Understanding Pips: The Basics of Forex Trading

In the realm of Forex trading, the term “pip” frequently emerges as a fundamental concept that traders must grasp. A pip, which stands for “percentage in point” or “price interest point,” represents the smallest price movement that an exchange rate can make based on market convention. In the context of Forex trading, understanding what a pip is and how it functions is crucial for both novice and seasoned traders alike.

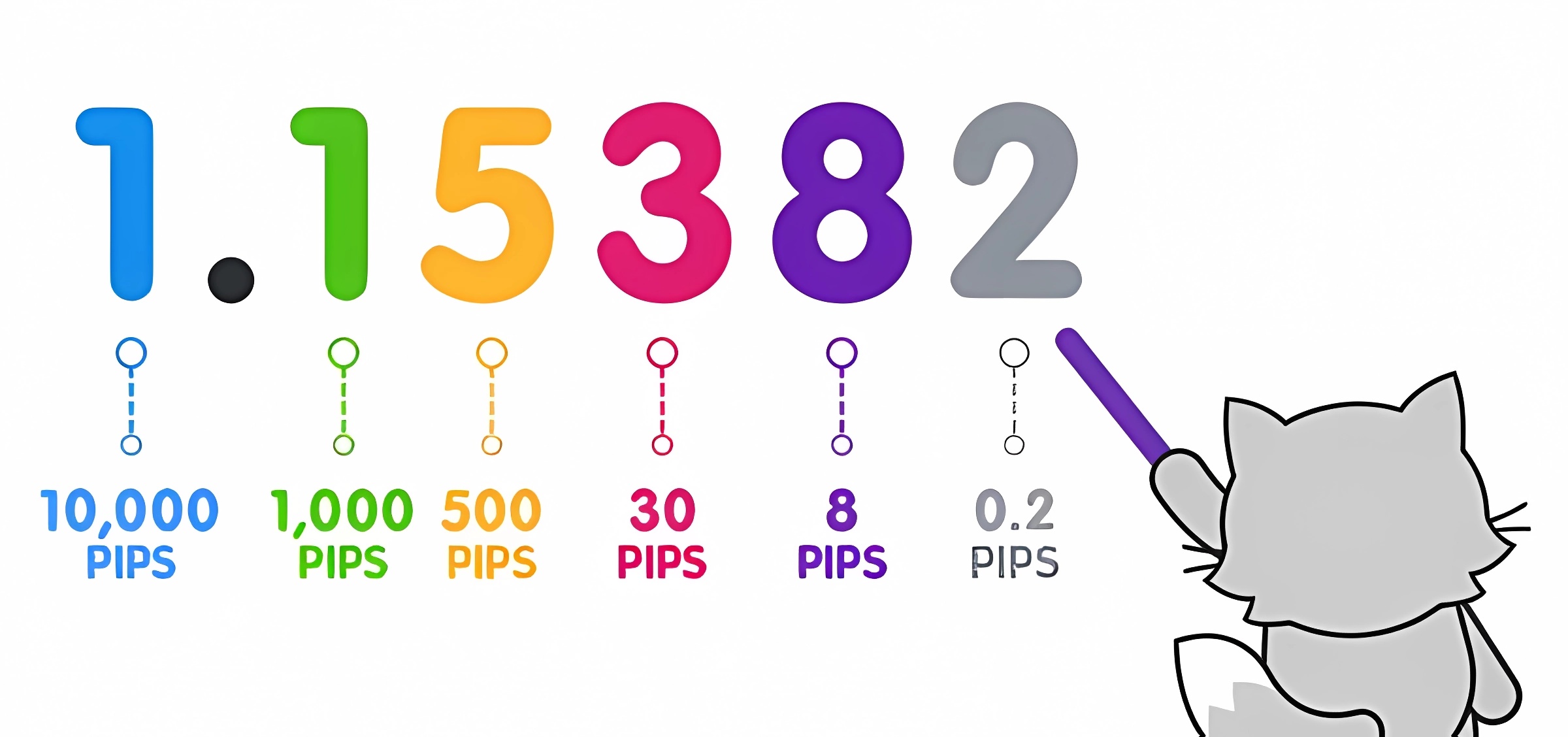

A pip is typically the fourth decimal point in a currency pair quotation. For example, if the EUR/USD currency pair moves from 1.1050 to 1.1051, that 0.0001 USD rise in value represents one pip. However, for currency pairs that involve the Japanese Yen (such as USD/JPY), a pip is denoted as the second decimal place, due to the Yen’s lower relative value.

How Pips Influence Currency Pair Valuation

Pips play a pivotal role in determining the valuation of currency pairs. They allow traders to quantify changes in exchange rates, which directly affect trading positions and profit margins. The movement of pips can have the following implications:

- Profit and Loss Calculation: Pips are used to calculate profits and losses in Forex trading. For instance, if you bought the EUR/USD pair at 1.1050 and sold it at 1.1060, you gained 10 pips. Depending on the size of your lot, this could translate into significant profits.

- Risk Management: Traders use pips to set stop-loss and take-profit orders, effectively managing risk by determining the maximum loss they are willing to accept or the profit target they aim to achieve.

Calculating Pips: A Step-by-Step Guide

Calculating pips can initially seem daunting, but breaking it down into a few simple steps makes it manageable:

- Identify the Pip Value: Determine the number of decimal places in the currency pair. For most pairs, it’s the fourth decimal, but for JPY pairs, it’s the second decimal.

- Measure the Movement: Subtract the starting exchange rate from the ending rate.

- Calculate the Pip Value: Multiply the pip movement by the position size (lot size) to determine the pip’s monetary value.

Example:

- Currency Pair: EUR/USD

- Lot Size: 100,000 units

- Move: From 1.1050 to 1.1060

