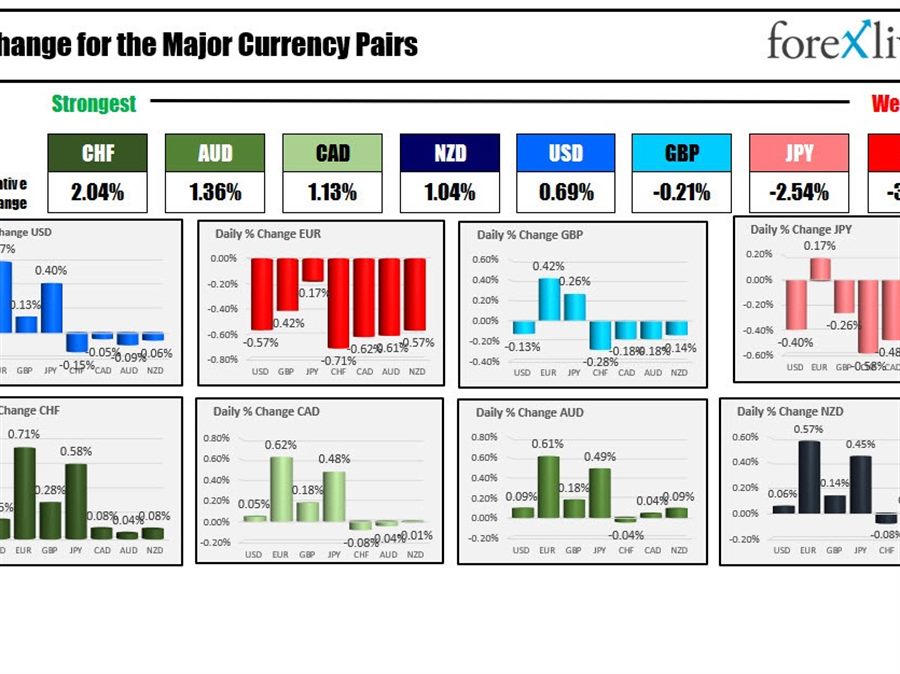

The strongest to weakest of the major currencies

The CHF is the strongest and the EUR is the weakest as NA trader enter for the day. The USD is is mixed with modest declines vs the CHF, CAD, AUD and NZD and gains vs the EUR, GBP and JPY. Today we will get some Fedspeak after the hiatus leading into and immediately following the FOMC rate hike on Wednesday. Fed’s Bowman, Evans and Barkin will explain themselves to the market. Fed’s Waller will also speak on CNBC momentarily. Fed’s Bullard who voted for 50 BP hike and also wanted to raise rates to 3.0% by the end of 2022 (now that is Volker-esque), had his first say in a note he penned (see Adam’s post here ).

Stocks are lower in pre-market trading. Yesterday the major indices Read this Term

Biden is to talk to Xi on Russian aggression and warns of helping Russia get through sanctions. The EU said they have evidence of dialogue on cooperation between the two countries.

Russia met bond obligations at least for now which is a good thing.

China’s Xi announced a pivot in regard to Covid suppression. They will be more tolerant (“maximum prevention” with the “least cost”).

The Hong Kong Hang Seng index fell -0.41%. The Shanghai composite index rose 1.12%.

US stocks are set open lower. US yields are lower. Gold Read this Term

A snapshot of the markets are showing:

Spot gold is down five dollars or -0.27% at $1937.57

Spot silver is down nine cents or -0.36% $25.21

WTI crude oil futures are trading at $103.22 after settling at $102.98 yesterday

bitcoin is trading at $40,489. It was trading around $40,700 near 5 PM yesterday

In the premarket for US stocks, the major indices are lower. Nevertheless the major indices are expected to close higher for the week due to a solid three day run:

Dow industrial average -200 the points after yesterday’s 417.66 point rise

S&P index -32 points after yesterday’s 53.81 point rise

NASDAQ index down -118 points after yesterday’s 178.23 point rise

In the European equity markets, the major indices are lower:

German Dax -1.7%

France’s CAC -1.5%

UK’s FTSE 100 -0.6%

Spain’s Ibex, -1%

Italy’s FTSE MIB -1%

In the US debt market, yields are lower with the two – 10 year spread down a pip at 24.3 basis points. The two – 10 year spread reached a low of around 19 basis points, before rebounding back higher yesterday. That was the lowest since March 2020 at the start of the pandemic (it reached around eight basis points at that time). A negative curve often precludes a recession.

US rates are lower

In the European debt market, the benchmark 10 year yields are also trading to the downside.

European 10 year yields are lower

ADVERTISEMENT – CONTINUE READING BELOW