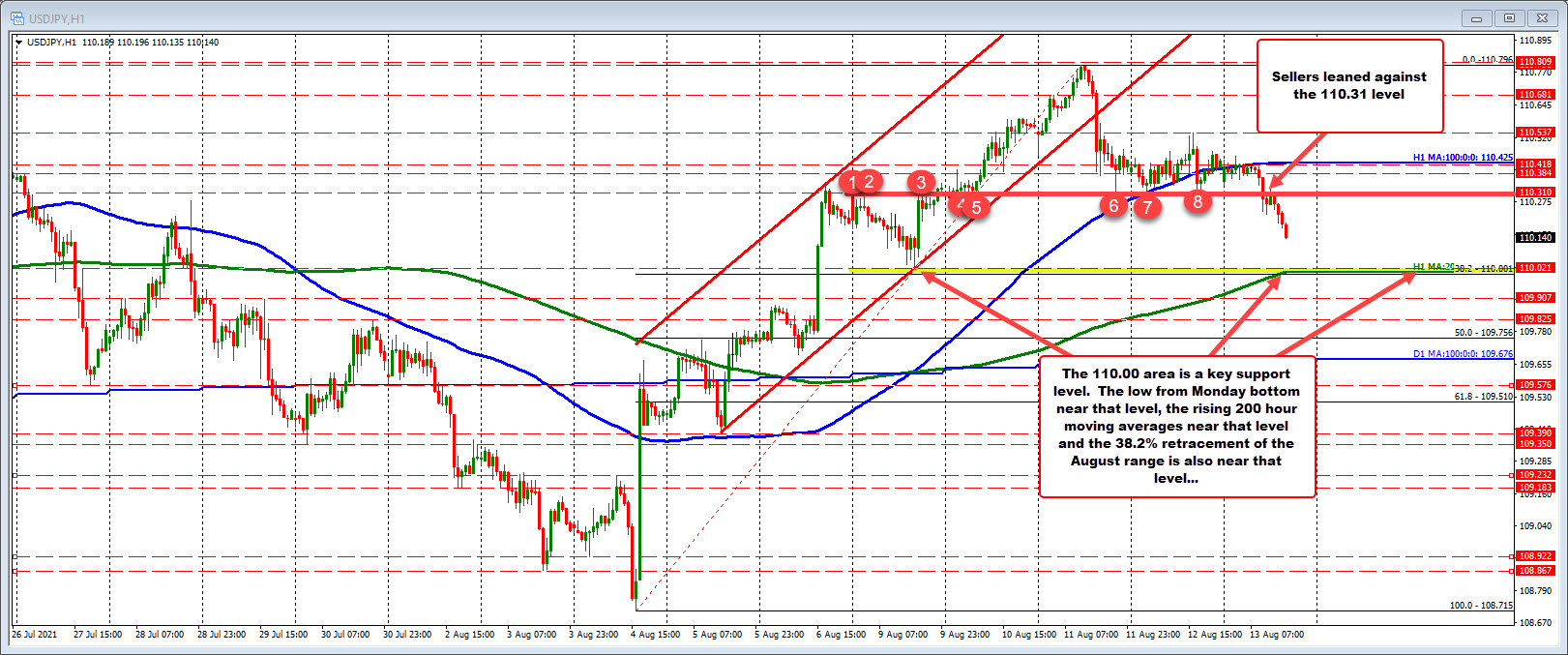

200 hour MA and 38.2% at 110.02 area

The USDJPY is moving to a new low at 110.15. It is the lowest level since Monday’s trade. The low for the week was reached on Monday at 110.02. The high was on Wednesday at 110.796. The range of 77 pips is not the lowest of the year. There was a range of 65 pips back in June for a week. Nevertheless activity has been limited.

Looking at the hourly chart, the 110.310 had a number of swing highs and swing lows over the last few days (and even going back to last week – see red numbered circles). The price today moved below that level, rebounded to 110.326, before rotating lower over the last four trading hours. Sellers are making a play. Sellers are taking control.

The next key target comes near the 110.00 area.

- The low from Monday’s trade is at 110.021.

- The rising 200 hour moving averages is at 110.003.

- The 38.2% retracement of the move up from the August low to the August high comes in at 110.001.

The cluster of technical support at that area makes it a key target and also a key bias defining level for buyers and sellers on a test.

Sellers looking for more downside would not want to see the price move back above the 110.310 old floor. That would sour the move of the break lower.