Fed’s Kaplan comments give stocks a boost

The major US stock indices are trading mixed in early New York trading, erasing the premarket declines. Comments from Feds Kaplan have given the indices a boost.

The pairs are still on track for declines this week. The Dow and S&P are on pace for the worst week since June. The NASDAQ is on pace for its worst week since May

The snapshot of the market currently shows:

- Dow is down -10 points or -0.03% at 34883

- S&P index is up 5.5 points or 0.13% at 4405.79

- NASDAQ index is up 53 points or 0.36% at 14595.50

In other markets:

- Spot gold is trading up $3.26 or 0.18% at $1782.48.

- Spot silver is down five cents or -0.24% $23.14

- WTI crude oil futures are still down $-1.04 or -1.60% at $62.60. Crude oil is on a six days losing streak (today would make it 7).

- The price of bitcoin is up $754 at $47,518

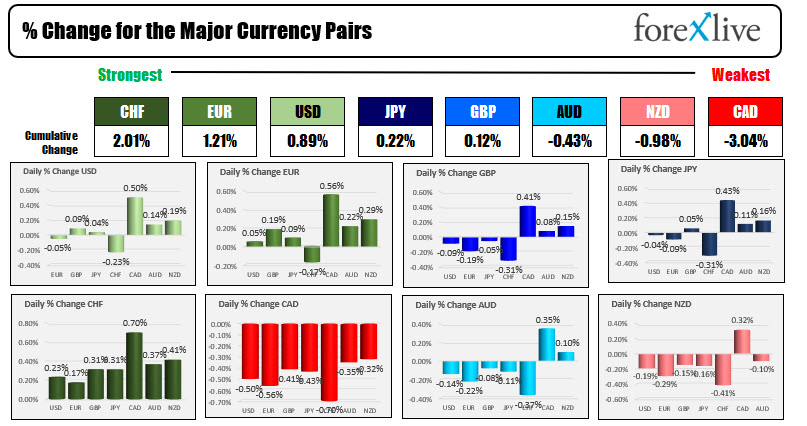

In the forex market, the CHF remains the strongest and the CAD is the weakest. The USD is mostly stronger with modest declines versus the EUR and the CHF. Most of the greenback’s move is vs the commodity currencies.

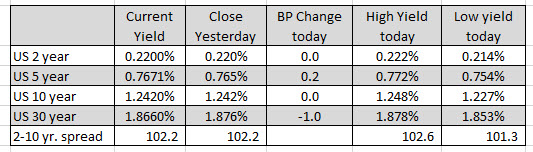

In the US debt market, the yields are little changed after opening the New York session more in the red.