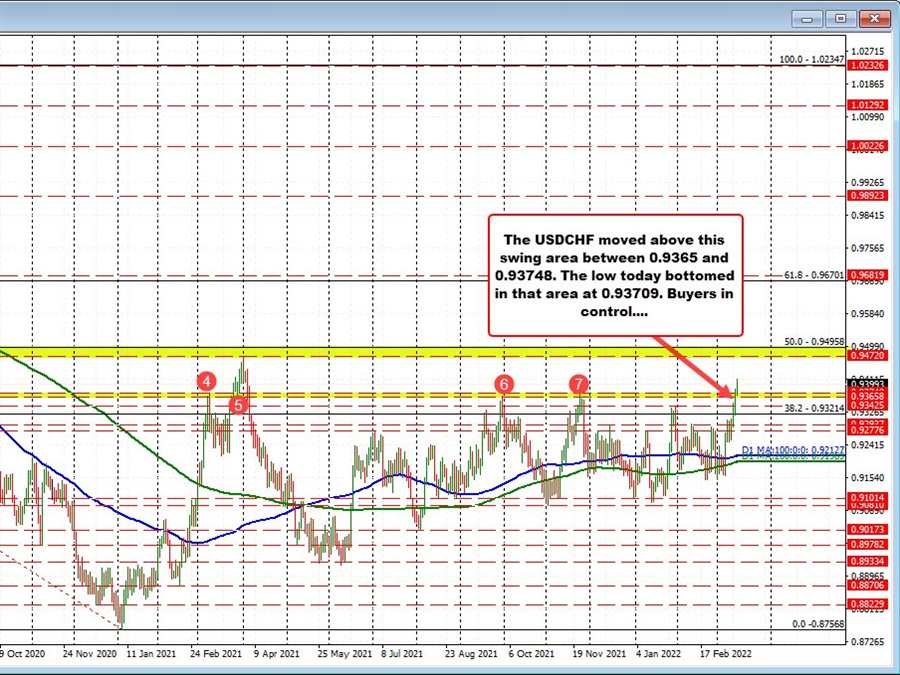

The USDCHF moved above a swing area on the daily chart between 0.9365 and 0.9375 during trading yesterday. Today, the pair’s low stalled the price between that area and 0.9370. The price has moved higher and trades right around the 0.9400 level after reaching a new session high at 0.9411.

Holding the swing area (see red numbered circles in the chart above) is a key barometer on the daily chart. Stay above is more bullish going forward. The swing high from 2021 reached 0.9472. That would be an upside target on further upside momentum in this currency pair.

Drilling to the hourly chart below, the price action today has been up and down. The initial move to the upside in the Asian session reached 0.9410, but then fell sharply to the low at 0.93709. As mentioned above, that low did stall within the swing area on the daily chart between 0.9365 and 0.9375. The buyers held onto control. That is bullish.

Now…. on the flip side, the recent high did take out the earlier high for the day, BUT only by a pip or so.

That lack of momentum may end up being a disappointment from a technical perspective. If the buyers cannot push above the highs in the next few hours, there could be a rotation back toward the aforementioned swing area from the daily chart on the disappointment.

However for the time period, I remain more bullish on the pair’s ability to hold support against the key swing area on the daily chart, with an eye toward a new high met with momentum.

.