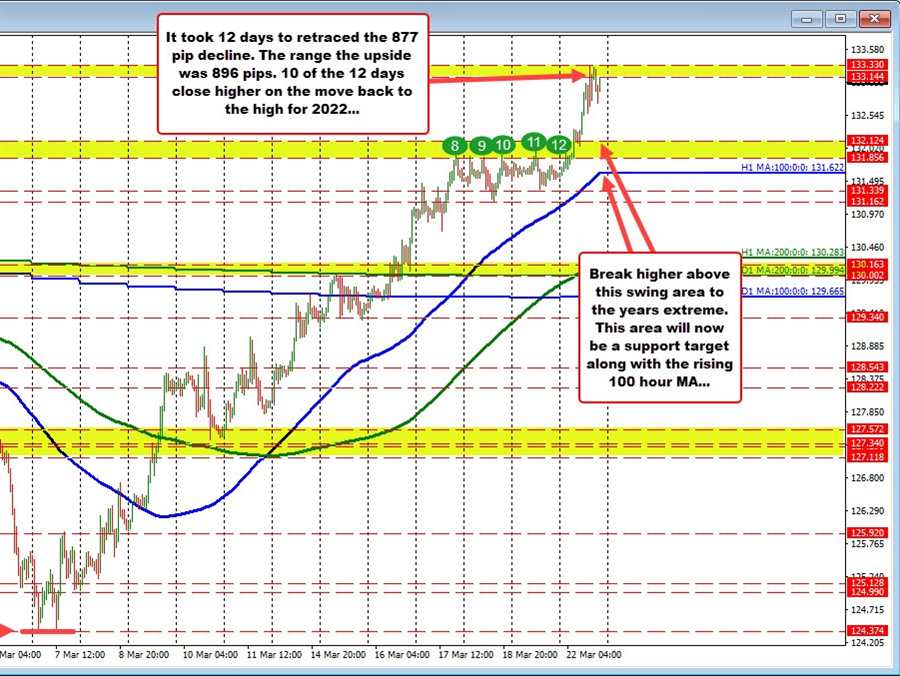

The EURJPY reached a high on February 10th at 133.14, and bottomed at 124.37 on March 7.

Since then the last 12 trading days has seen a full retracement of the 877 pip decline with the price moving briefly above the February 10 high to a high of 133.33 (range of 896 pips from the low to the high).

It took 17 days to take the journey down, and 12 days to take the journey back up (10 of 12 days closed higher on the way up). Near the extreme the price move back above a lower swing area between 131.856 and 132.124. That area will be eyed along with the rising 100 hour MA at 131.65 as support. Stay above keeps the buyers in control firm control. Move below those levels and the trend move tranisitions into from strong like bull, to more mixed bias with sellers taking back some control. .