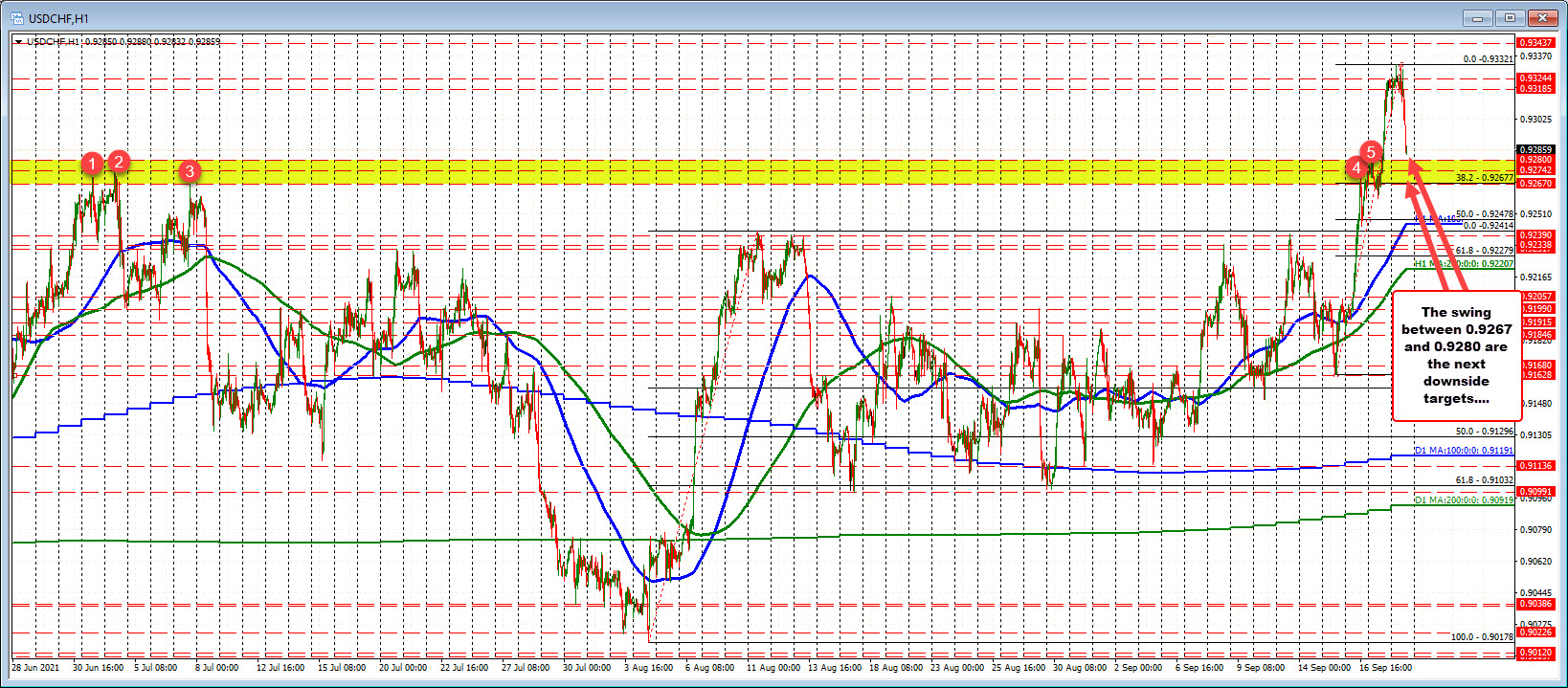

The swing area between 0.9267 and 0.9280 is eyed

On Friday, despite anxious (lower) equity markets, the USDCHF rose sharply. Typically, the CHF is a safe haven currency. On Friday (and last week) the technicals took control and the CHF fell despite lower equities for the day/week.

Today, the traders in the USDCHF are not ignoring the tumble in the stock markets. The CHF is getting a safe haven flows and the USDCHF is retracing some of the gains from Friday’s trade..

The low has reached 0.9283. That is above the high swing area between 0.9267 and 0.9280. Those swing highs reach back to early July and from Thursday and Fridays trade last week. The 38.2% retracement of the move up from the swing low from Wednesday’s trade comes in at 0.92677 which is also within that range.

Although lower, the corrective move still remains above that swing area and as a result keeps the buyers in play. Yes the move off the high up at 0.93321 give the sellers some hope, but technically speaking, getting below the 38.2% retracement and that swing area is still needed to tilt the bias more to the downside and give sellers some comfort that the break was a false break.