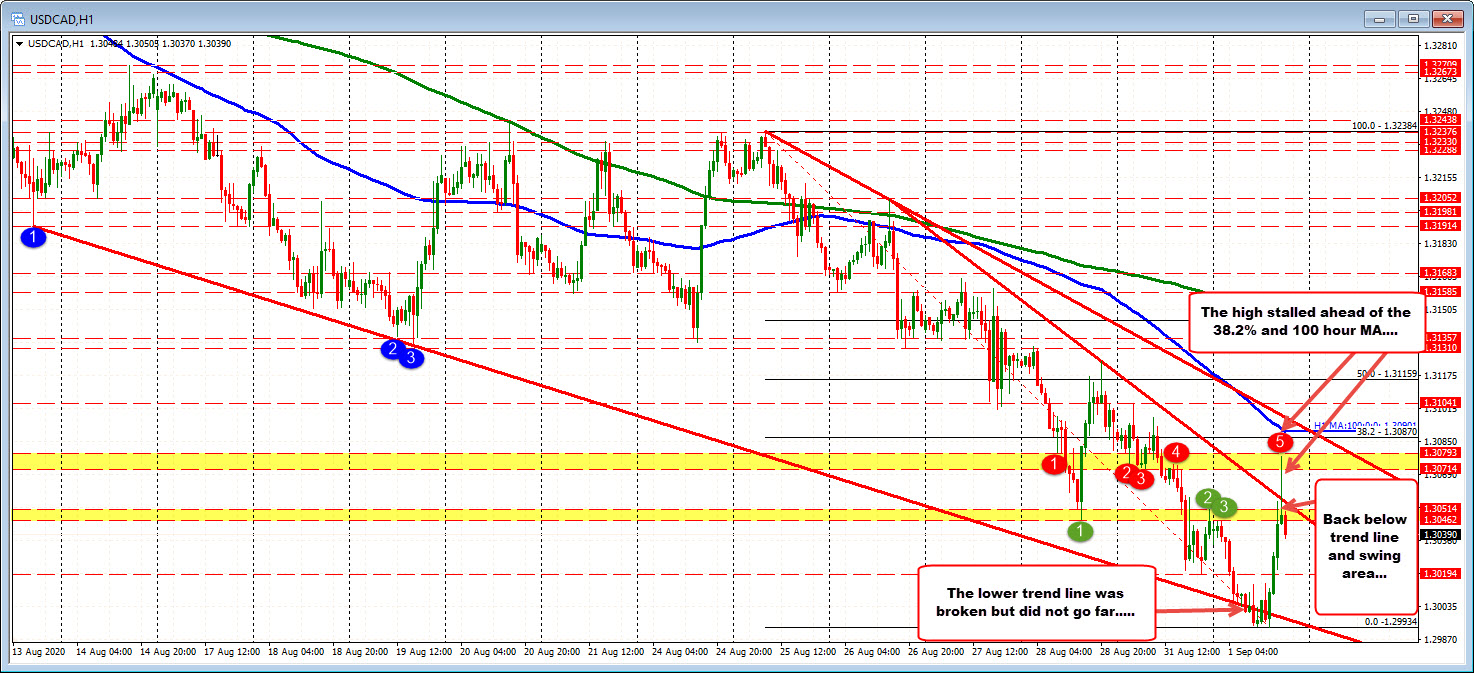

Price high stalls ahead of the 38.2% and 100 hour MA

The USDCAD fell to the lowest level since January 7 at 1.29934. The low for the year reached 1.29565. The low from the end of December was just below that at 1.29508.

The run lower stalled, however, and raced higher helped by the better US ISM data.

Looking at the hourly chart below, the fall lower did find buyers after momentum below a lower trend line just wasn’t there (see red numbered circles on the chart below). Eventually sellers turned to buyers. The data helped to push the price above a topside trend line.

The run to the upside, however, could not extend to the 38.2% retracement at 1.30870. The price also stalled ahead of its falling 100 hour moving average at 1.30901. The high price for the day reached 1.30775. Ultimately if the buyers are to take more control, they would need to extend above the 38.2% retracement and 100 hour moving average. Failure to do that, and the corrective move is simply a plain-vanilla rotation into resistance.

The subsequent fall from the high has taken the price below a swing area between 1.304621 1.30514 (see yellow area in the chart below), and back below the broken trend line as well. Stay below and the 1.30194 area would be the next target followed by the lower trend line and lows for the day.

Buyers made a play to the upside but could not complete the run. The sellers have counter punched with the move back below the broken trend line and swing area. How will the fight continue is dependent upon the who can take more control from here. Getting back above the broken trend line puts the buyers back in the front seat. Until then, the sellers really haven’t lost much.