The USDCHF falls despite gains in stocks in premarket

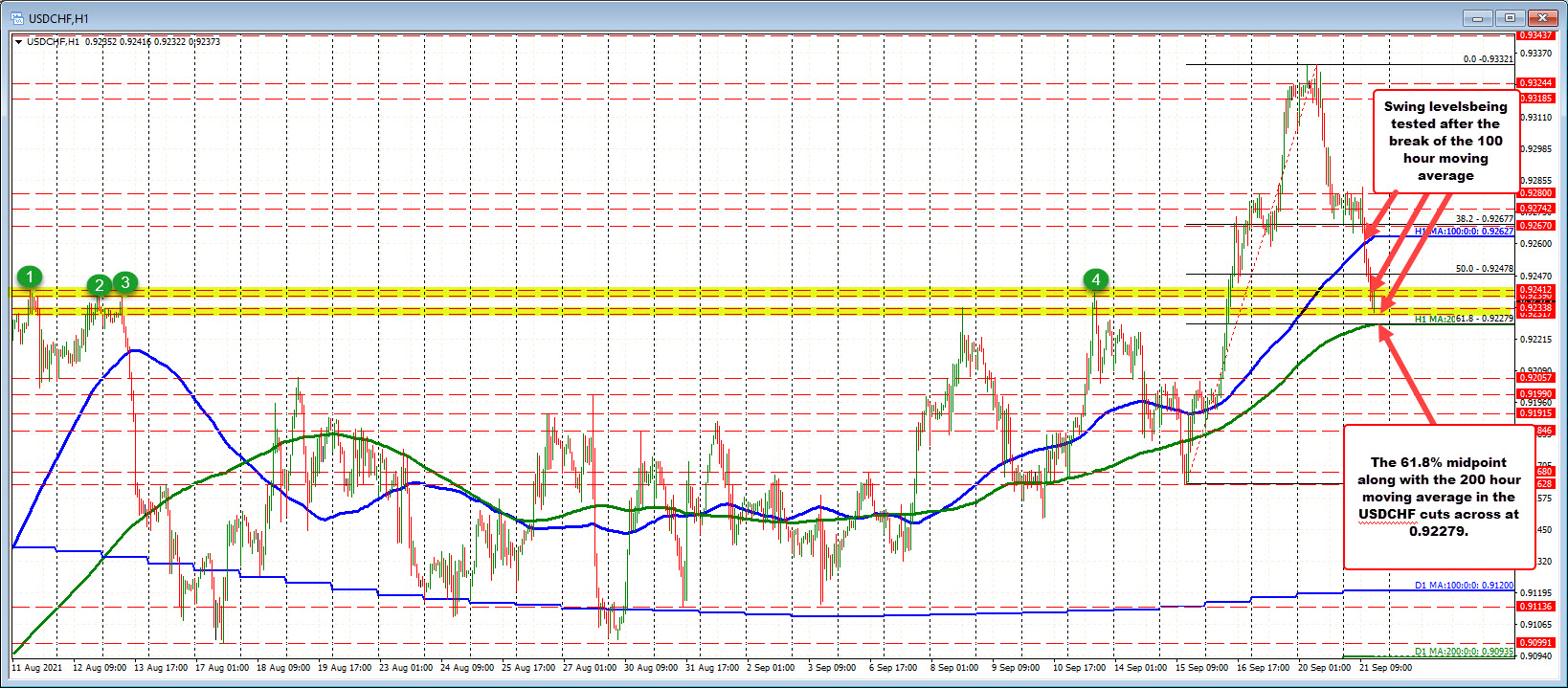

Technically looking at the hourly chart, the price declined today pick up steam after breaking back below its 100 hour moving average (blue line currently at 0.92627. The price has also moved below its 50% midpoint at 0.92478 of the move up from the September 15 low. That level will be eyed as a risk/bias defining level going forward today. Will back above and we could see the buyers return.

The pair has moved back below recent swing highs going back to August 11, August 12 and August 13 along with the swing high highs from September 8 and September 13. Those levels come in around 0.9240 and 0.9233. The next key target on the downside comes in at 0.92279 which is home to both the 200 hour moving average and the 61.8% retracement of the move up from the September 15 low.

A move below 0.92279 would increase the bearish bias.