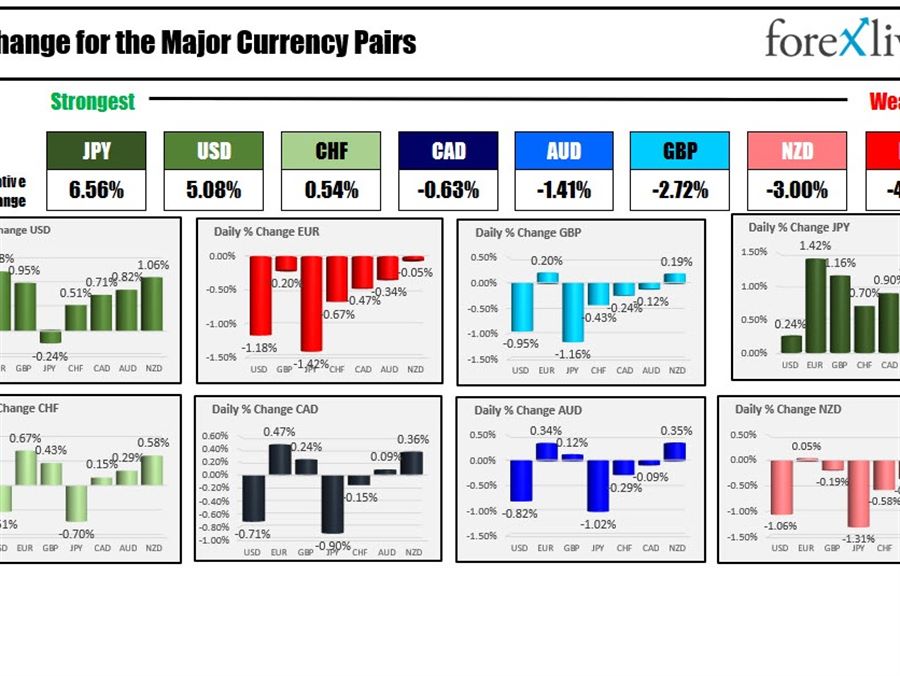

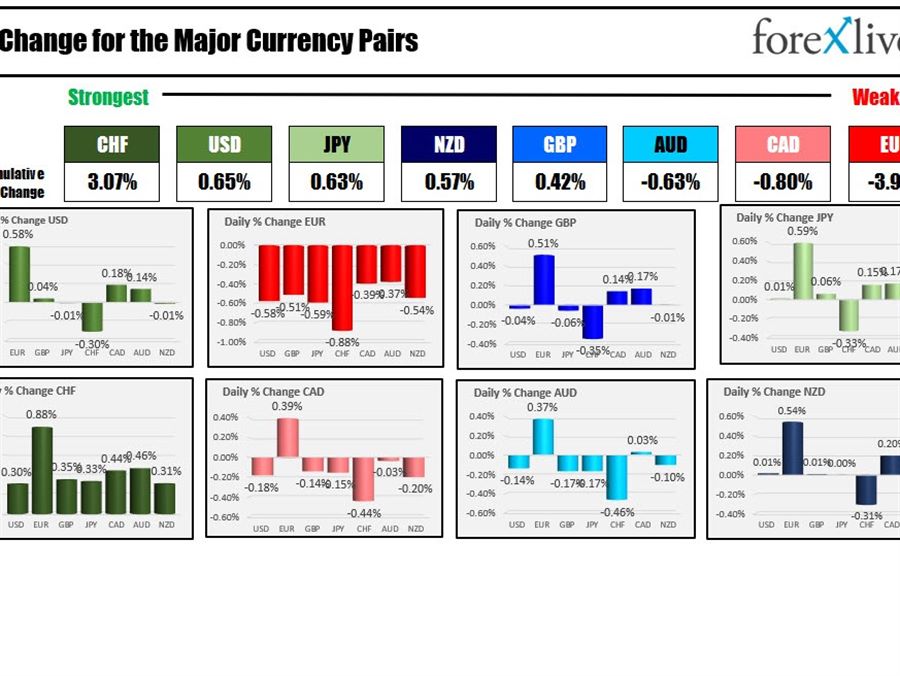

As North American traders enter for the day, the flow of funds are showing the JPY and the USD are the strongest of the majors, while the EUR is the weakest.

Vladimir Putin authorized a full invasion of Ukraine, which put all the markets into overdrive in their respective flow of funds directions.

- Stocks fell sharply. The NASDAQ was down near 20% from its all-time high at the close yesterday while the S&P was down around 12%.

- Gold surged and traders highest level since August/September 2020,

- Oil surged above $100 for the first time since the end of July 2014. Russia is the world’s second-largest oil producer and the largest supplier of natural gas to Europe

- Yields in the US and Europe moved lower

- Other commodities including wheat and corn rose. Both Russia and Ukraine supply large chunks of the exported wheat and corn to the global markets

In the forex, the USDRUB spiked higher reaching near 89.00, but has since come off and trades near 83.699 in volatile trading. That is still above the close from yesterday at 80.88. The Russian central bank is trying to stabilize the its currency. The Russian stock market had it’s worst day on record.

The JPY and USD have been supported, while the EUR is being sold.

In response, the NATO leaders will meet this morning along with the G7 leaders. Pres. Biden is scheduled to speak this afternoon. Expect the EU to block Russian businesses access to key technologies and markets. Expect freezing of Russian assets and Russian banks access to European financial markets. It is unclear if that means denial of service from the SWIFT payment system..

A snapshot of the markets shows:

- Spot gold is trading up $54 or 2.85% at $1962

- Spot silver is trading up $0.76 or 3.04% $25.28

- WTI crude oil is trading up $6.85 at $98.93

- Bitcoin is trading down to $35,209. That is down near $2000 from the close yesterday

In the premarket for US stocks, the major indices are down sharply. The Dow and NASDAQ is working on its sixth day down in a row while the S&P is now working on its fifth consecutive down day

- Dow is down -763 points points after yesterday’s -464.85 point decline

- S&P is down -95 points after yesterday’s -79.28 point decline

- NASDAQ index is down -378 points after yesterday’s -344.03 point decline

In the European stock market, the major indices are also down sharply with declines of 3% to 5%

- German Dax, -4.9%

- France’s CAC, – 4.9%

- UKs FTSE 100, – 3%

- Spain’s Ibex, -4.1%

- Italy’s FTSE MIB, -4.8%

In the US debt market, yields have moved sharply lower on flight to safety flows:

The European debt market, the benchmark 10 year yields are also lower with the largest moves lower in the UK and German yields as investors fought to the relative safety of those two countries.