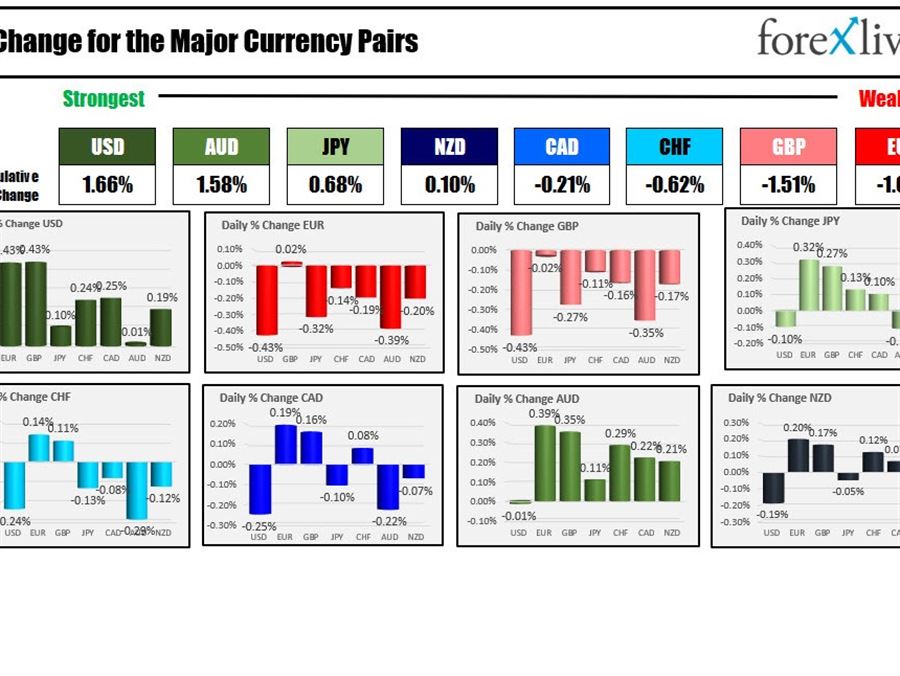

The USD is the strongest and the EUR is the weakest as the North American session begins.

Overnight the UK PPI inflation hit a 30 year high at 6.2% and was above expectations. The GBP moved lower as the BOE’s response and the threat of continued inflation, is likely to weigh on the economy and growth. The UK budget will be released.

Russia continues to say they are progressing according to plan,and that plan – according to Italy’s Draghi – has no plans for peace. PS.Russia closed the Caspian Pipeline Consortium’s export terminal to fix storm damage. The pipeline supplies some 700,000 bpd to the export market.

US stocks are trading lower today after the major indices pushed higher yesterday led by the Nasdaq which was up near 2%. US yields are taking a breather (although the 10 year did reach a new high of 2.417% overnight before coming back down). The benchmark yield is trading above and below unchanged. The US treasury will auction $16 billion of 20 year notes at 1 PM ET. Crude oil is trading back above $112 (actually near $112.50). Gold is higher.

A snapshot of the markets currently shows:

- Spot gold up $8.30 or 0.44% at$1929.12

- Spot silver is up $0.22 or 0.98% at $24.99

- WTI crude oil is trading at $112.16. That’s up $2.87

- Bitcoin is trading at $42,032 which is down around $360 on the day

Looking at US stocks, the major indices are giving up some of the gains from yesterday. The major indices have been on a tear to the upside with the NASDAQ and S&P up five the last six trading days (Nasdaq up 12.14% from March 14 low and S&P up 8.41%). The S&P closed above its 200 day MA yesterday at 4473.11 (closed at 4511.60):

- Dow Jones -90.46 points after yesterday’s +254.47 point rise

- S&P index down 15 points after yesterday’s 50.43 point rise

- NASDAQ down 89 points after yesterday’s 270.36 point rise

In the European equity markets the major indices are mostly lower:

- German DAX, -0.8%

- France’s CAC, -0.6%

- UK’s FTSE 100 up 0.1%

- Spain’s Ibex -1.0%

- Italy’s FTSE MIB -0.5%

In the US debt market, the yields are mixed with the short and lower. The 30 year bond is up modestly. The two – 10 year spread as moved out to 25.4 basis points from 22.3 basis points near the close yesterday:

The European debt market, the benchmark 10 year yields are lower as they too take a breather from the recent run up.