The EU is mixed after the PEPP reduction

Today, the US will release the initial jobless claims which came in at post-Covid lows at 340K last week. The expectations are near that level at 343K today. The continuing claims are expected at 2744K (vs. 2.748K last week). There are a slew of Fed speakers on the docket today with Feds Evans, Daly. Kaplan, Bowman, Williams, Kashkari, and Rosengren all scheduled to speak today. The Bank of Canada Gov. Maclem will also give a speech explaining the BOC decision yesterday (at 12 PM). ECBs Lagarde will conduct her traditional press conference at 8:30 AM ET.

Today, the US will release the initial jobless claims which came in at post-Covid lows at 340K last week. The expectations are near that level at 343K today. The continuing claims are expected at 2744K (vs. 2.748K last week). There are a slew of Fed speakers on the docket today with Feds Evans, Daly. Kaplan, Bowman, Williams, Kashkari, and Rosengren all scheduled to speak today. The Bank of Canada Gov. Maclem will also give a speech explaining the BOC decision yesterday (at 12 PM). ECBs Lagarde will conduct her traditional press conference at 8:30 AM ET.

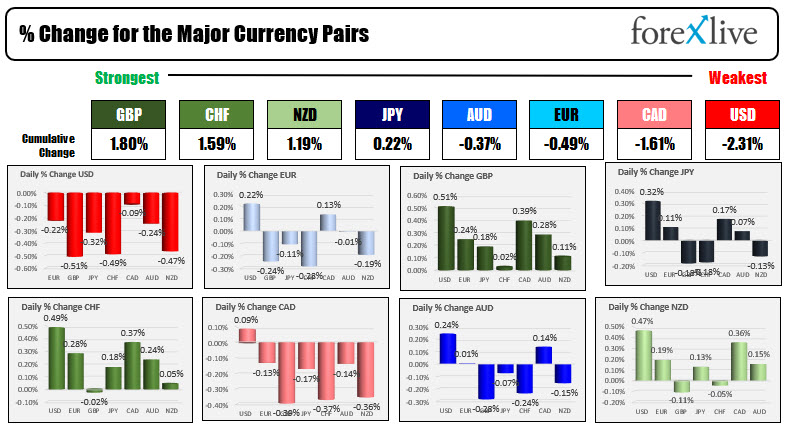

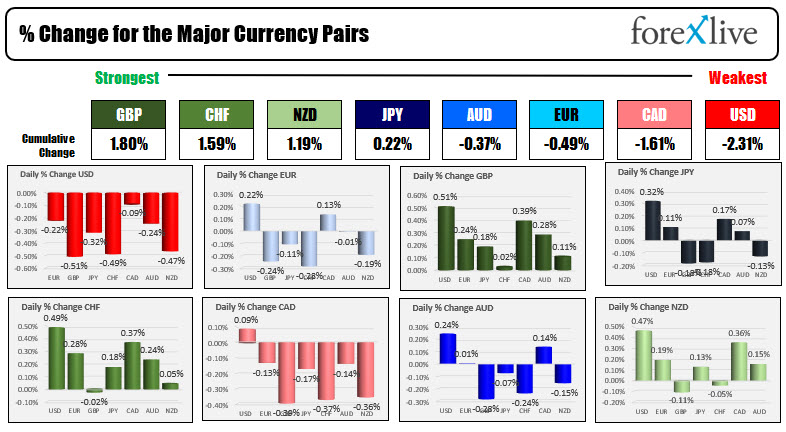

In other markets as North American trading gets underway shows:

- Spot gold is trading up $8.60 or 0.48% $1797.98.

- Spot silver is up $0.29 or 1.22% $24.21

- WTI crude oil futures are up $0.46 or 0.66% at $69.76

- the price of bitcoin is up $333 or 0.78% at $46,450

In the US premarket for stocks, the major indices are modestly lower/unchanged

- Dow Jones -4 points after yesterday’s -68.93 point decline (-0.20%)

- S&P index -3 points after yesterday’s -5.94 point decline (-0.13%)

- NASDAQ index -6.1 points after yesterday’s -87.69 point decline (-0.57%)

In the European markets, the major indices are now mixed after the ECB decision:

- German DAX, unchanged

- France’s CAC, +0.1%

- UK’s FTSE 100, -0.9%

- Spain’s Ibex, -0.5%

- Italy’s FTSE MIB, +0.1%

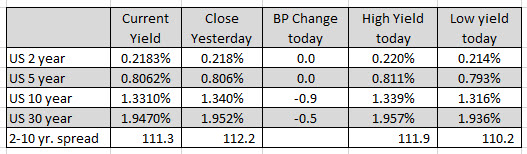

In the US debt market, the benchmark 10 year yield is trading down around -1 basis point at 1.331%. That is up from the overnight low of 1.316%. The U.S. Treasury will auction off 30 year bonds at 1 PM ET. The 10 year note auction went off without a hitch and with strong international demand yesterday.

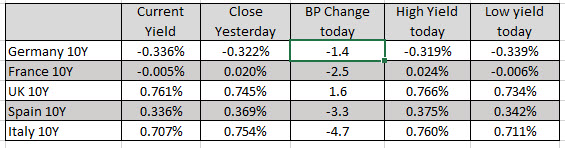

In the European debt market, the benchmark 10 year yields are mostly lower. France’s 10 year has dipped back below the 0.0% level at -0.005%.