The price of the AUDUSD this week extended above its 100 day moving average (top blueline currently at 0.72376) on Wednesday for the first time since January 14. The run to the upside saw the price extend up to a high of 0.72831. The RBNZ rate hike helped to push the price higher in sympathy with the NZDUSD ‘s rise. However, momentum faded and the price closed back below the key 100 day moving average and 0.72376.

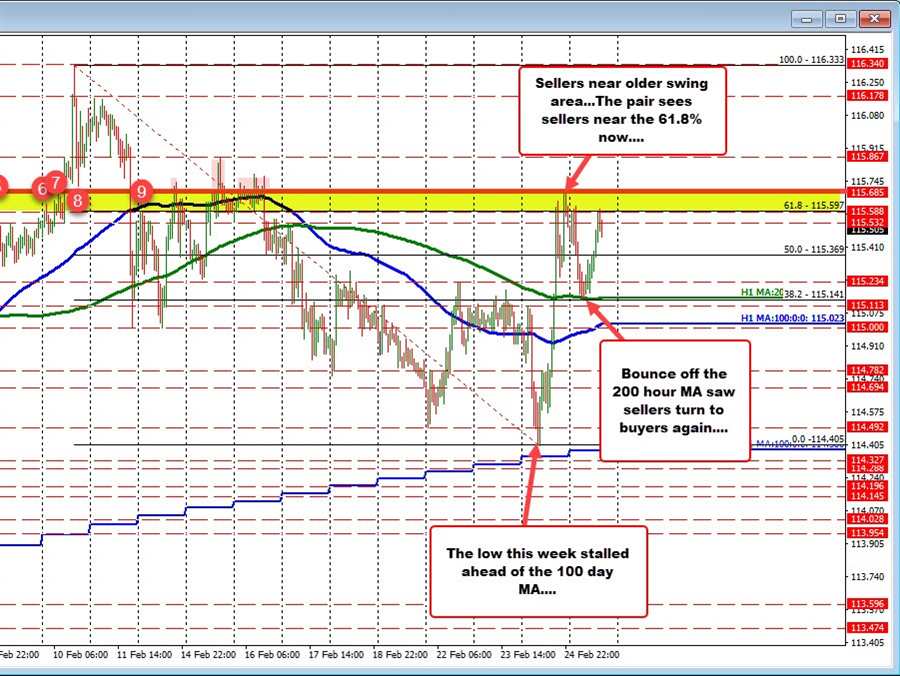

Yesterday, the pair first fell sharply on the back of strong dollar buying. The low price extended toward the 61.8% retracement at 0.70879 and the swing low from February 14 at 0.70859. The low price bottom than 0.7094 short of those targets. A reversal of the US stock market helped to lead to risk on buying in the pair.

Today, the momentum higher has continued. The run to the upside today has seen the price extend back above its 200 hour moving average of 0.71938, and 100 hour moving average of 0.72047. However, the key 100 day moving average and 0.72376 stalled the rally, and the price has since rotated lower. The price has settled between its 100 hour moving average below at 0.72047, and it’s 100 day moving average above and 0.72376. Traders will now look for a break in the to the upside to the downside. The price could also settle between those moving averages and wait for next week.

US stocks are back higher with the Dow industrial average leading the way today with a 1.76%. The NASDAQ index lags but now trades at 1.0% and near its high for the day.