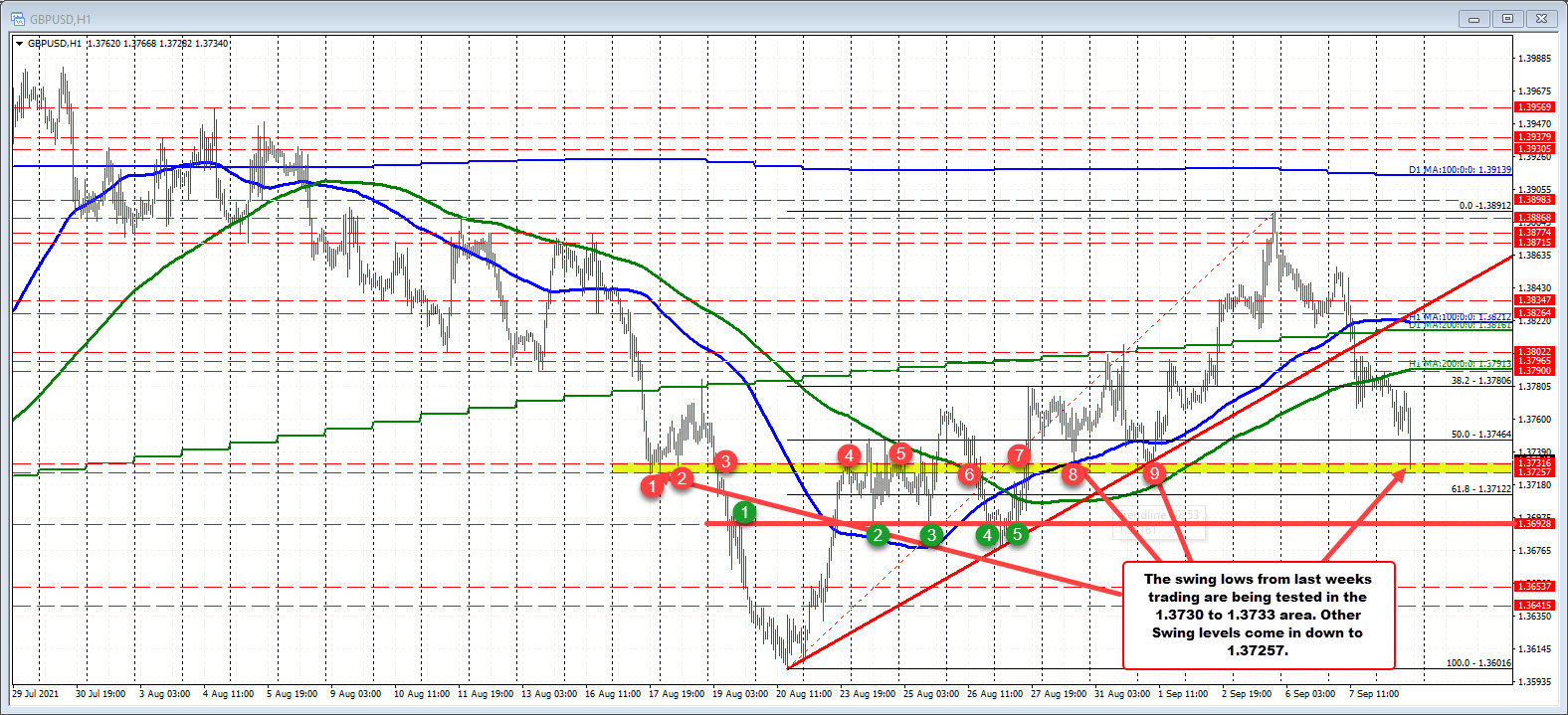

Rebound. The USDJPY moves back above the cluster of moving averages that sit in the middle of the trading range

The USDJPY is moving up to a new session high at 110.055.

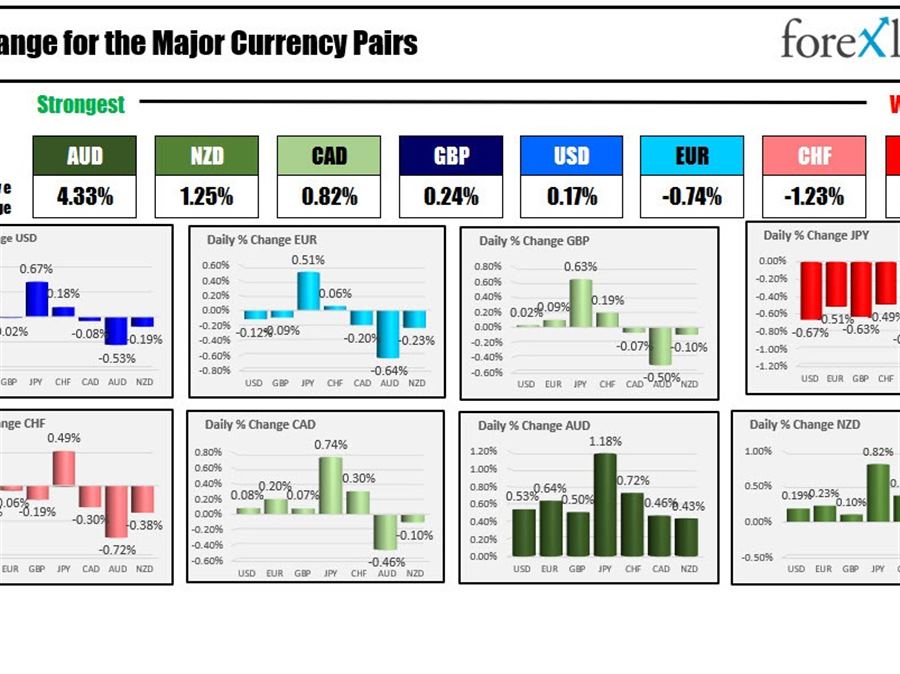

The run to the upside is being helped by a push higher in yields over the last hour or so. The 10 year yield was up about 1.2 basis points earlier in the New York session. It is currently trading up around 2.4 basis points. That has helped to push the dollar up to new highs versus the USDJPY and USDCHF. The EURUSD has come off it’s highs, but remains above the closing low from yesterday and the Asian session low.

Looking at the hourly chart, the price earlier today moved above its 100 hour moving average at 109.702, then worked on getting above its 100 day moving average at 109.84 and 200 hour moving average at 109.868. During the London morning session, buyers were able to extend higher and that extension is continuing in the early US trading session.

On the topside, the pair is getting closer to the swing highs from both Monday and Tuesday near 110.154. Move above that area and the pair has retraced its earlier declines for the weekend will look toward another swing area between 110.222 and 110.263. Above that are the swing highs going all the way back to August 13 near 110.413.

Earlier this week, the low for the week stalled right near the August 16 and August 17 low at 109.110. Holding that level gave the buyers the go-ahead to push higher.