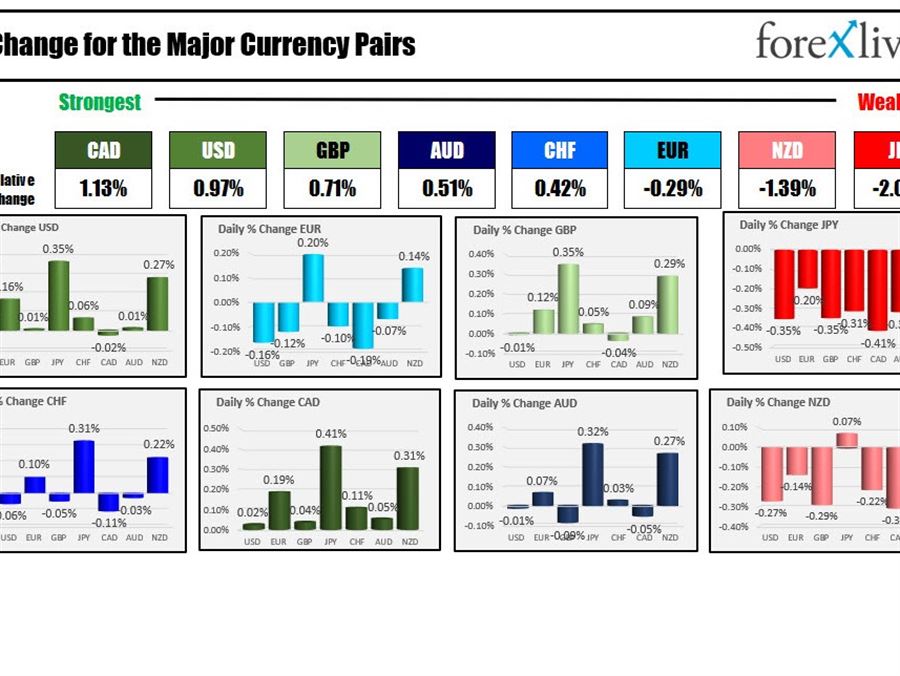

The CAD is the strongest and the JPY is the weakest as NA traders enter for the day. The major indices are relatively scrunched together as NATO, G7 and EU will have meetings today, but the USDJPY continues to trend to the upside rising to the highest level since the week December 13, 2015 (the price moved above the end of January 2016 highs today) .

The focus will be on the EU meeting where leaders can put additional pressure on Russia by stopping all purchases of Russian oil. Durable goods orders and initial claims will also be released. Flash Markit Manufacturing PMI will be released at 9:45 AM ET.

There are a number of Fed speakers on the schedule including Waller, Bullard and Evans. The Fed officials are mostly onboard to increase rates by 50 BPs at the May meeting at least. The drive to neutrality sooner rather than later (2.5%) is becoming more the norm, but it will take time (unless at some point they decide 100 BP hike is warranted).

A look around the markets is showing:

- Spot gold is trading up $11.23 or 0.58% at $1953.15

- Spot silver is up $0.16 or 0.72% $25.28

- Crude oil is trading at lower by -$0.40 at $114.53

- Bitcoin is trading at $42,949 near unchanged on the day

In the premarket for US stocks, the major indices are rebounding after yesterday’s 1.3% declines:

- Dow industrial average is up 105 points after yesterday’s -448.96 point decline

- S&P index is up 17.5 points after yesterday’s -55.37 point decline

- NASDAQ index is up 66 points after yesterday’s -186.21 point decline

The European equity markets, the major indices are mixed:

- German DAX, -0.1%

- France’s CAC, unchanged

- UK’s FTSE 100 +0.1%

- Spain’s Ibex -0.2%

- Italy’s FTSE MIB +0.4%

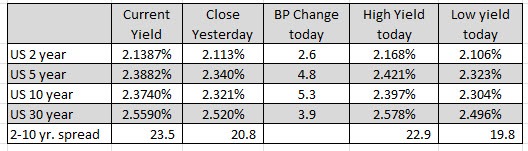

In the US debt market, the yields have moved higher after yesterday’s decline that saw yields fall about eight basis points. The 10 year is up 5.3 basis points the 2– 10 year spread has widened to about 23.5 basis points from 20.8 basis points yesterday:

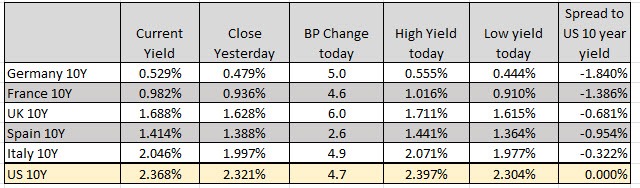

In the European debt market, 10 year yields are also moving higher across the board: