EURUSD, GBPUSD, USDCAD, and AUDUSD moves to new extremes

The dollar has moved higher and in the process has some of the pairs breaking levels and reaching new day extremes.

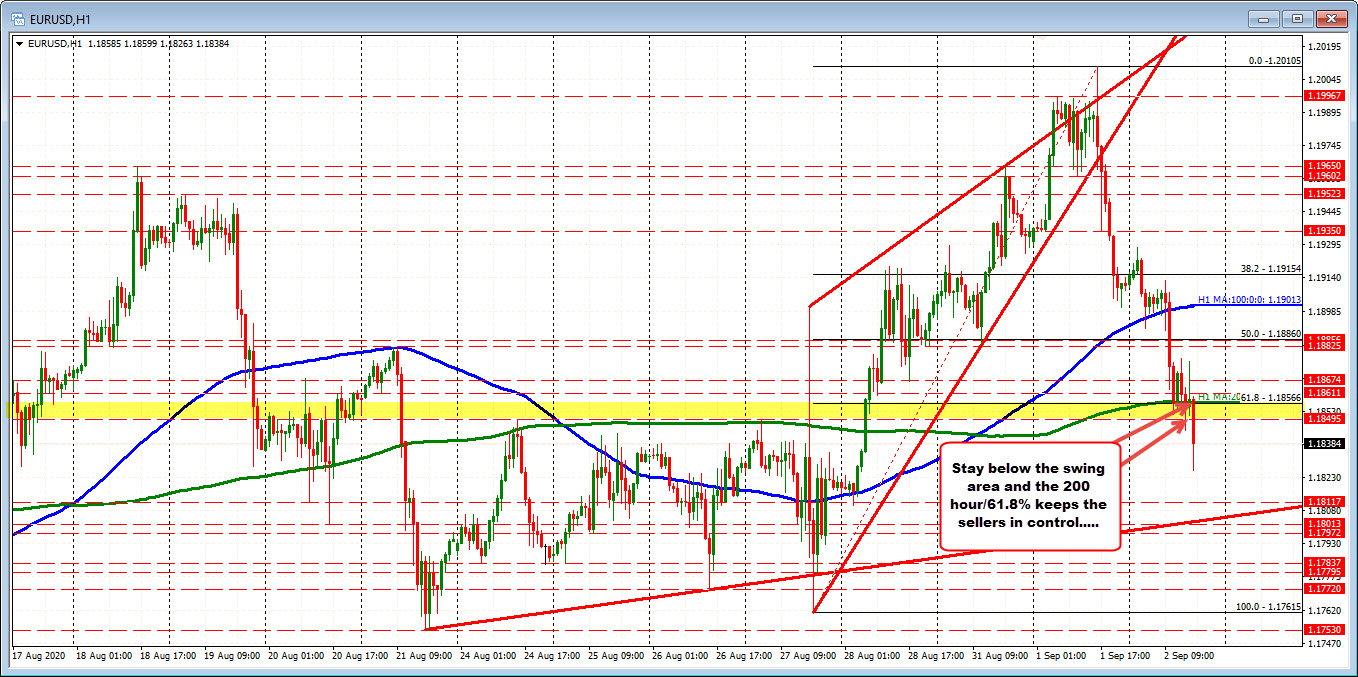

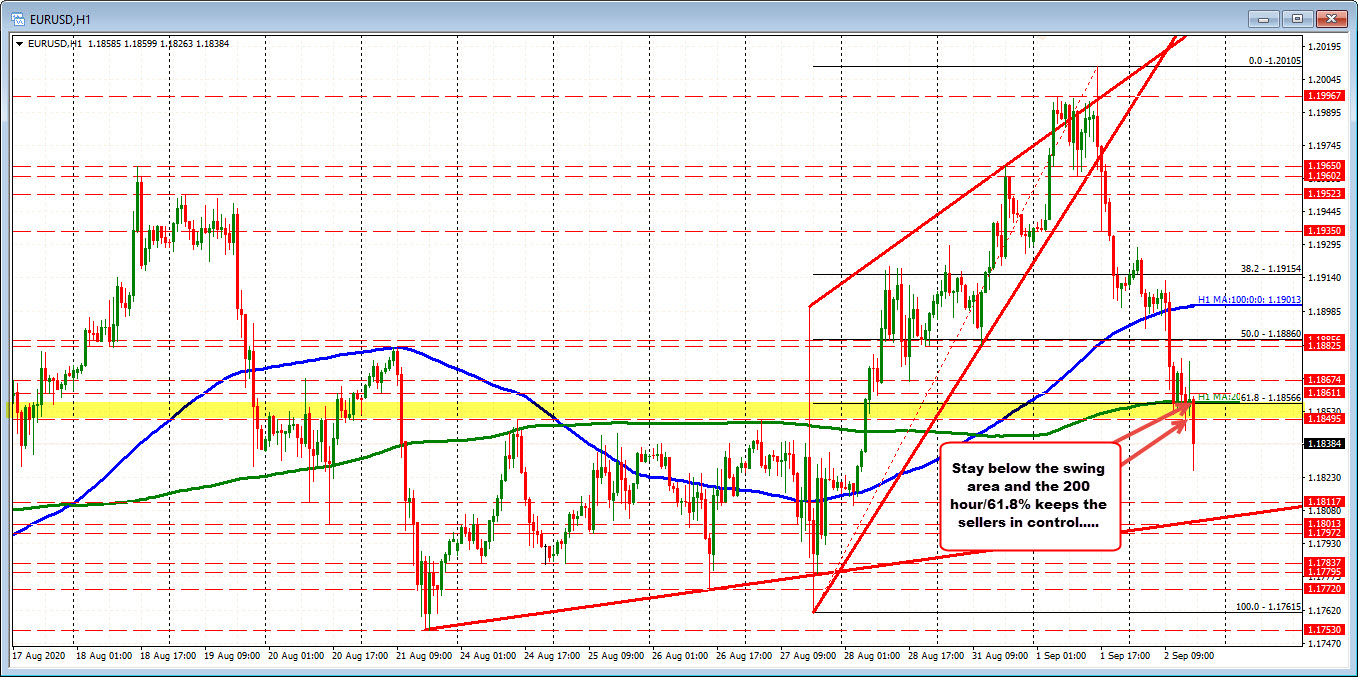

EURUSD: The EURUSD has moved back below the 200 hour moving average/61.8% at 1.18566 and also the ceiling from August 24 and August 27 at 1.18495.

The pair tried to rally after the ADP report only to stall ahead of upside targets. The break of the technical levels has sent the price down to 1.18263. Resistance now comes in against the 1.18495 and 1.18566 area. Stay below keeps the bears in control.

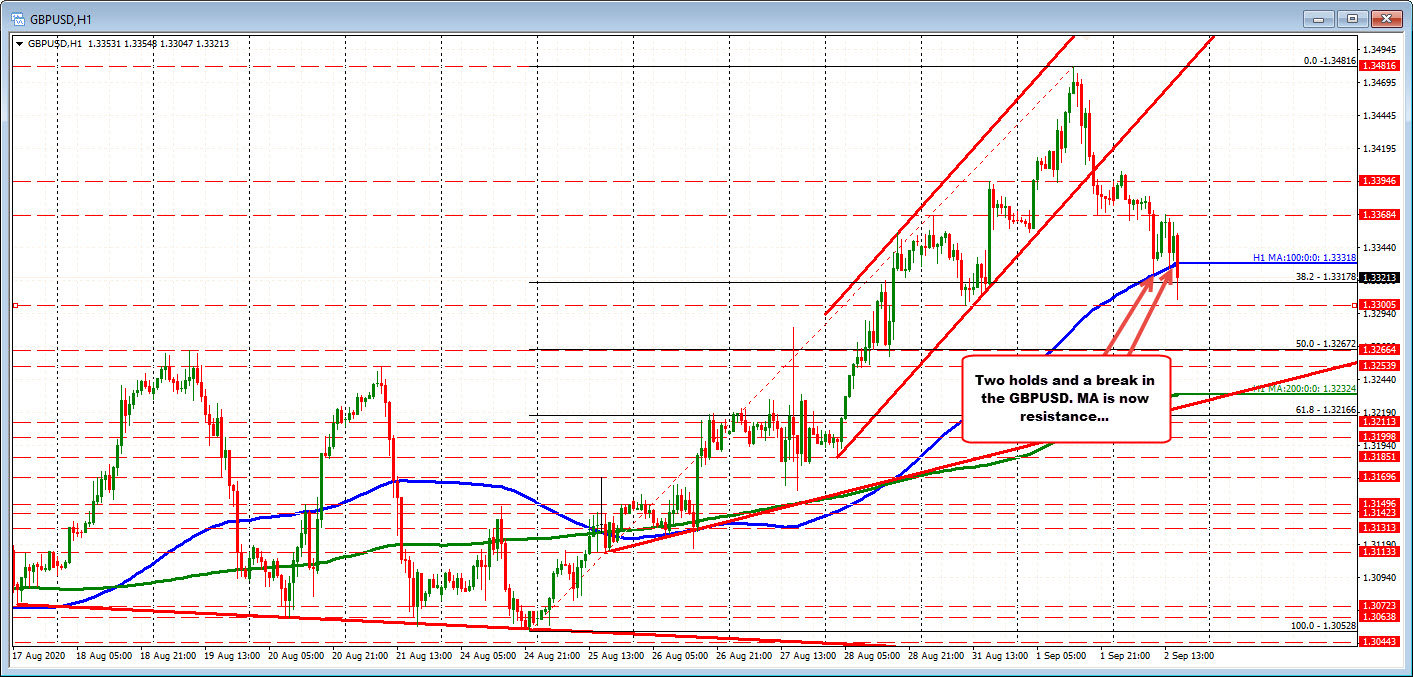

GBPUSD: The GBPUSD stalled against its 100 hour moving average on 2 separate occasions today. That moving average currently comes in at 1.33318 and was broken. The low price reached 1.33047. The next target comes against the swing low from Monday straight at 1.33005. Stay below the 100 hour moving average keeps the sellers more control.

USDCAD: The USDCAD found sellers against its 100 hour moving average yesterday and again during the Asian and London morning session. There was attempt to move above the moving average (currently at 1.30716) in the London morning