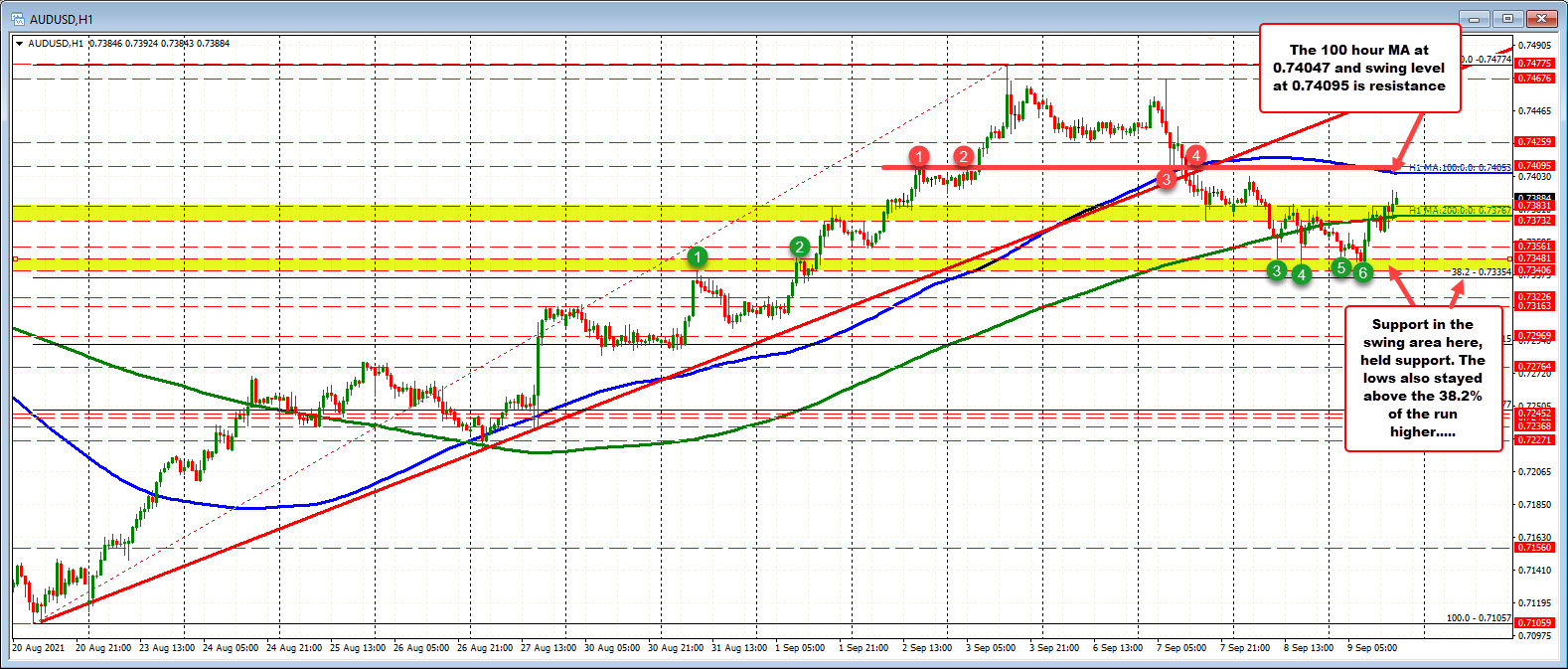

Recovery day after yesterday’s sharp fall

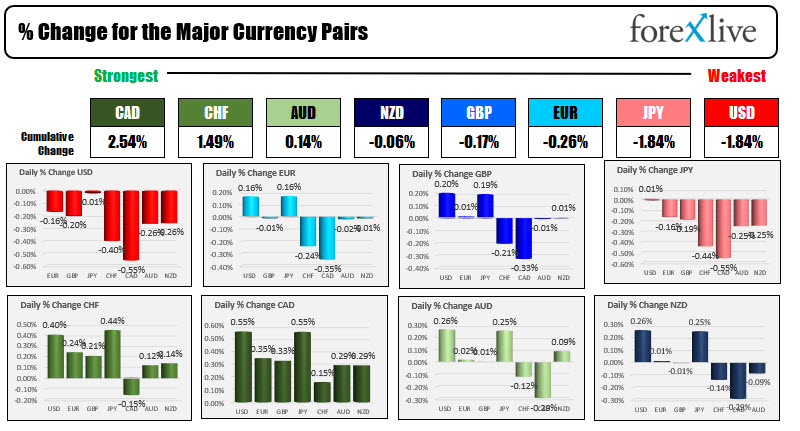

In other markets this morning:

- Spot gold is trading up $3.43 or 0.27% at $1767.95.

- Spot silver is up $0.33 or 1.42% at $22.58

- WTI crude oil futures are up $0.87 or 1.23% at $71. Oil has been supported today on news that shall output from the Gulf of Mexico will be less through the year and due to damage from the storms

- Bitcoin is up $207 at $43,243 after yesterday’s sharp decline

In the US pre-market for US stocks, the futures are implying a higher opening for the major indices erasing some of the losses from yesterday’s sharp move to the downside:

- Dow 264 points after yesterday’s -614.41 point decline

- S&P + 33 points after yesterday’s -75.26 point decline

- NASDAQ index +120 points after yesterday’s -330 point decline

In the European equity markets, the major indices are also moving higher in trading today:

- German Dax +1.4%

- Francis CAC, +1.3%

- UK’s FTSE 100 +1.1%

- Spain’s Ibex, +1.25%

- Italy’s FTSE MIB +1.3%

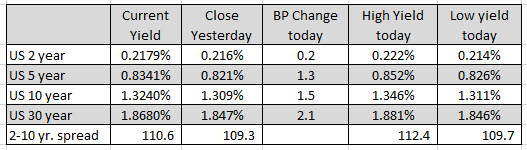

In the US debt market, yields are higher after the declines yesterday. The yield curve as measured by the 2-10 year spread is a touch steeper at 110.6 basis point versus 109.3 basis point:

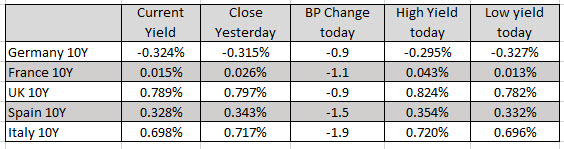

In the European debt market, the benchmark 10 year yields are trading down between about one and two basis point: