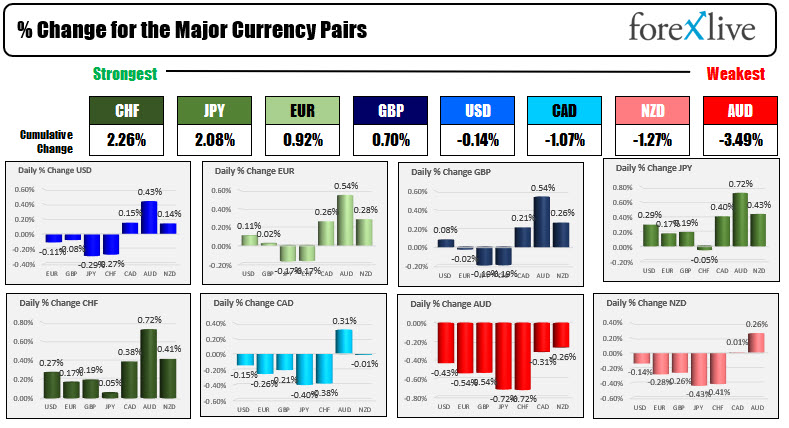

AUDJPY down -0.72% on the day

As London/European traders look to exit for the day, the AUDJPY is one of the the biggest movers (tied with the AUDCHF actually). The AUDJPY has move down 0.72% on the day.

Looking at the hourly chart, the pair has been pushing lower after peaking last on September 7 at 81.983. That high came in just short of the September 3 high at 82.021.

On Friday, the price tried to extend back above its 200 and 100 hour moving averages (green and blue lines), but could not sustain momentum. The price moved back to the downside.

Both yesterday and again today, the highs retested the 100 hour moving average and the downward sloping trendline. Sellers leaned against those levels, stayed below and as a result, the bias remains more to the downside.

The selling in the US stocks helped to push the pair down on “risk off” flows.

What now?

The NASDAQ is back higher on the day which should be somewhat of a relief (i.e. may slow the fall). The S&P and Dow are still lower, however, and the price action today is somewhat of a concern as investors have sold higher levels on two successive days now.

Looking at the AUDJPY chart, the 38.2% of the move up from the August 20 low comes in at 80.443. If the price can build some value above that level, the low may be in. If so, it would likely take more upside momentum in the stocks to push higher.