Yields up but off the highs for the day.

The reaction to the FOMC meeting minutes has seen the

- dollar move lower but has recovered most of the declines.

- US yields are higher on the day but not much change from pre-minute release levels

- US stocks have moved lower with the Dow industrial average leading the way to the downside with a decline of -0.43%. The NASDAQ index is down -0.17% and the S&P index is down -0.35%. Gold is down $-1.50 at $1784.24

- The price of crude oil remains nearer its low levels. The currently trades at $65.46. The low price reached $65.29

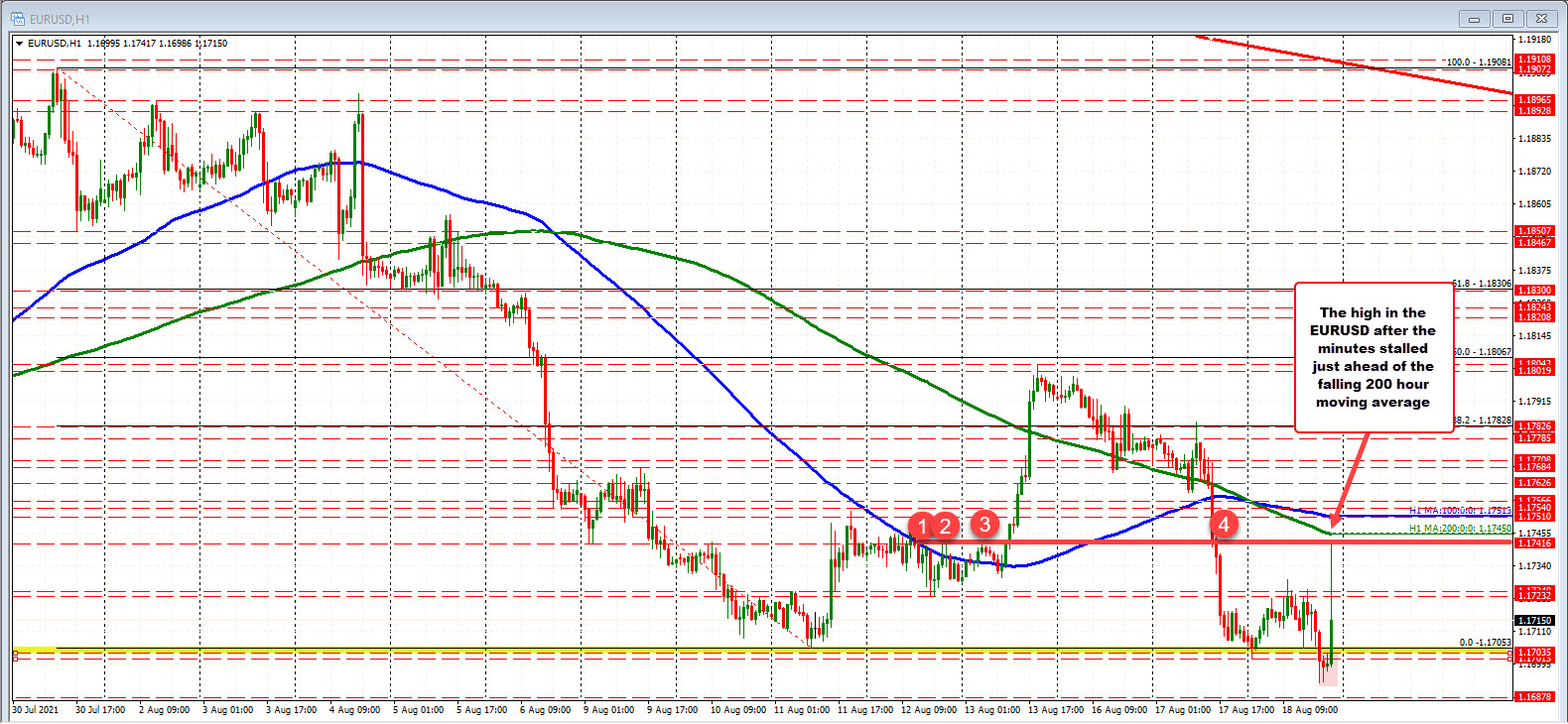

EURUSD: The EURUSD moved sharply higher and approached its 200 hour moving average at 1.1745. The hi reach 1.1741 and backed off. The current price is back down at 1.1712. The old lows from March and July will be eyed once again as support at 1.17035 to 1.17053. That area was broken on a few occasions today. The most recent was the last few hours before the minute release.

