP/USD is trading at 1.5000, it means 1 pound is equivalent to 1.5 dollars. The GBP/USD is the fourth most traded currency pair on the forex exchange market, giving it ample liquidity and a low spread. Whilst the spreads of currency pairs vary from broker to broker, generally speaking, the GBP/USD often stays within the 1 pip to 3 pip spread range, making it a decent candidate for scalping. The GBP/USD pair, also informally known as “cable” (due to transatlantic cables being used to transmit its exchange rate via telegraph back in the 19th century) has a positive correlation with the EUR/USD, and a negative correlation with the USD/CHF. Trading the GBP/USDWhilst a lot of traders and even brokers will assert that the best time to trade the GBP/USD is during its most active hours during London and New York, doing so can be a double-edged sword due to the often-unpredictable nature of the pair. Its volatility also fluctuates often, and so what could be a profitable looking strategy one month, may not be so productive in later months. In addition, purely technical traders can really struggle to be consistent with this pair, (i.e. by ignoring fundamentals), due to the unique political nature of the United Kingdom. The recent drama surrounding Brexit has added another layer of uncertainty to this currency pair. With a smooth resolution not in the cards for the foreseeable future, it is clear the GBP/USD will be influenced by any developments and negotiations with the European Union.

The GBP/USD is the currency pair encompassing the United Kingdom’s currency, the British pound sterling (symbol £, code GBP), and the dollar of the United States of America (symbol $, code USD). The pair’s rate indicates how many US dollars are needed in order to purchase one British pound. For example, when the GBP/USD is trading at 1.5000, it means 1 pound is equivalent to 1.5 dollars. The GBP/USD is the fourth most traded currency pair on the forex exchange market, giving it ample liquidity and a low spread. Whilst the spreads of currency pairs vary from broker to broker, generally speaking, the GBP/USD often stays within the 1 pip to 3 pip spread range, making it a decent candidate for scalping. The GBP/USD pair, also informally known as “cable” (due to transatlantic cables being used to transmit its exchange rate via telegraph back in the 19th century) has a positive correlation with the EUR/USD, and a negative correlation with the USD/CHF. Trading the GBP/USDWhilst a lot of traders and even brokers will assert that the best time to trade the GBP/USD is during its most active hours during London and New York, doing so can be a double-edged sword due to the often-unpredictable nature of the pair. Its volatility also fluctuates often, and so what could be a profitable looking strategy one month, may not be so productive in later months. In addition, purely technical traders can really struggle to be consistent with this pair, (i.e. by ignoring fundamentals), due to the unique political nature of the United Kingdom. The recent drama surrounding Brexit has added another layer of uncertainty to this currency pair. With a smooth resolution not in the cards for the foreseeable future, it is clear the GBP/USD will be influenced by any developments and negotiations with the European Union.

Read this Term has also raced higher today (see GBPJPY

GBP/JPY

The GBP/JPY is the currency pair encompassing the British pound of the United Kingdom (symbol £, code GBP), and the Japanese yen of Japan (symbol ¥, code JPY). The pair’s rate indicates how many Japanese yen are needed in order to purchase one British pound. For example, when the GBP/JPY is trading at 165.00, it means 1 British pound is equivalent to 165 Japanese yen. The British pound (GBP) is the world’s fourth most traded currency, whilst the Japanese yen is the world’s third most traded currency, resulting in a very liquid and popular currency pair. GBP/JPY Prized for its Versatility Among TradersThe GBP/JPY often stays within the 1 pip to 4 pip spread range on most forex brokers. This coupled with its consistently high range and volatility makes it a great candidate for both medium term and long-term trading, although it is also very popular with scalpers. The GBP/JPY is one of the most widely traded forex pairs. A lot of traders actually prefer it to the major pairs, because of the potential it provides. It’s popular with both technical and fundamental traders. The pair’s range easily surpasses a hundred pips on most days.Seasoned news traders also love this pair, since it reacts more vigorously to economic reports and news releases compared with most of the other pairs which possess similar spreads.However, high spreads and whipsaws can be a problem during the really high impact releases.When it comes to technical trading on the GBP/JPY, the classical tried and trusted technical analysis tools and patterns are still the number one weapon of choice. Despite the almost exponential increase in the number of indicators and scripts available in recent years, perhaps with a few exceptions, they simply don’t provide the consistent level of insight a trader needs.Additionally, trading the GBP/JPY gives you exposure to some of the most important economies in the world. Designated as a safe haven currency by investors, the JPY garners popularity in times of volatility or turmoil.By extension, the GBP has remained a paramount currency, despite the recent fallout wrought by Brexit negotiations with the European Union. As such, the currency pair has been highly subject to these discussions, with no resolution presently in sight.

