Gains of 0.30% to 0.60% for the major indices

The European major indices are ending the session higher after earlier declines. The indices have been dried higher by solid gains in the US after Fed Powell’s Jackson Hole speech.

The provisional closes are showing:

- German DAX, +0.3%. The index was down -0.3% at session lows

- France’s CAC +0.2%. It was down -0.32% at the lows

- UK’s FTSE 100 +0.3% vs an intraday low of -0.25%

- Spain’s Ibex, +0.35%. It fell -0.5% at session lows

- Italy’s FTSE MIB +0.5% after falling -0.18% at the session lows

For the week, the major indices are higher:

- German DAX, +0.2%

- France’s CAC, +0.8%

- UK’s FTSE 100, +0.85%

- Spain’s Ibex, +0.4%

- Italy’s FTSE MIB +0.3%

In other markets as London/European traders look to exit for the week

- Spot gold is up around $19.50 or 1.1% at $1811.67.

- Spot silver is up $0.38 or 1.61% at $23.93

- WTI crude oil futures are up $1.38 or 2.05% at $68.81

- The price of Bitcoin is up close to $1400 and $48,224.66 as it climbs back toward the $50,000 level

In the US stock market, the major indices are higher led by the NASDAQ index. The NASDAQ and S&P are trading at record highs (would be the 52nd and 31st record close for each).

- Dow industrial average is up 212 points or 0.6% at 35425.38 (the high price reached 35231.11)

- S&P index is up 33.82 points or 0.76% at 4503.68 (the high price reached 4506.20)

- NASDAQ index is up 161 points or 1.08% 15106.93 (the high price reached 15110.30)

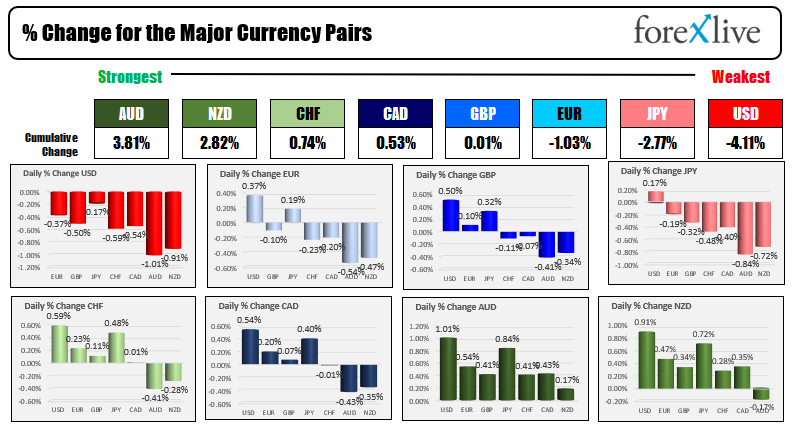

In the forex, the US dollar is the weakest of the major currencies. The AUD and NZD are the strongest as risk on flows send those pairs higher.

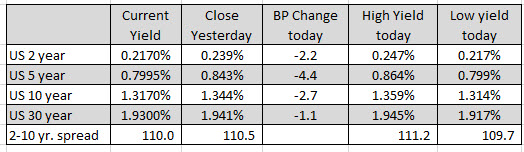

US yields are down on the day with the 10 year at 1.3170% after trading as high as 1.359%.

Looking at the 10 year chart below, the high yield reached yesterday stalled right near the 38.2% retracement at 1.3755%. The high yield reach 1.375% yesterday. That high was also near earlier August swing high levels. The yield is also back below its 200 day moving average at 1.3396%.