Snatch defeat from the jaws of victory

The European indices were higher at the North American opening. However, the indices could not ignore the liquidation in the US indices and are closing the session lower on the day. The provisional closes are showing:

- German DAX, -1.6%. It was up 1.64% at its highs

- France’s CAC, -0.7%. It was up 1.98% at its highs

- UK’s FTSE 100, -1.6%. It was up 0.93% at the high

- Spain’s Ibex, -0.4%.. It was up 2.33% at its highs

- Italy’s FTSE MIB, -1.8%. It was up 1.42% its highs

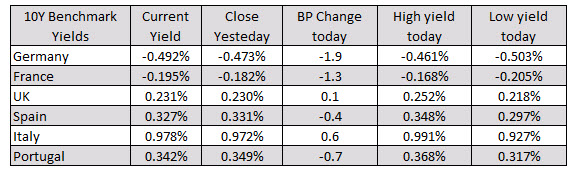

In the 10 year note sector, the benchmark yields are mixed:

In other markets as London/European traders look to exit:

- spot gold is trading down $16.4 or -0.84% $1926.70

- spot silver is trading down $0.89 or -3.24% $26.55

- WTI crude oil futures are down $-1.01 or 2.46% at $40.49

in the US stock market, the current snapshot shows

- the S&P index -103 points or -2.86% at 3478.40. The low price reached 3453.00

- the NASDAQ index is trading down -512 points or -4.24% at 11545. It’s a low price reached 11433.45

- Dow industrial average is down 595 points or -2.04% at 28504. It’s low price reached 28292.43.

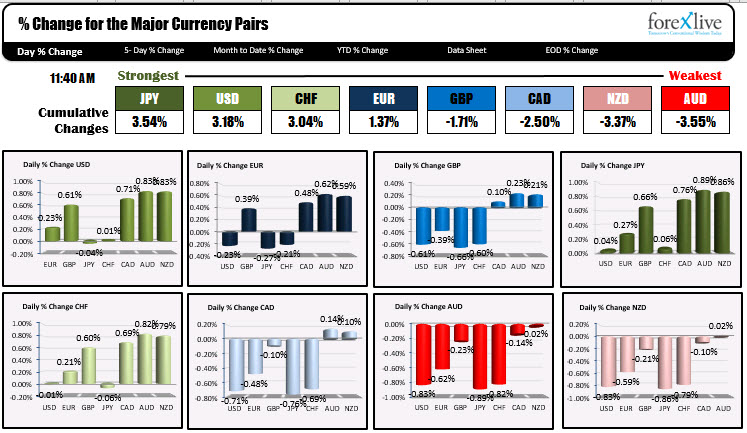

In the forex market, the JPY has moved to the strongest of the majors followed by the USD. The AUD and NZD are now the weakest. At the start of the session the USD was the strongest and the GBP was the weakest.