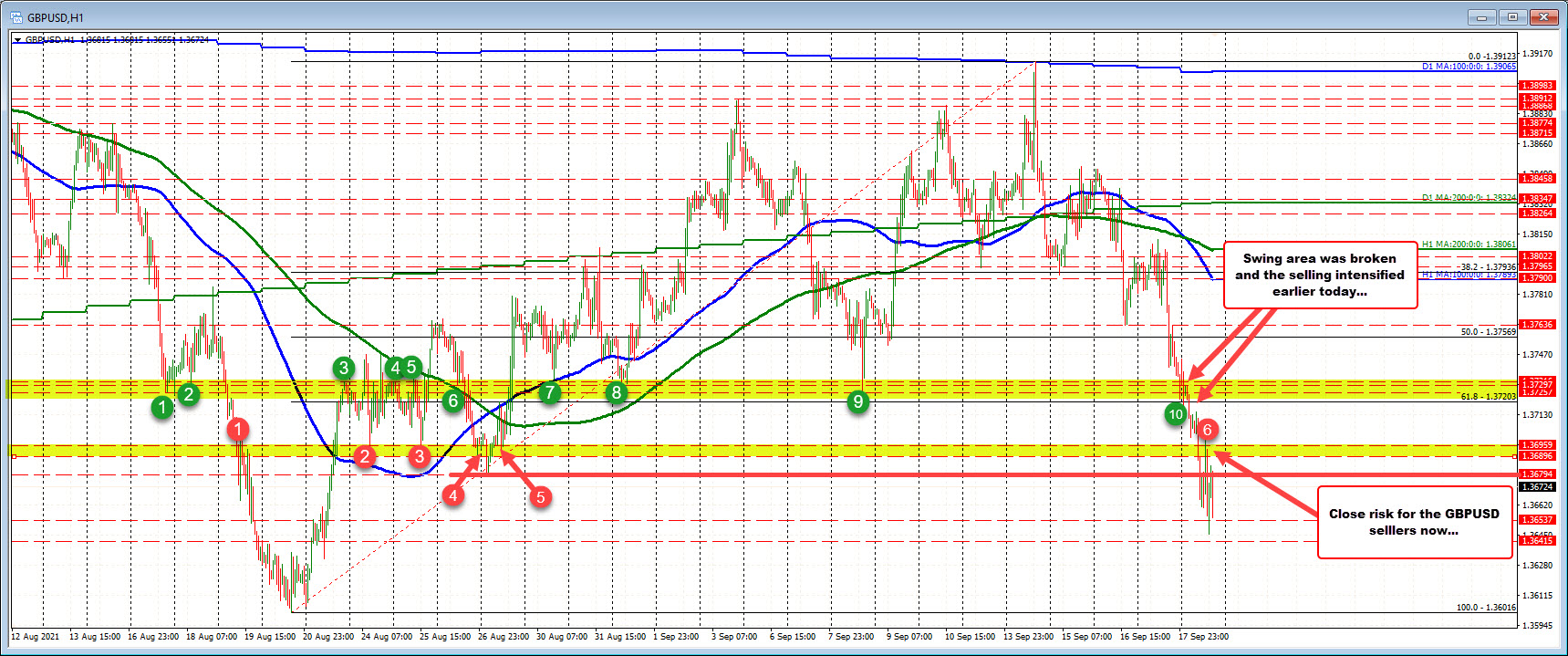

Up and down action between 1.3645 and 1.3699 (call it 1.3700)

The GBPUSD is consolidating in the lower end of the day’s trading range. The pair is trading down -0.53%, but has been consolidating between the low for the day at 1.3645 and the most recent corrective high at 1.3699 (call it 1.3700). The current price is trading between those levels of 1.3668.