The GBP/JPY is the currency pair encompassing the British pound of the United Kingdom (symbol £, code GBP), and the Japanese yen of Japan (symbol ¥, code JPY). The pair’s rate indicates how many Japanese yen are needed in order to purchase one British pound. For example, when the GBP/JPY is trading at 165.00, it means 1 British pound is equivalent to 165 Japanese yen. The British pound (GBP) is the world’s fourth most traded currency, whilst the Japanese yen is the world’s third most traded currency, resulting in a very liquid and popular currency pair. GBP/JPY Prized for its Versatility Among TradersThe GBP/JPY often stays within the 1 pip to 4 pip spread range on most forex brokers. This coupled with its consistently high range and volatility makes it a great candidate for both medium term and long-term trading, although it is also very popular with scalpers. The GBP/JPY is one of the most widely traded forex pairs. A lot of traders actually prefer it to the major pairs, because of the potential it provides. It’s popular with both technical and fundamental traders. The pair’s range easily surpasses a hundred pips on most days.Seasoned news traders also love this pair, since it reacts more vigorously to economic reports and news releases compared with most of the other pairs which possess similar spreads.However, high spreads and whipsaws can be a problem during the really high impact releases.When it comes to technical trading on the GBP/JPY, the classical tried and trusted technical analysis tools and patterns are still the number one weapon of choice. Despite the almost exponential increase in the number of indicators and scripts available in recent years, perhaps with a few exceptions, they simply don’t provide the consistent level of insight a trader needs.Additionally, trading the GBP/JPY gives you exposure to some of the most important economies in the world. Designated as a safe haven currency by investors, the JPY garners popularity in times of volatility or turmoil.By extension, the GBP has remained a paramount currency, despite the recent fallout wrought by Brexit negotiations with the European Union. As such, the currency pair has been highly subject to these discussions, with no resolution presently in sight.

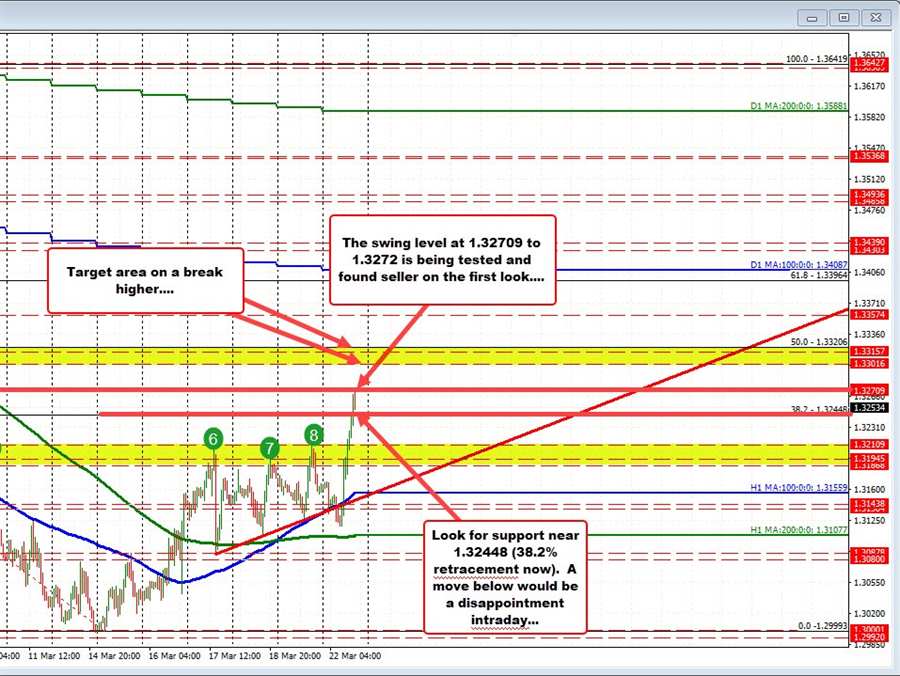

Read this Term post here), and in the process broke above the 1.3211 area which stalled rallies last week and yesterday, and the 38.2% retracement of the move down from the February 18 high at 1.32448.

The price high just reached 1.3273. That level dovetails the swing lows from February 24 at 1.3272, and the swing low from March 2 at 1.32709. The price has rotated back down toward 1.3255 after the test of that target area.

On the downside now, watch the 38.2% retracement 1.32448 for support. A move below that could disappoint the traders looking for the break and run. Stay above, however, and the bias remains in the favor of the buyers (and keeps the door open for another run to the 1.3270 to 1.3272 area.

Other support on a break below the 1.32448 level comes near the 1.3211 level which was the high yesterday and last week (see green numbered circles).