session, but that attempt failed. This current break is the 2nd try. The price has moved up to test the 38.2% retracement 1.30870. Staying above the moving average (and trend line too – see chart below), keeps the buyers in control).

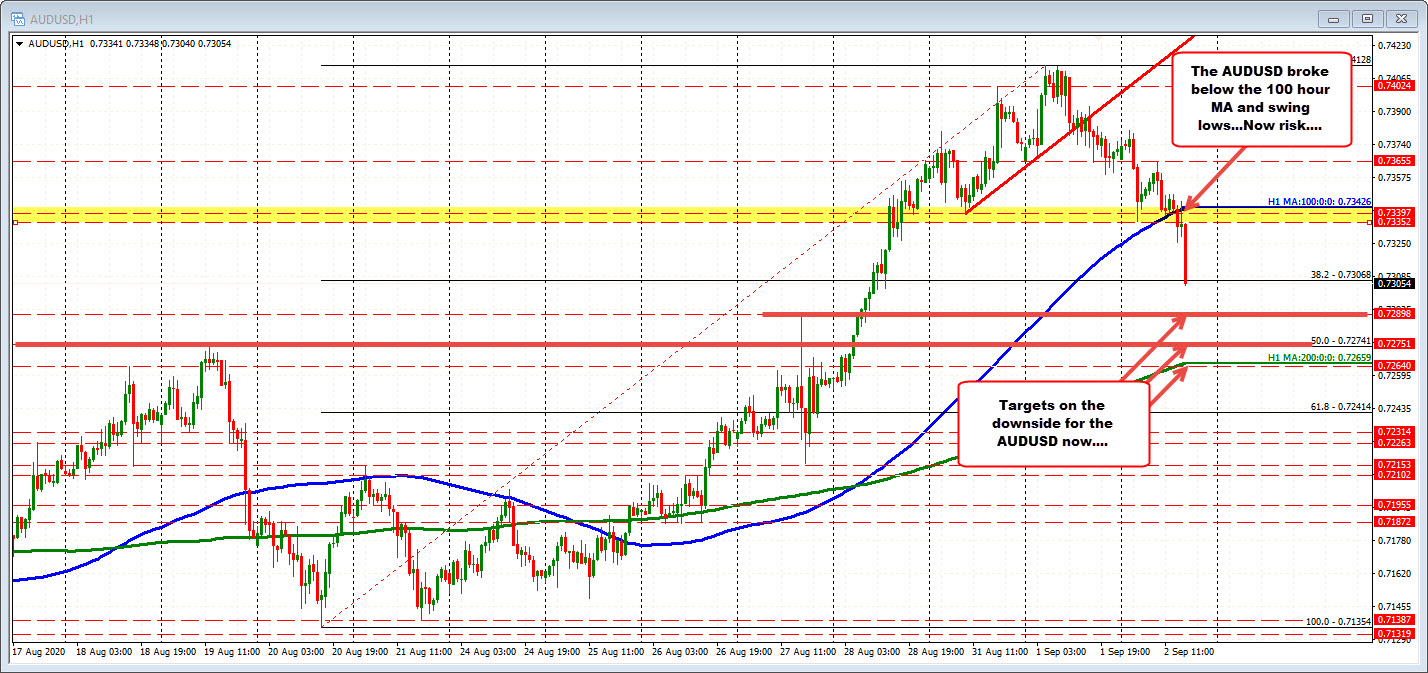

AUDUSD: The AUDUSD has moved below and away from its 100 hour MA at 0.73426 and is currently testing the 38.2% of the move up from the August 20 low at 0.73068. A move below will open the door for a test of the high from last Thursday at 0.72898 and the 50% retracement at 0.72741. The risk for sellers is not The 100 hour MA at 0.73426.