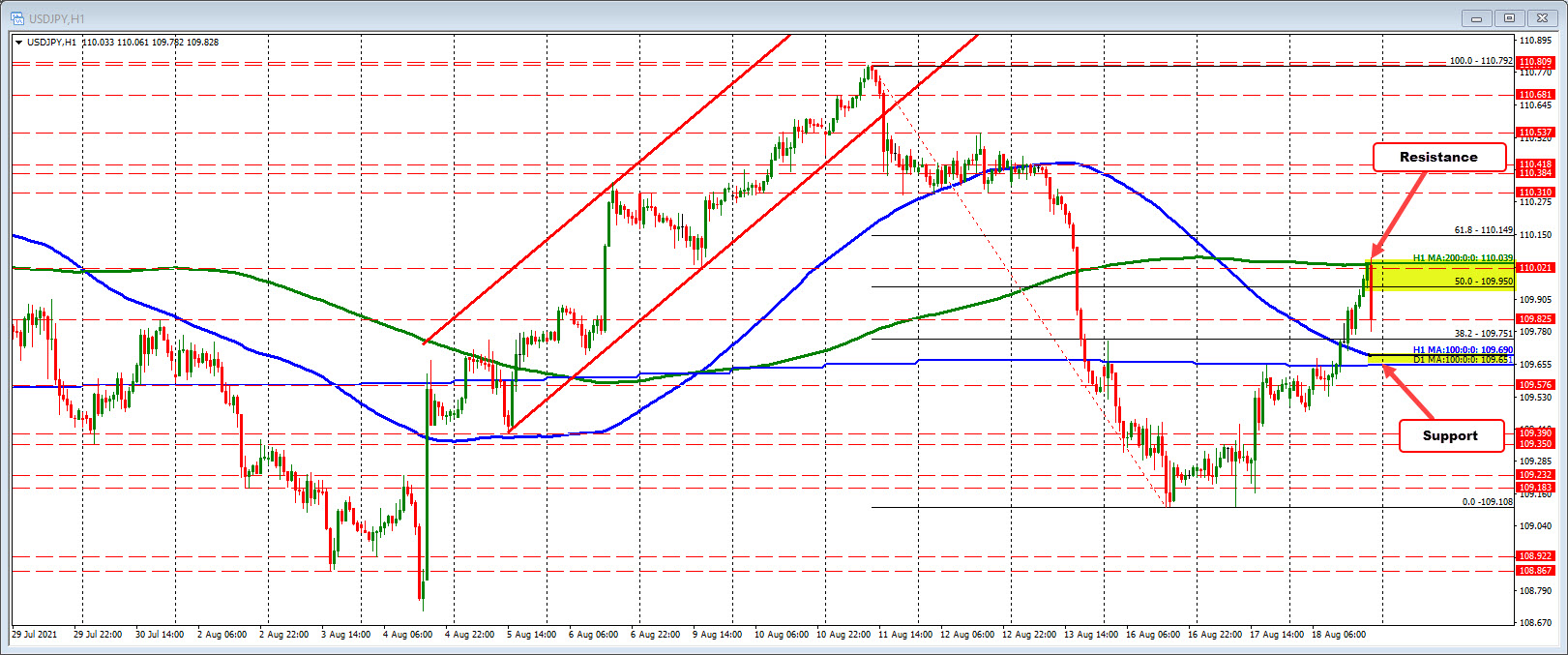

USDJPY: The USDJPY backed off from its 200 hour MA at 110.039 and fell back below the 50% midpoint at 109.95 (of the move down from the August 11 high). T he price low reached 109.772. The 100 hour moving averages at 109.69. The 100 day moving averages at 109.651.

GBPUSD: The GBPUSD moved briefly above its 200 hour moving average at 1.37803, but backed off. The price is currently trading at 1.3772. That is right around the earlier session only. Moving back above the 200 day moving average would be more bullish.