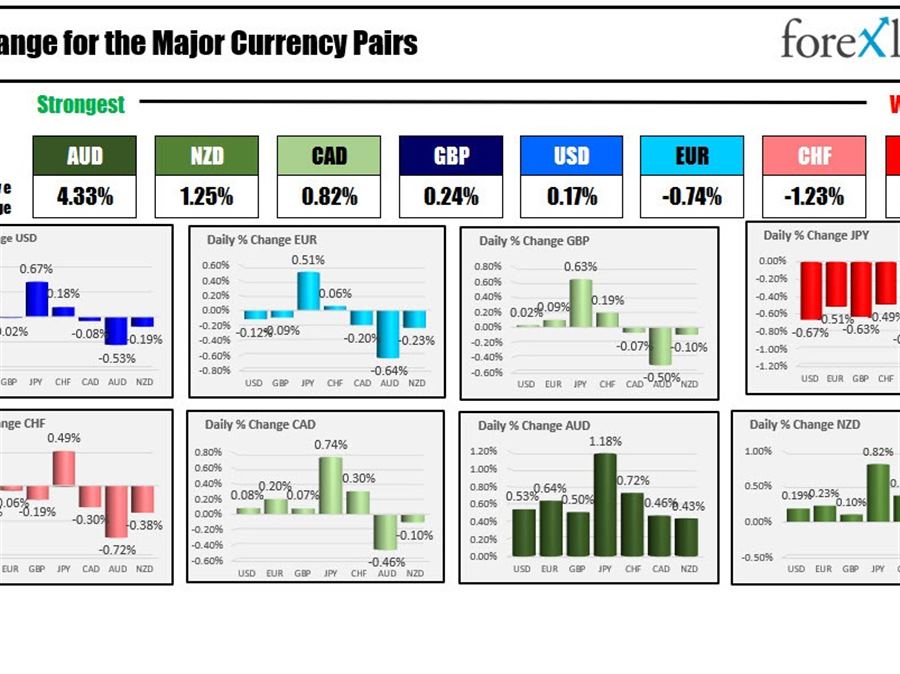

The strongest to weakest of the major currencies

The strongest weakest of the major currencies Read this Term

The European inflation Read this Term

US yields are sharply higher, after three days of declines. The tenure yield is up to 2.40%, while the two year is at 2.38%. The two – 10 year spread is getting closer to the inversion level but still is a pip or two away from that inversion. Going negative is thought to be a precursor to a recession but not until further down the road.

Speaking of further down the road, the US jobs data – which is a lagging indicator – is expected to show another strong gain. The expectations are for a near 500K rise after last month 678K increase. The ADP report on Wednesday showed a gain of 455K, but the correlation has not been accurate of late. Market participants will be eyeing the labor force participation rate which came in at 62.3 percent last month. As inflation rises will people re- enter the workforce as their buying power deteriorates quickly. The unemployment rate is expected to come in at 3.7% versus 3.8% last month.

Crude oil prices are back below the $100 level after Pres. Biden announced a 1 million barrel per day SPR sale over the next six months. OPEC this week said that they would continue to stay on the 400 K production increases schedule. US Baker Hughes will be released later today. Pres. Biden is now urging US oil companies to pump more oil to help bring down oil prices.

US stocks are higher after two days of declines.

A snapshot of the markets as North American traders enter for the day shows:

Spot gold is trading down $-8.92 or -0.45% at $1927.54

Spot silver down $0.12 or -0.48% at $24.63

Spot crude oil is trading back below $100 at $98.56 that’s down $1.70 on the day

Bitcoin is trading lower at $45,100

In the premarket for US stocks, the major indices are trading higher ahead of the jobs report and after a two day decline to and the calendar month and quarter:

Dow industrial average is up 206 points after yesterday’s -550.46 point decline

S&P index up 26 points after yesterday’s -72.04 point decline

NASDAQ index is up 108 points after yesterday’s -221.76 point decline

In the European equity markets, the major indices are mostly lower with the exception of the UK’s FTSE 100

German DAX, up 0.4%

France’s CAC, up 0.45%

UK’s FTSE 100 up 0.25%

Spain’s Ibex, up 0.75%

Italy’s FTSE MIB up 0.85%

In the US debt market, US yields are sharply higher ahead of the jobs report. The yield curve continues to move toward parity with the two – 10 year spread basis point or so away from going inverted.

US yields are higher

In the European debt market, the benchmark 10 year yields are higher as well but trading closer to their low levels.

European benchmark yields are higher

ADVERTISEMENT – CONTINUE READING BELOW