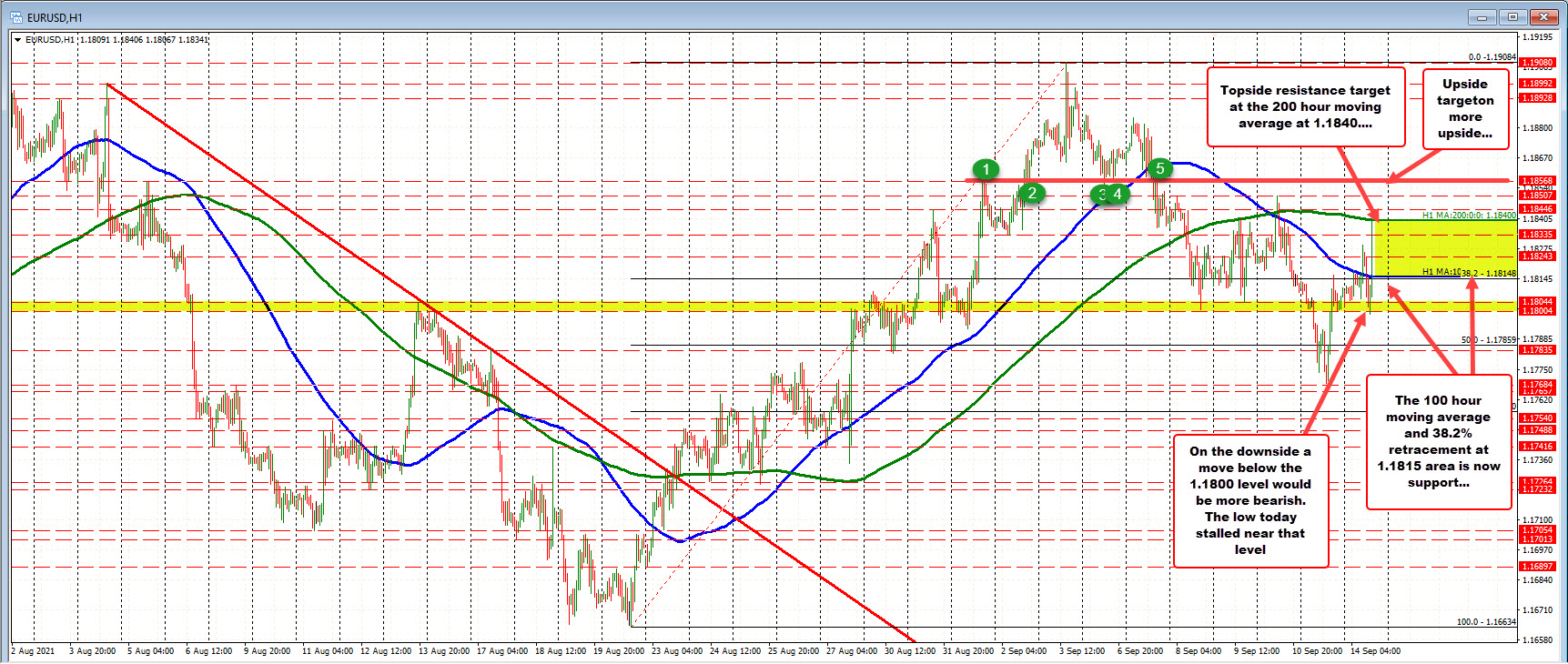

EURUSD trades between 100/200 hour MA

The USD moved lower on the initial reaction to the lower than expected CPI.

For the EURUSD, the price moved higher, but did find sellers leaning against its 200 hour moving average at 1.1840. The high price reached 1.18406. The current price is trading at 1.1832.

The move to the upside on the data release also saw the pair break above its 100 hour moving average at 1.18157. The 38.2% retracement of the range since August 20 also comes in near that level I.18148.

With the 100 hour moving average/38.2% retracement both near 1.1815, and the 200 hour moving average at 1.1840, those levels now become the support and resistance for traders.

The intraday bias is more positive with the price being positive on the day and data perhaps suggesting a lower US dollar on less fears of a Fed rate increase anytime soon. However, should the price move back below its 100 hour moving average, the bias would shift back to the downside. A move back below the 100 hour moving average would have traders targeting the 1.1800 to 1.18044 level on the downside. The low price today stalled near the 1.1800 level.

On a break above the 200 hour moving average, the high price from Friday’s trade came in at 1.18507. Above that watch the 1.18568 level. That was the high price from September 1 and near low prices from sixth. On September 7, the price move below that level and has stayed below since that time.