The EURUSD is up for the 2nd consecutive day. Yippee. The low price yesterday stalled just below the 1.0900 level (at 1.0899). The current price is trading at 1.0997. The high price today reached 1.1019.

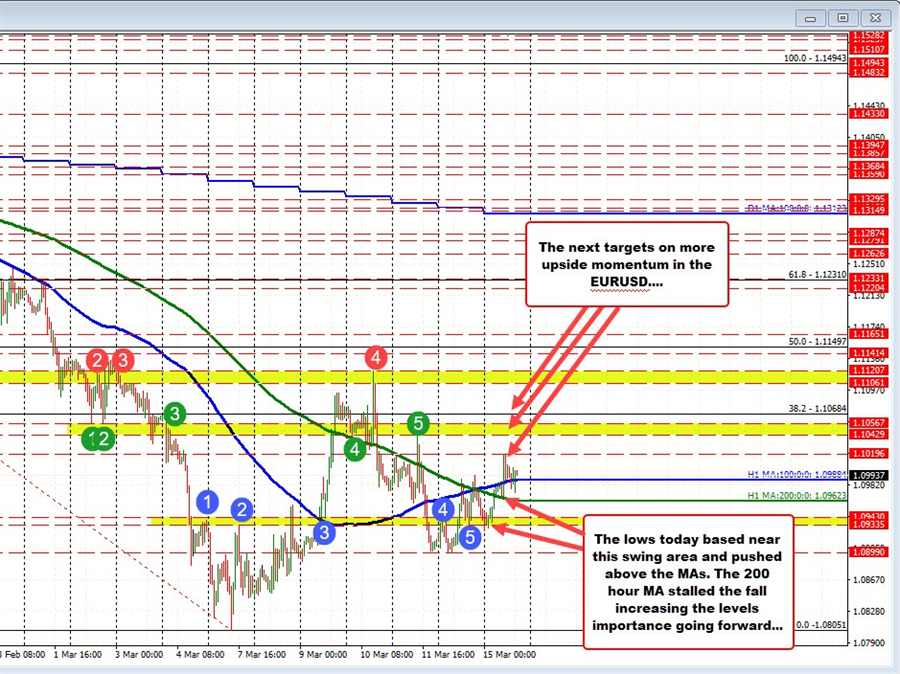

Looking at the hourly chart, the price action today moved back above its 200 hour moving average and 100 hour moving average (green and blue lines in the chart above).

The 200 hour moving average (green line) is currently at 1.09623. The 100 hour moving average (blue line) is at 1.09884. With the current price trading at 1.0998, the price is back above both those moving average levels. That is a more bullish bias intraday at least.

The corrective low after the break above the 200 hour moving average did stall against that same moving average and pushed higher off of that level. That also gives the pair more of a bullish bias. The simple trading rule is if the price can stay above the moving averages, the shorter term bias does give the buyers control in the short term.

Targets On the topside would be to extend above the high for the day at 1.10196. Above that comes the high from Friday’s trade at 1.10429 and swing lows going back to March 2 at 1.10567. The 38.2% retracement of the move down from the February 10 high at 1.10684 would be another target to get to and through to give the buyers more confidence.

Overall, the price action is positive, but there is work to do to increase the bullish bias after the move lower from the February 10 high.