Calculation:

- Pip Movement = 0.0010

- Pip Value = 100,000 (lot size) x 0.0001 (pip) = $10 per pip

The Role of Pips in Forex Market Volatility

Forex market volatility is influenced significantly by pip movements. Large pip changes in short periods can indicate high volatility, often driven by economic news, geopolitical events, or market sentiment shifts. Traders must be aware of such volatility as it can lead to:

- Higher Profit Opportunities: Rapid pip movements can yield substantial profits if timed correctly.

- Increased Risk: Volatility also entails higher risk, necessitating disciplined risk management strategies.

Strategies to Maximize Profits Using Pips

Maximizing profits in Forex trading involves leveraging pip movements effectively. Here are some strategies:

- Scalping: Focus on small pip movements within short time frames to accrue small but frequent profits.

- Swing Trading: Capitalize on larger pip movements by holding positions over several days.

- Trend Following: Use technical analysis to identify and follow trends, aiming for significant pip gains during prolonged market movements.

Common Mistakes When Trading Pips in Forex

In Forex trading, Common Mistakes When Trading Pips in Forex can severely impact your trading success. Here are some pitfalls to avoid:

- Ignoring Spread Costs: Always account for the spread, which can affect the actual pip movement in your favor or against you.

- Lack of Risk Management: Failing to set appropriate stop-loss and take-profit levels can result in significant losses.

- Over-Leveraging: High leverage might amplify returns, but it can equally magnify losses if the market moves against your position.

Comparative Table: Pip Value Across Different Lot Sizes

| Lot Size | Pip Value (EUR/USD) | Pip Value (USD/JPY) |

|---|---|---|

| Micro (1,000) | $0.10 | ¥10 |

| Mini (10,000) | $1.00 | ¥100 |

| Standard (100,000) | $10.00 | ¥1000 |

Understanding pips and their implications in Forex trading sets the foundation for informed decision-making and effective risk management. By mastering the calculation and strategic use of pips, traders can enhance their market analysis and trading outcomes, leading to potentially profitable Forex trading endeavors.

Leave feedback about this