13 of the last 15 days are higher.

The EURUSD is trading above and below the unchanged level currently after the run to the highest level since the May 13, 2018 week stalled at 1.1908 (it did get above 1.1900) looking at the weekly chart, the price moved above the 61.8% retracement at 1.18221 and the September 2018 high at 1.18147 yesterday.

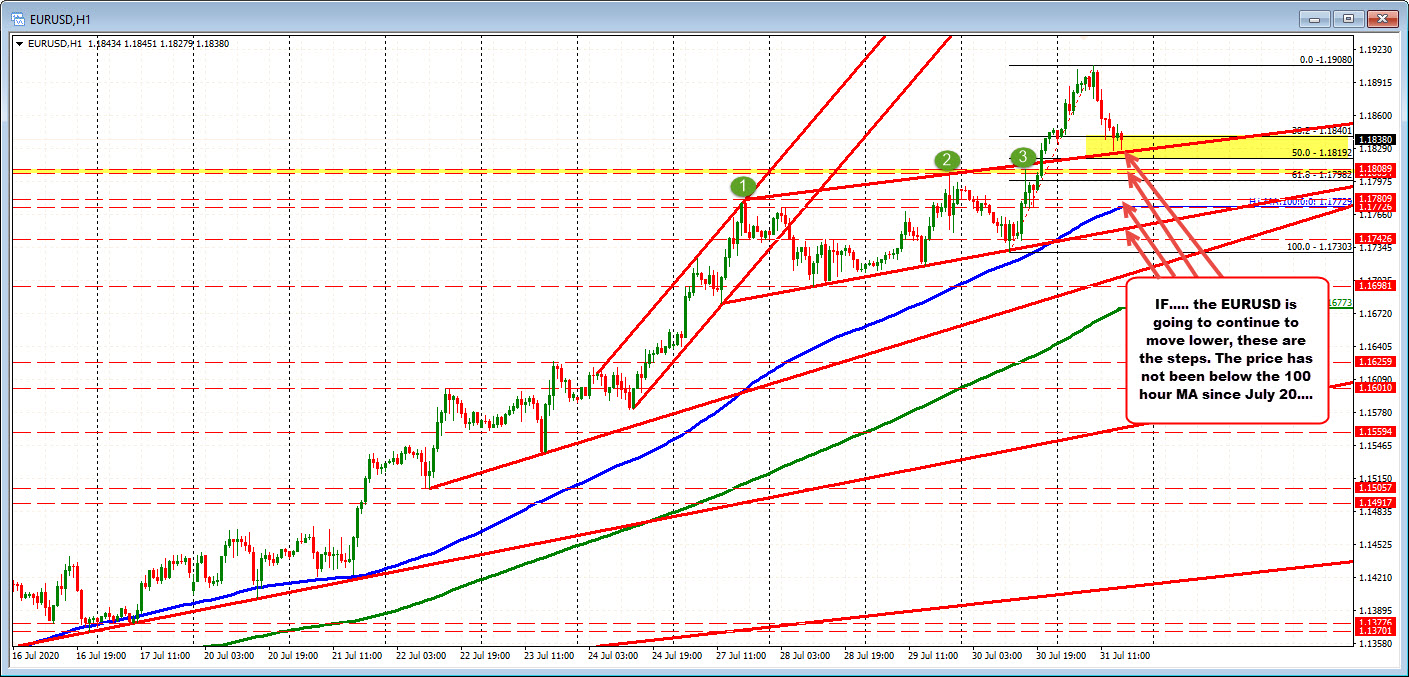

Drilling to the hourly chart, the price low has reached 1.18268. That is just above the underside of the broken trend line from late yesterday. It is also just above the 50% of the trend move higher from yesterday’s low to the high price today. That level comes in at 1.18192.

Those levels are the minimum downside hurdle that would need to be cleared for sellers to take back some control from the buyers. However there are other levels that are just as important including the swing highs from Wednesday and Thursday between 1.18054 and 1.18089, and the 100 hour moving average at 1.17729 (and moving higher). The price has not traded below the 100 hour moving average since July 20.

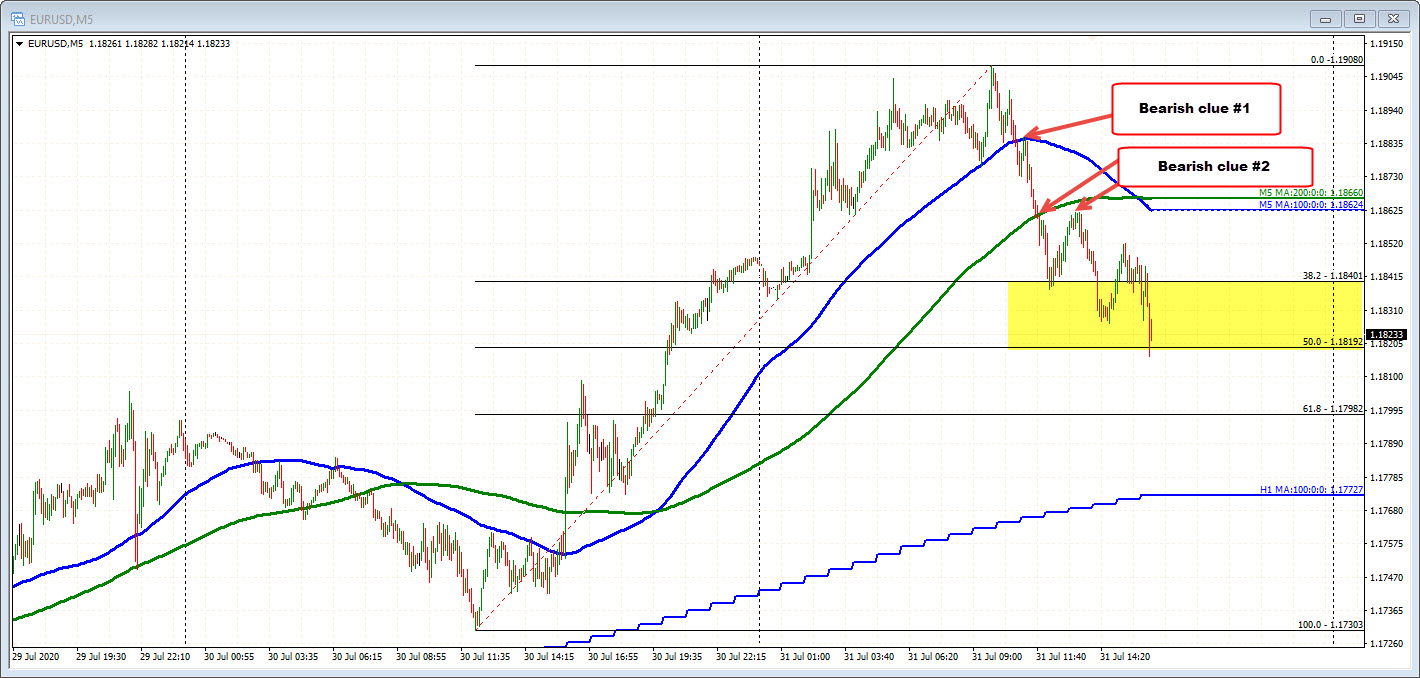

Drilling to the 5 minutes chart below, the price started to lose momentum on the break of the 100 bar moving average earlier in the session, followed by the break of the 200 bar moving average (green line in the chart below). The price is currently testing the 50% retracement of the move up from yesterday’s low. Move below that level and the intraday traders might see more desire to probe to the downside.