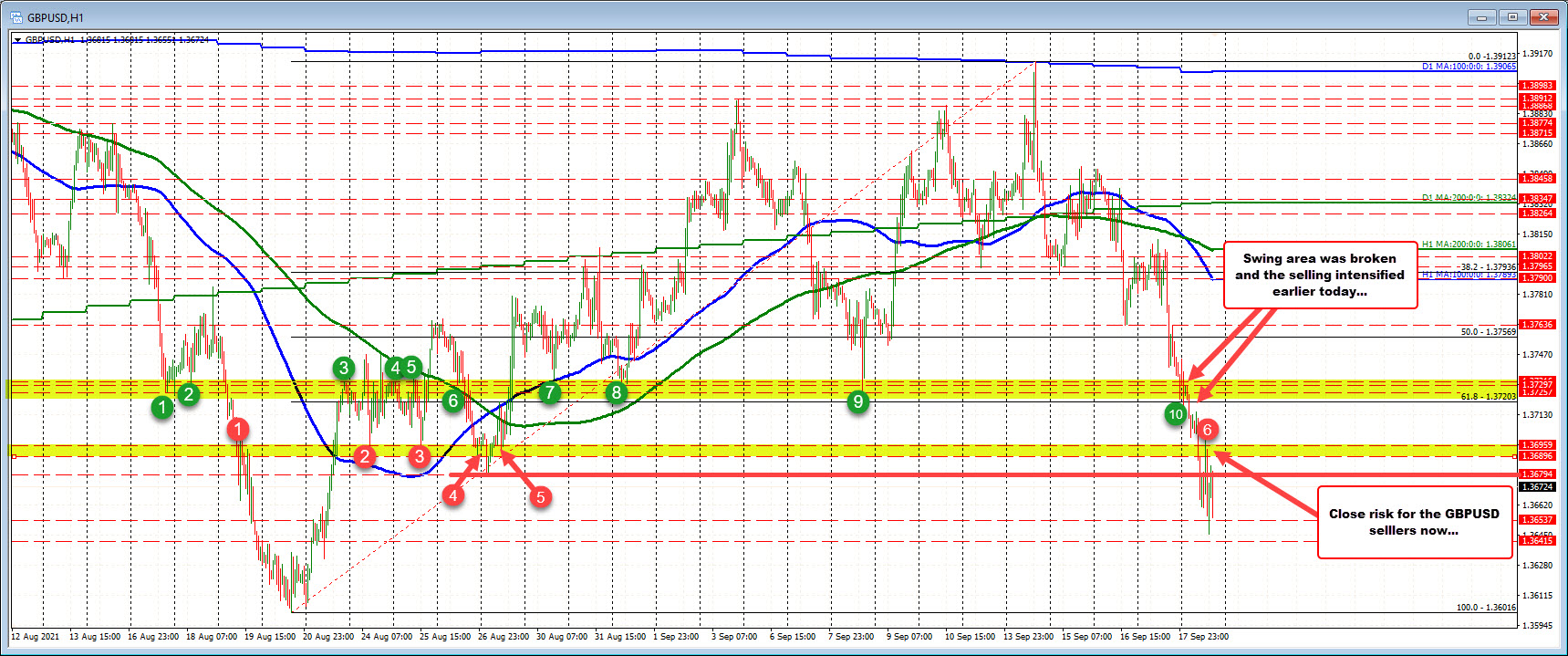

Technically, the pair today fell below these 61.8% retracement at 1.37203 and that triggered some selling. A swing area between 1.3689 to 1.36959 has a number of swing levels going back to August 18 (see red numbered circles). As mentioned the price did rise up to 1.3699 after the first bounce, but that small break was quickly reversed (and also found sellers against the natural resistance at 1.3700).

What now?

The 1.36794 was a swing low going back to August 27. The price has traded above that level in the US morning session, but only by a few pips. If the price should start trading more comfortably above that level, we could see another run toward the 1.3700 level. Get above that level and traders could be looking toward the broken 61.8% retracement 1.37203.

On the downside (the sellers are still more in control), the low from August comes in at 1.36016 (call it 1.3600). The swing low from July comes in at 1.3571. That would be another downside target on further selling momentum.