Trade lower on the day but near the middle of the trading range

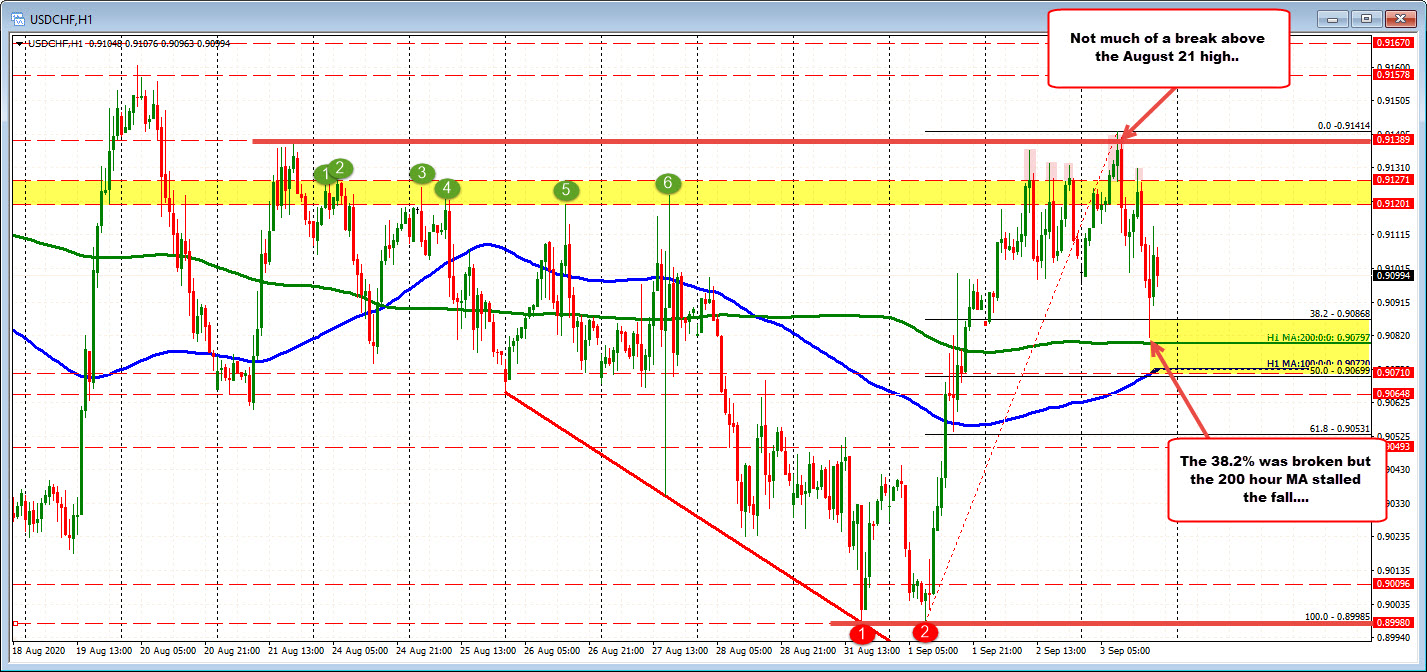

The USDCHF moved higher in the Asian session and in the process ticked above the August 21 swing high at 0.91389. The problem with a break is that it only made it to 0.91414 before finding sellers and pushing back to the downside.

The move lower has not been without its ups and downs. The liquidation and stocks sent some of the flow funds into the relative safety of the Swiss franc. The USDCHF fell below the 38.2% retracement of the move up from the September 1 low at 0.90868, but held above the 200 hour moving average at 0.90797. The low price reached 0.90815.

The price currently trades at 0.91037. That is on the lower side of the range for the day, but still around for so pips below the close from yesterday. The price can go either way from here. In fact, stocks are moving back down toward the lower levels, but there isn’t much reaction in the USDCHF pair (traders seen content to watch vs react). Nevertheless, what we know is a ceiling was made along with a support target at the moving averages.