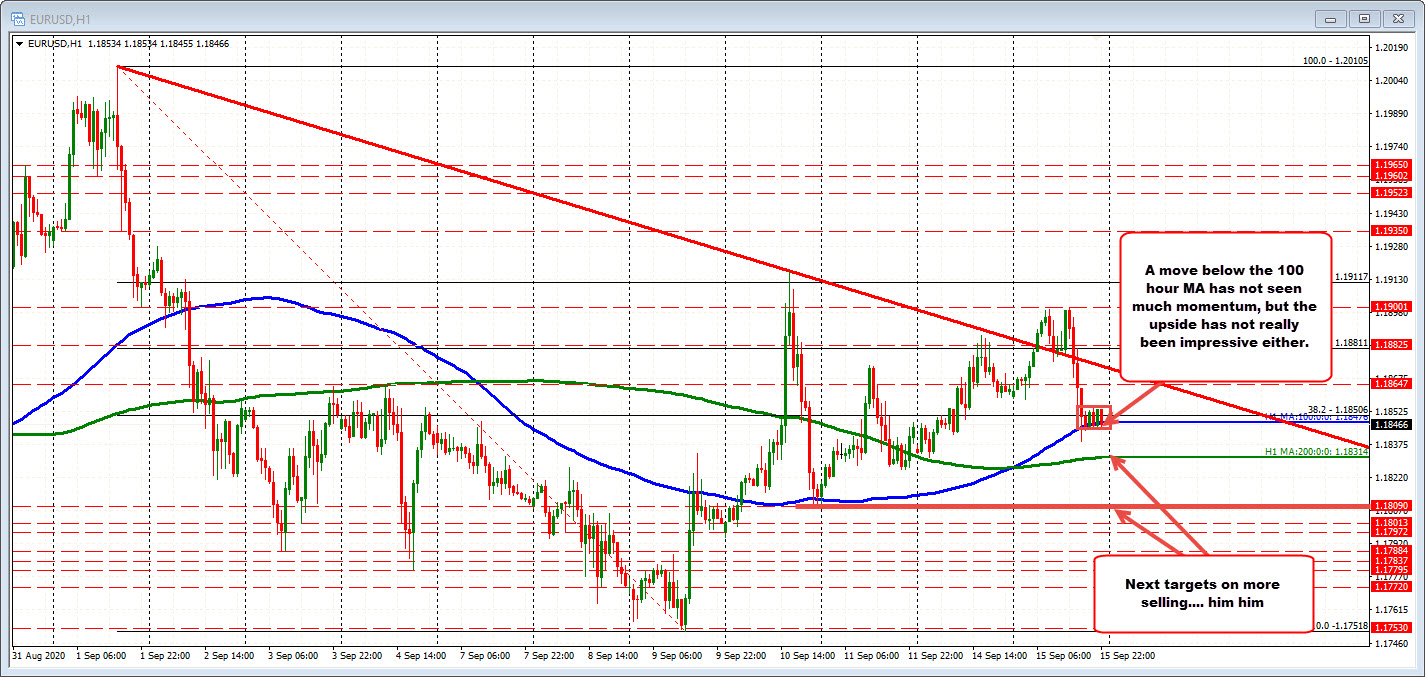

The GBPUSD is moving toward its falling 100 hour moving average (blue line in the chart above) at 1.30855. That moving average is also within a swing area between 1.3080 and 1.30878. Get above both, would be a step in the bullish direction from a technical perspective.

Recall from Friday, the 100 hour moving average stalled the rally (it was at a higher level as well). Back on last Thursday, the 100 hour moving average was broken, but found resistance sellers near the 1.3186 to 1.31945 swing area, and was also well short of the 200 hour moving average (green line).

The 200 hour moving average is currently at 1.31467 and falling. It would be another key target to get to and through on further upside momentum. The price last traded above the 200 hour moving average back on February 23 when the moving average was at 1.3576. The price low today reached 1.2999 (call it 1.3000). That low is a nice round number to form a bottom, and a full 576 pips from that broken 200 hour moving average level back on February 23.

Is it time to probe the upside?

Get and stay above its 100 hour moving average and the buyers can feel more confident for a move toward the 200 hour moving average and then see what happens there.