Understanding the Basics of Forex Pips

The foreign exchange market, or Forex, is the largest financial market in the world, with a daily turnover exceeding $6 trillion. A fundamental concept within this market is the “pip,” which stands for “percentage in point” or “price interest point.” Understanding pips is essential for anyone looking to engage in currency trading.

Forex Pip: The Smallest Price Movement Unit

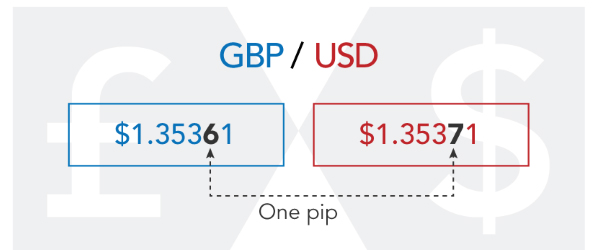

In Forex trading, a pip is the smallest price movement in the exchange rate of a currency pair. Typically, most currency pairs are quoted to four decimal places. Thus, a pip is usually one unit of the fourth decimal place, or 0.0001. For example, if the EUR/USD currency pair moves from 1.1000 to 1.1001, it is said to have moved by one pip. However, there are exceptions such as the Japanese yen pairs, which are quoted to two decimal places. In this case, a pip is equal to 0.01.

How Forex Pips Impact Currency Trading

Pips are crucial in Forex trading as they are the primary unit by which traders measure price movements and potential profits or losses. Here’s how pips impact trading:

- Pricing: Pips help in determining the price spread between the bid and ask price of a currency pair.

- Performance Measurement: They allow traders to measure how much a currency pair has moved over a given time period.

- Risk Management: Pips aid traders in setting stop-loss and take-profit levels to manage risk effectively.

Calculating Pip Values in Forex Markets

The value of a pip can vary depending on the currency pair being traded and the size of the trade. Here’s how to calculate the pip value:

- Formula: Pip Value = (Pip in Decimal Places / Exchange Rate) * Lot Size

- Example: For a standard lot (100,000 units) of the EUR/USD pair, if the exchange rate is 1.1000, the pip value would be (0.0001 / 1.1000) * 100,000 = $9.09.

Here’s a comparative table to illustrate pip values in different scenarios:

| Currency Pair | Lot Size | Exchange Rate | Pip Value |

|---|---|---|---|

| EUR/USD | Standard Lot | 1.1000 | $9.09 |

| USD/JPY | Mini Lot | 110.00 | $0.91 |

| GBP/USD | Micro Lot | 1.3000 | $0.77 |

Role of Pips in Forex Profit and Loss

The role of pips in determining profit and loss cannot be overstated. When trading Forex, your gains or losses are measured in pips. If you buy a currency pair and it moves in your favor, the number of pips gained determines your profit. Conversely, if the market moves against you, the pips lost will determine your loss. Therefore, understanding pip values and movement is crucial for financial success in Forex trading.

Strategies for Using Pips in Forex Trading

Professional Forex traders develop strategies that consider pip movements to optimize their trading outcomes:

- Scalping: This strategy involves making multiple trades throughout the day to capture small pip movements. Traders often aim for 5-10 pips per trade.

- Day Trading: This involves holding trades for a day and aiming to capture significant pip gains within that period.

- Technical Analysis: Using technical indicators to predict future pip movements based on historical data.

- Risk-Reward Ratio: Setting a favorable risk-reward ratio, such as 1:2, ensuring that potential profits in pips outweigh potential losses.

Practical Tips for Utilizing Pips:

- Always be aware of the currency pair’s pip value, as it is essential for calculating profit and loss.

- Use stop-loss orders to protect against adverse pip movements.

- Stay informed about economic news, as major announcements can lead to significant pip fluctuations.

In conclusion, Understanding the Basics of Forex Pips is foundational for anyone entering the Forex market. Pips are not just units of measurement; they are tools that traders use to gauge market movements, manage risks, and set trading objectives. By mastering the concept of pips, traders can enhance their market strategies, ultimately leading to better-informed and more successful trading outcomes.