The USD is mixed ahead of the jobs data.

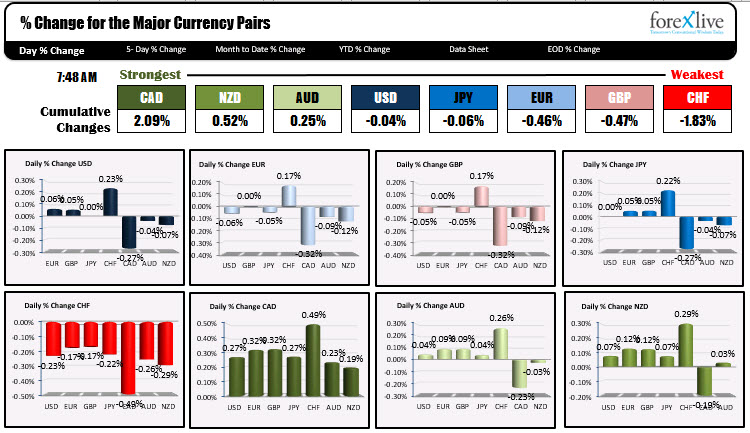

As North American traders enter for the day, the CAD is the strongest, the CHF is the weakest. The USD is mixed as the market awaits the US (est +1350K new jobs and 9.8% unemployment rate) and Canada (+250K new jobs and 10.2% unemployment rate) jobs reports.

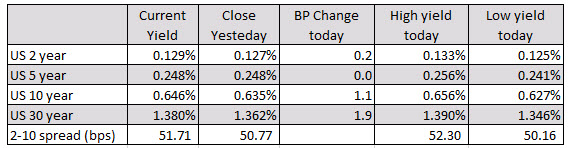

- Rates are mixed (short end flat, long end up marginally).

- Stocks are mixed (rotation out of tech continues with Nasdaq down, S&P unchanged, and Dow up) after the rout yesterday (Nasdaq down near 5% on the day).

- Gold and silver are up today after being down yesterday.

The market is waiting for the jobs reports. There is also stimulus chatter but still no breakthrough. The two political sides have agreed that they will not shut down the government in October at least.

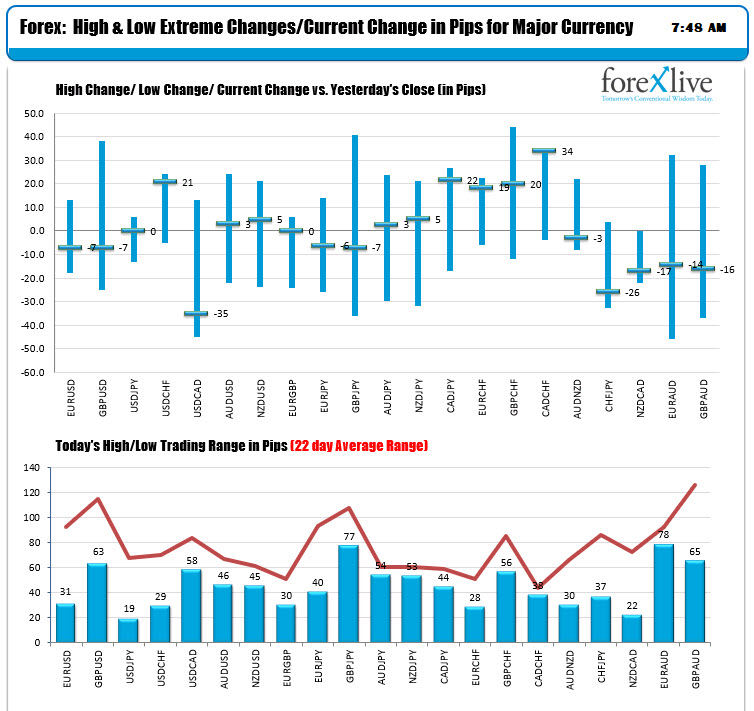

The ranges are modest for the major indices with the GBPUSD up at 63 pips and leading the way. The USDCAD has a 58 pip range, but the EURUSD, USDJPY, and USDCHF are well behind with ranges of only 31 pips or less. The USD is higher vs the CHF and down vs teh CAD. The changes vs the EUR, GBP, JPY, AUD and NZD are all within 7 pips of unchanged. Wait. Wait.

- Spot gold is up $7.40 or 0.38% $1938.20

- Spot silver is up $0.19 or 0.75% at $26.78

- WTI crude oil has rebounded by $0.18 or 0.44% $41.55

In the premarket for US stocks, the major indices are mixed with the NASDAQ index lagging as rotation out of technicals send that index lower while the Dow is trading higher. The snapshot currently shows:

- Dow, +118 points

- S&P, +1 point

- NASDAQ index, –108 points

European shares are trading mostly lower

- German DAX, -0.4%

- France’s CAC, -0.1%

- UK’s FTSE 100, -0.1%

- Spain’s Ibex, +0.7%

- Italy’s FTSE MIB, unchanged

US debt market, yields are mixed/marginally higher with the yield curve steepening by about 1 basis point (2 – 10 yield spread).

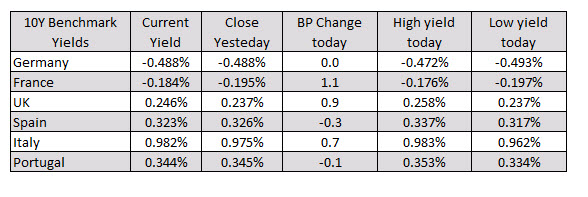

In the European debt market, the benchmark 10 year yields are mixed but little changed. The biggest mover is France with a 1.1 basis point gain. The biggest decline is Spain at -0.3 basis points