Stocks higher helping

The USDJPY has pushed back to the upside as stocks have rebounded and erased the bid of the declines. The NASDAQ index traded down as much as -114.4 points or -0.75%. It is currently trading down just -5.24 points or -0.03% at 15156.53. The S&P index was -8.88 points or -0 point to 0% at 4471.82.

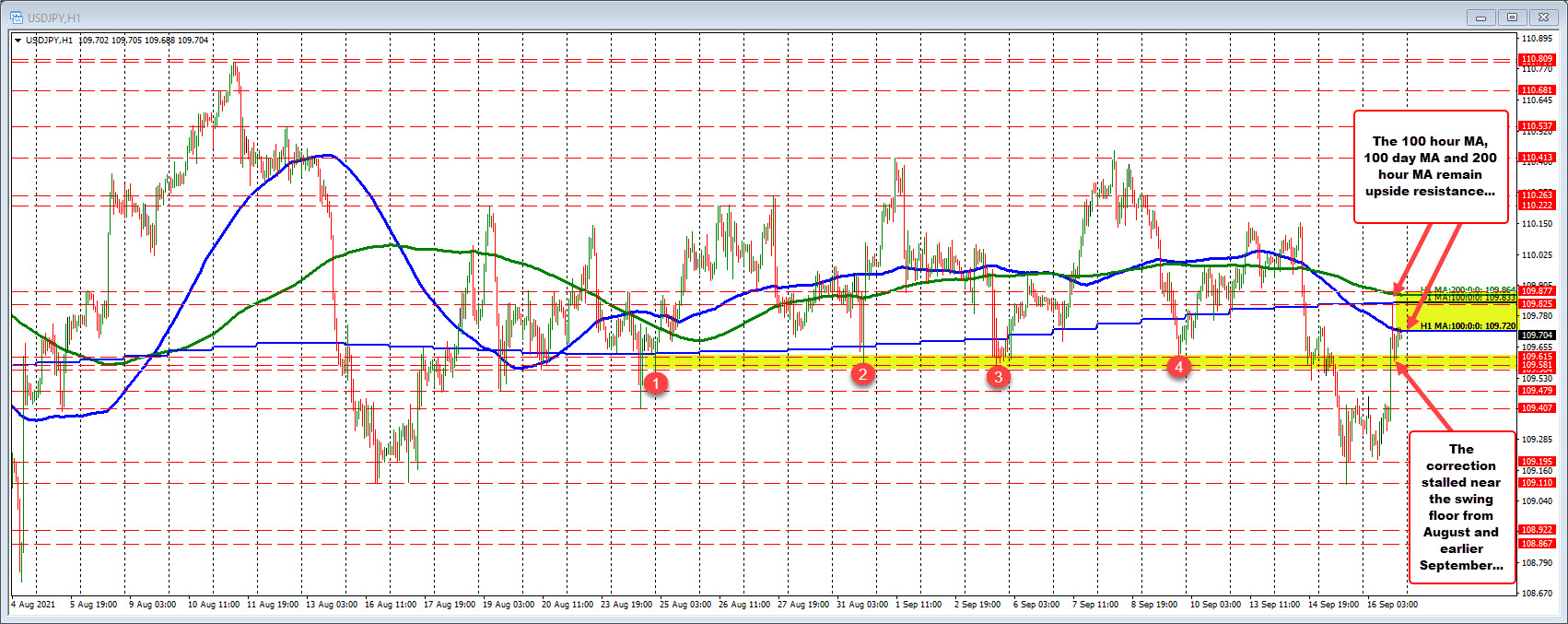

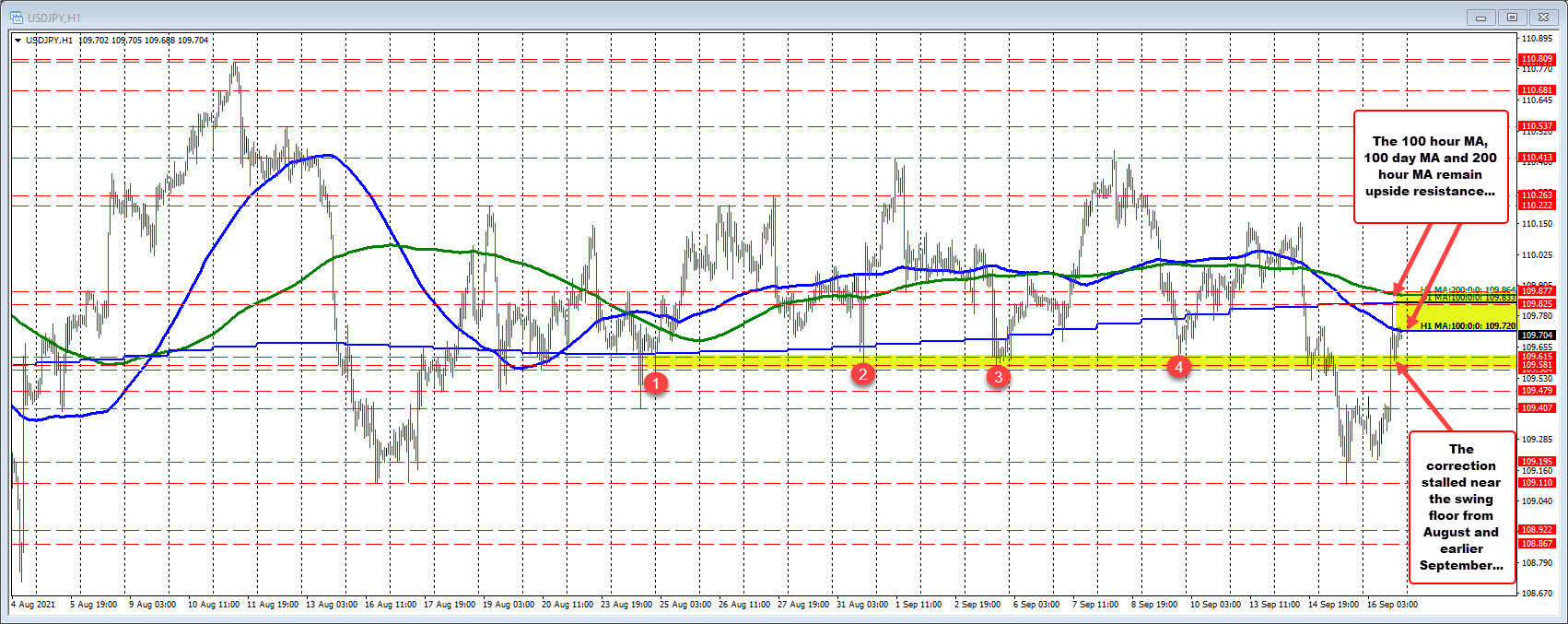

Looking at the USDJPY, the pair was higher coming into the US trading and extended up through its 100 hour moving average on to its next target against the 100 day moving average at 109.833. Sellers leaned against that level on pushed price back down toward the swing area between 109.56 and 109.61 (see earlier post outlining the key technical levels). Buyers leaned against the area and have pushed price back higher. The 100 hour moving average is being tested at 109.72.

The same technicals apply as the earlier post. Get above the 100 hour moving average and traders would target the 100 day moving average and 200 hour moving average at 109.833 and 109.864 respectively. Get above those levels opens the upside for further gains.

Conversely a move back below the 109.56 level and the sellers start to take more control once again.