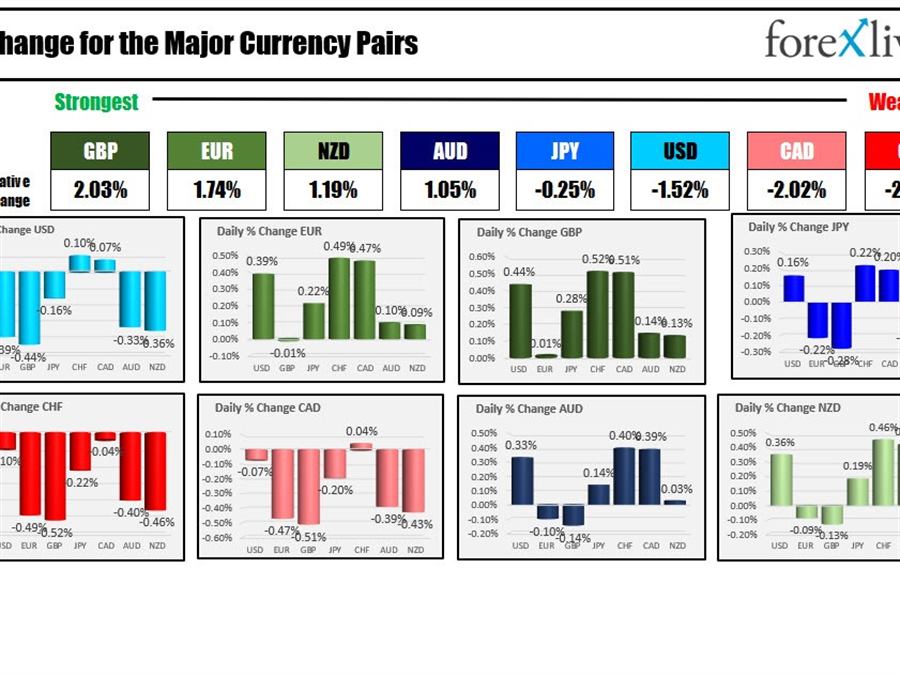

As the North American session begins, the GBP is the strongest and the CHF is the weakest . The pound’s rise was helped by stronger jobs and wage data with the jobless rate falling below its pre-pandemic level (3.9%), and average earnings growing at an accelerated pace and above expectations (4.8% versus 4.6%). The German ZEW economic sentiment index plunged to -39.3 from 54.3 last month on the Russian invasion news. The USD is mostly lower with small gains versus the CHF and the CAD.

China concerns are increasingly on the “:wall of worry” with stocks moving lower once again on the back of the Covid lockdowns in major industrial centers. The Shanghai composite index fell -4.95%. The Hang Seng index fell -5.72%. US/China meetings did little to appease concerns about China support of the Russian invasion (which could ultimately to China sanctions). Meanwhile in Ukraine fighting continues as meetings between Ukraine and Russia yielded little results yesterday. Ukraine’s Zelensky said that meetings will continue today which he cited is a positive development. Time will tell.

Ahead of the Fed decision on Wednesday, US stocks are marginally higher (erasing the earlier losses). The FOMC is expected to increase rates by 25 basis points but could lean toward 50 basis points sooner than expected in the future. The Fed is likely to increase its dot plot tightenings for 2022 to 4 or most likely (?) 5. Private economists and the market is up toward seven as inflation continues to be a concern.

Helping the inflation story however, is oil prices which are lower once again in trading today. After reaching $130 last week the price has now dip back below the $100 level on demand concerns from the China lockdown, and perhaps on the sticker shock from the spike in gasoline price rises globally. Crude oil is currently down around -7.8% at $95.08. Gold is also lower after trading as high as $2070.42 last week. It is back down and moving toward $1900 again. The low price from 2022 comes in at $1778.50. The current price is near the 50% midpoint of the low to high price range (midpoint at $1924.19).

A snapshot of the market is showing:

- Spot gold is down $-25.07 or -1.28% at $1925

- Spot silver is down -$0.37 or -1.47% $24.65

- WTI crude oil is down – $-7.56 or -7.53% at $95.47

- Bitcoin is trading at $38,641 after trading as low as $38,142 and as high as $39,801 in overnight trading

IN the premarket for US stocks:

- Dow is up 34 points after yesterday’s 1.05 point rise

- S&P is up 4.75 points after yesterday’s -31.2 point decline

- Nasdaq is up 47 points after yesterday’s -262.59 point decline

In the European stock market, the major indices are pointing higher in trading today:

- German Dax -1.24%

- France’s CAC -1.26%

- UK FTSE 100, -0.86%

- Spain’s Ibex -0.22%

- Italy’s FTSE MIB -0.96%

In the US debt market, the snapshot shows a modest decline in rates after sharp gains over the last few days.

European benchmark 10 year yields are also lower after the sharp fall in the German ZEW economic sentiment index.